- United States

- /

- Luxury

- /

- NYSE:NKE

Can Nike's (NKE) Digital Pivot Offset Trade Uncertainty and Revive Its Growth Story?

Reviewed by Sasha Jovanovic

- In the past two weeks, NIKE announced first quarter 2025 earnings with sales of US$11.72 billion and net income of US$727 million, along with updates on its ongoing share buyback and high-profile app refresh focused on athlete stories and sport innovation.

- Amid broader market concerns over potential new U.S. tariffs on Chinese imports, the company’s turnaround initiatives under a new CEO and enhanced digital focus are becoming increasingly critical for its strategy.

- We'll explore how the trade tensions and renewed push for product innovation impact NIKE's medium-term growth narrative and challenges.

AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

NIKE Investment Narrative Recap

To be a NIKE shareholder today, you need to believe in its ability to reignite brand and product innovation while navigating external challenges such as potential new U.S. tariffs on Chinese imports. Recent earnings confirm ongoing revenue growth, but also highlight the pressure on profitability and net margins, so far, the headline news has not presented a material change to the short-term turnaround catalyst, though headline risk remains high.

Of the recent announcements, NIKE’s continued share buyback, repurchasing more than 124 million shares for over US$12.1 billion since 2022, stands out as most relevant, reflecting confidence in its financial flexibility during a time of margin pressure. While this supports shareholder returns in the near term, it does not directly address the underlying issues of declining earnings or revenue challenges in core markets.

However, with tariff risk mounting and sales growth just keeping pace, investors should be aware that one of the biggest risks is how quickly new trade barriers could disrupt...

Read the full narrative on NIKE (it's free!)

NIKE's narrative projects $50.7 billion in revenue and $4.4 billion in earnings by 2028. This requires 3.1% yearly revenue growth and a $1.2 billion increase in earnings from the current $3.2 billion.

Uncover how NIKE's forecasts yield a $82.25 fair value, a 22% upside to its current price.

Exploring Other Perspectives

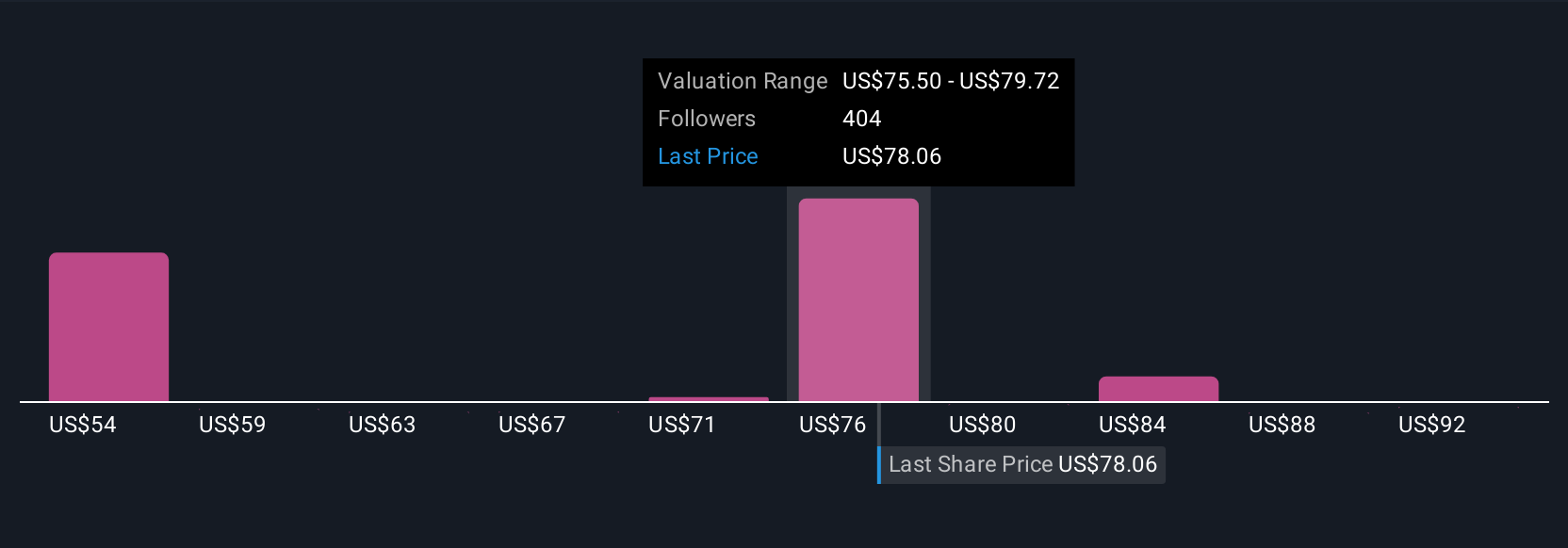

The Simply Wall St Community contributed 48 fair value estimates for NIKE stock, ranging from US$57.41 to US$96.60 per share. While views spread widely, many highlight that margin pressure and uncertain revenue growth still weigh on the company’s outlook, reminding you to compare these diverse perspectives before making decisions.

Explore 48 other fair value estimates on NIKE - why the stock might be worth 15% less than the current price!

Build Your Own NIKE Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your NIKE research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free NIKE research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate NIKE's overall financial health at a glance.

No Opportunity In NIKE?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Find companies with promising cash flow potential yet trading below their fair value.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if NIKE might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:NKE

NIKE

Designs, develops, markets, and sells athletic and casual footwear, apparel, equipment, accessories, and services for men, women, and kids in North America, Europe, the Middle East, Africa, Greater China, the Asia Pacific, and Latin America.

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives