- United States

- /

- Luxury

- /

- NYSE:ONON

Clover Health Investments And 2 Other Growth Stocks With Strong Insider Confidence

Reviewed by Simply Wall St

The United States market has shown positive momentum, rising 1.3% over the last week and climbing 8.2% in the past year, with earnings forecasted to grow by 14% annually. In such a promising environment, growth companies with high insider ownership can be particularly appealing as they often reflect strong internal confidence and potential for sustained performance.

Top 10 Growth Companies With High Insider Ownership In The United States

| Name | Insider Ownership | Earnings Growth |

| Super Micro Computer (NasdaqGS:SMCI) | 14.1% | 39.6% |

| Duolingo (NasdaqGS:DUOL) | 14.3% | 39.9% |

| FTC Solar (NasdaqCM:FTCI) | 32.2% | 61.8% |

| AST SpaceMobile (NasdaqGS:ASTS) | 13.3% | 60.7% |

| Credo Technology Group Holding (NasdaqGS:CRDO) | 12.1% | 65.1% |

| Astera Labs (NasdaqGS:ALAB) | 15.3% | 43.7% |

| Niu Technologies (NasdaqGM:NIU) | 36% | 82.8% |

| BBB Foods (NYSE:TBBB) | 16.2% | 29.9% |

| Clene (NasdaqCM:CLNN) | 19.4% | 67% |

| Upstart Holdings (NasdaqGS:UPST) | 12.5% | 102.6% |

Here's a peek at a few of the choices from the screener.

Clover Health Investments (NasdaqGS:CLOV)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Clover Health Investments, Corp. offers Medicare Advantage plans in the United States and has a market cap of approximately $1.93 billion.

Operations: Clover Health Investments generates revenue through its provision of Medicare Advantage plans in the United States.

Insider Ownership: 22.3%

Revenue Growth Forecast: 13.7% p.a.

Clover Health Investments is navigating a transition with forecasted profitability in three years, despite recent net losses shrinking significantly from US$19.17 million to US$1.27 million year-over-year for Q1 2025. Insider ownership remains high, though recent months saw more buying than selling activity among insiders. Revenue growth is expected at 13.7% annually, outpacing the broader U.S. market but below the ideal 20% mark for rapid growth companies, while trading significantly below estimated fair value suggests potential undervaluation.

- Get an in-depth perspective on Clover Health Investments' performance by reading our analyst estimates report here.

- Upon reviewing our latest valuation report, Clover Health Investments' share price might be too pessimistic.

On Holding (NYSE:ONON)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: On Holding AG develops and distributes sports products globally, with a market capitalization of approximately $15.72 billion.

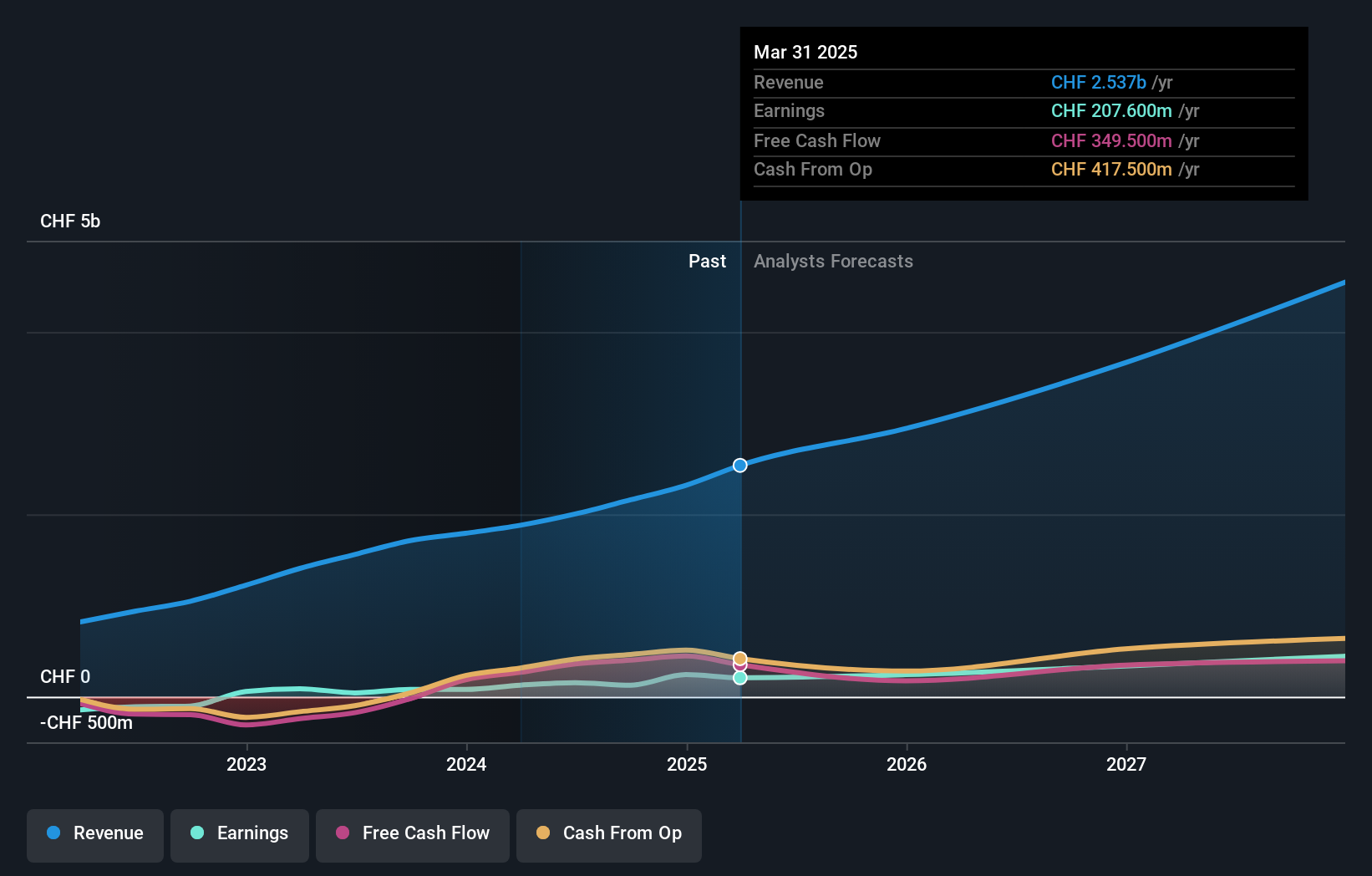

Operations: The company's revenue primarily comes from its Athletic Footwear segment, which generated CHF 2.32 billion.

Insider Ownership: 27.9%

Revenue Growth Forecast: 17.9% p.a.

On Holding is experiencing robust growth, with net income reaching CHF 242.3 million in 2024, a significant increase from the previous year. The company anticipates at least 27% sales growth in 2025, aiming for CHF 2.94 billion in revenue. The leadership transition to Martin Hoffmann as CEO and strategic appointments signal a focus on innovation and global brand presence. While insider trading activity is minimal, earnings are forecasted to grow faster than the U.S. market average at 18% annually.

- Navigate through the intricacies of On Holding with our comprehensive analyst estimates report here.

- Our valuation report unveils the possibility On Holding's shares may be trading at a premium.

Spotify Technology (NYSE:SPOT)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Spotify Technology S.A., along with its subsidiaries, offers audio streaming subscription services globally and has a market cap of approximately $134.74 billion.

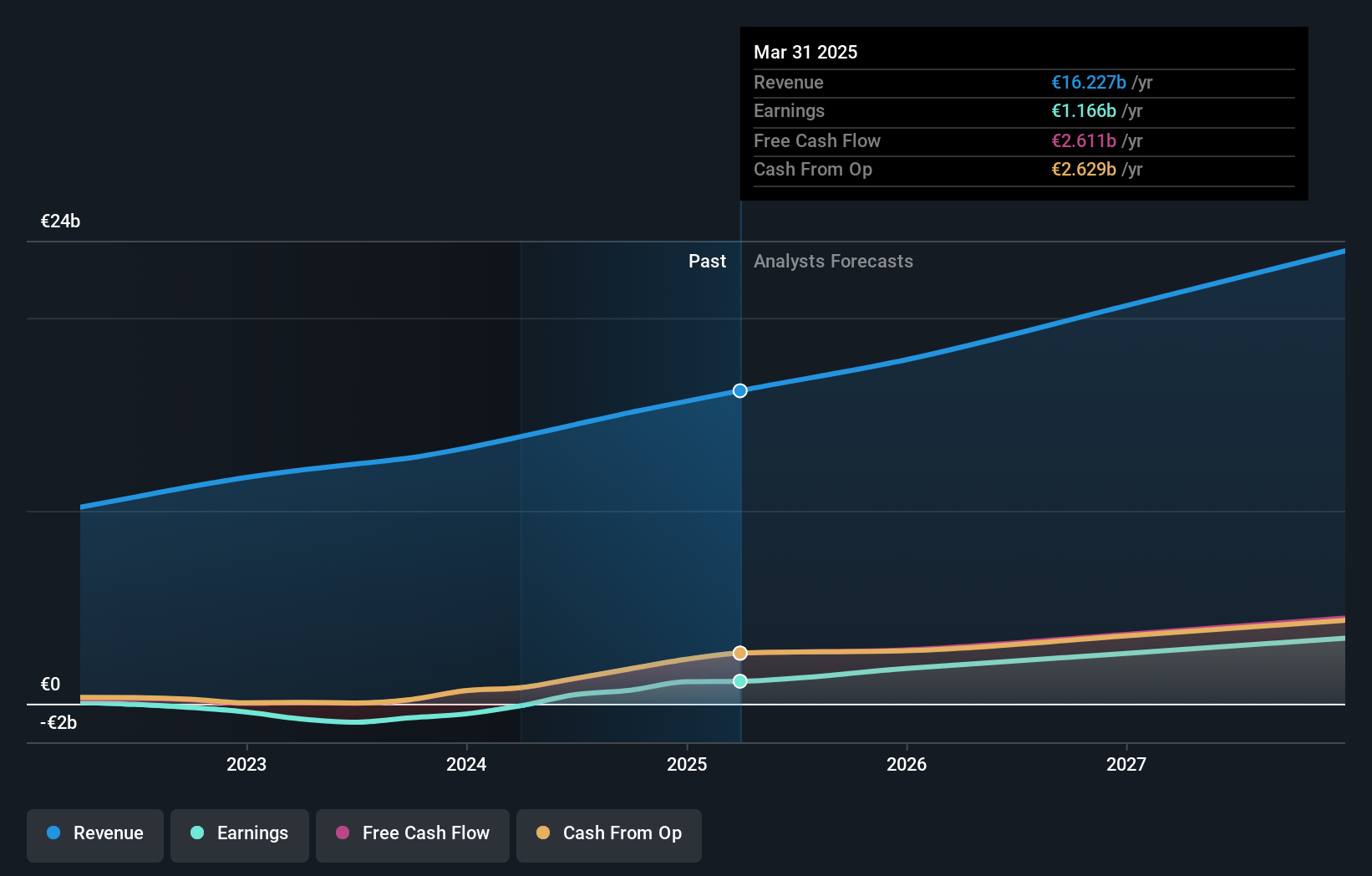

Operations: The company's revenue is derived from two main segments: Premium, generating €14.34 billion, and Ad-Supported, contributing €1.88 billion.

Insider Ownership: 16.2%

Revenue Growth Forecast: 11.9% p.a.

Spotify Technology has demonstrated strong growth, becoming profitable this year with a forecasted earnings growth of 25.2% annually, outpacing the U.S. market average. Recent earnings show increased sales of €4.19 billion and net income rising to €225 million for Q1 2025. Despite no recent insider trading activity, Spotify's strategic guidance for Q2 projects $4.3 billion in revenue, reinforcing its growth trajectory amidst high insider ownership stability and robust return on equity projections at 24%.

- Click here to discover the nuances of Spotify Technology with our detailed analytical future growth report.

- The valuation report we've compiled suggests that Spotify Technology's current price could be inflated.

Next Steps

- Gain an insight into the universe of 200 Fast Growing US Companies With High Insider Ownership by clicking here.

- Interested In Other Possibilities? The end of cancer? These 23 emerging AI stocks are developing tech that will allow early idenification of life changing disesaes like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ONON

On Holding

Engages in the development and distribution of sports products worldwide.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives