- United States

- /

- Banks

- /

- NYSE:CFG

3 US Dividend Stocks Offering Up To 7.0% Yield

Reviewed by Simply Wall St

As the major U.S. stock indexes, including the Dow Jones Industrial Average, S&P 500, and Nasdaq Composite, are on track for gains amid a backdrop of benign inflation data and robust corporate earnings reports, investors continue to seek opportunities in dividend stocks that offer attractive yields. In today's market environment, characterized by steady economic indicators and strategic interest rate decisions by the Federal Reserve, dividend stocks can provide a reliable income stream while potentially enhancing portfolio stability.

Top 10 Dividend Stocks In The United States

| Name | Dividend Yield | Dividend Rating |

| Columbia Banking System (NasdaqGS:COLB) | 5.14% | ★★★★★★ |

| Interpublic Group of Companies (NYSE:IPG) | 4.60% | ★★★★★★ |

| Peoples Bancorp (NasdaqGS:PEBO) | 4.91% | ★★★★★★ |

| Southside Bancshares (NYSE:SBSI) | 4.58% | ★★★★★★ |

| Dillard's (NYSE:DDS) | 5.52% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.23% | ★★★★★★ |

| Farmers National Banc (NasdaqCM:FMNB) | 4.86% | ★★★★★★ |

| CompX International (NYSEAM:CIX) | 4.68% | ★★★★★★ |

| First Interstate BancSystem (NasdaqGS:FIBK) | 5.61% | ★★★★★★ |

| Ennis (NYSE:EBF) | 4.83% | ★★★★★★ |

Click here to see the full list of 132 stocks from our Top US Dividend Stocks screener.

Here's a peek at a few of the choices from the screener.

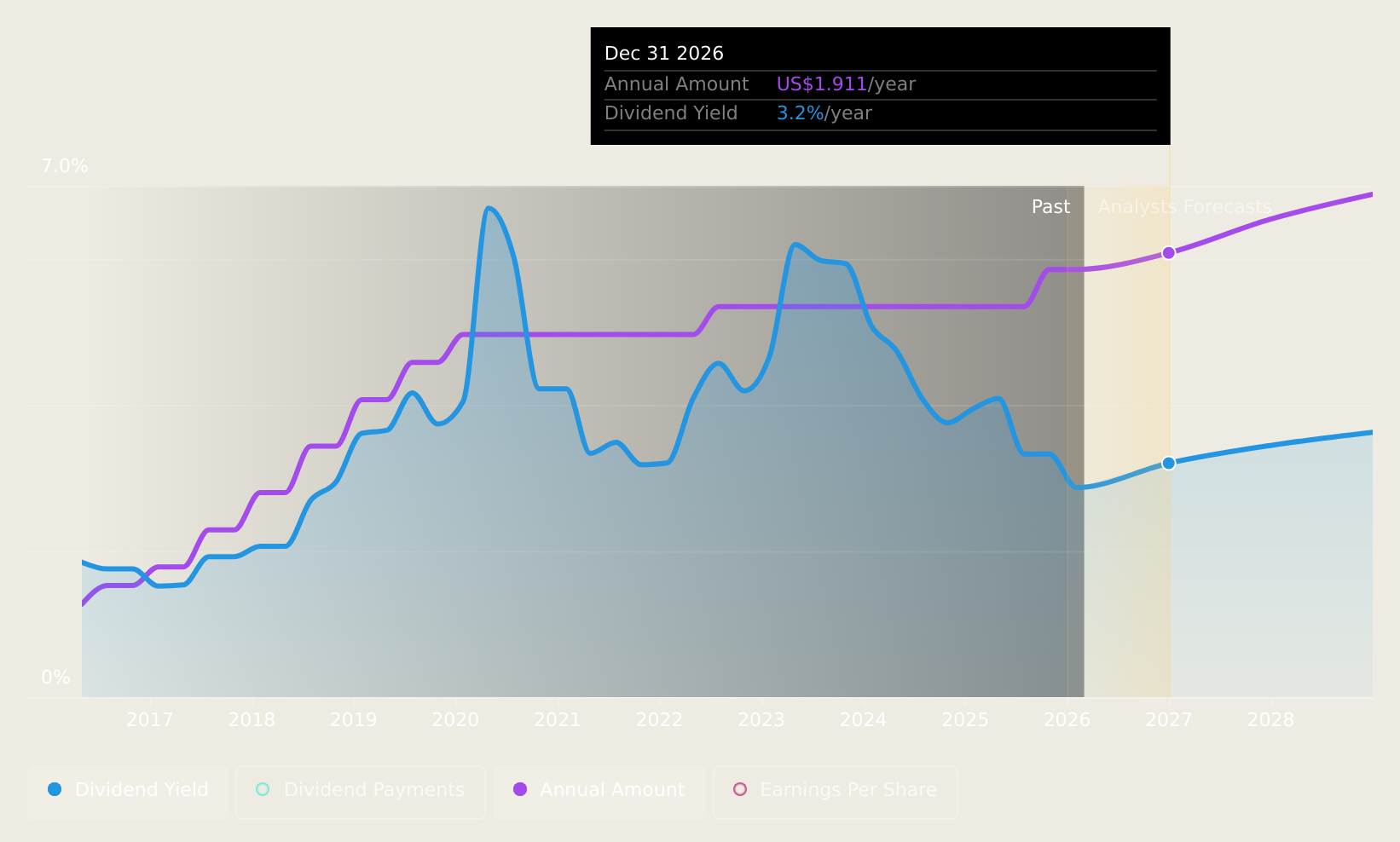

Citizens Financial Group (NYSE:CFG)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Citizens Financial Group, Inc. is a bank holding company offering retail and commercial banking products and services to individuals, small businesses, middle-market companies, corporations, and institutions in the United States with a market cap of approximately $20.98 billion.

Operations: Citizens Financial Group generates revenue through its Consumer Banking segment, which accounts for $5.37 billion, and its Commercial Banking segment, contributing $2.51 billion.

Dividend Yield: 3.5%

Citizens Financial Group has delivered stable and growing dividends over the past decade, with a current payout ratio of 55.2%, ensuring coverage by earnings. The dividend yield of 3.47% is below the top quartile in the US market, but its dividends are forecast to remain well-covered at a 30.1% payout ratio in three years. Recent earnings showed strong growth, with net income rising to US$401 million in Q4 2024 from US$189 million a year prior.

- Click here to discover the nuances of Citizens Financial Group with our detailed analytical dividend report.

- In light of our recent valuation report, it seems possible that Citizens Financial Group is trading behind its estimated value.

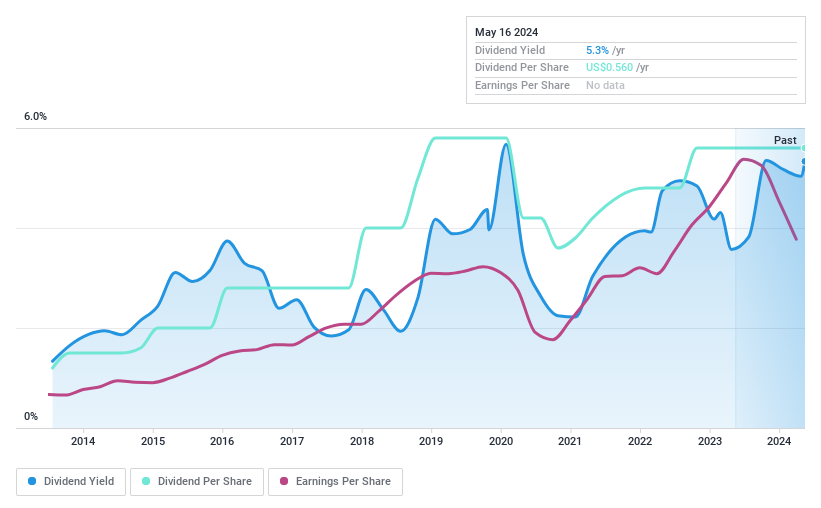

Marine Products (NYSE:MPX)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Marine Products Corporation designs, manufactures, and sells recreational fiberglass powerboats for the sport boat and sport fishing boat markets worldwide, with a market cap of approximately $311.03 million.

Operations: Marine Products Corporation generates revenue from the design, manufacture, and sale of recreational fiberglass powerboats catering to both sport boat and sport fishing boat markets globally.

Dividend Yield: 5.9%

Marine Products faces challenges with its dividend reliability, as payments have been volatile over the past decade. Despite a high dividend yield of 5.9%, the payout ratio of 102% indicates dividends are not well-covered by earnings, raising sustainability concerns. Recent financials show declining performance, with sales dropping to US$236.56 million in 2024 from US$383.73 million in 2023 and net income falling to US$17.85 million from US$41.7 million year-over-year, impacting profitability and dividend security.

- Delve into the full analysis dividend report here for a deeper understanding of Marine Products.

- In light of our recent valuation report, it seems possible that Marine Products is trading beyond its estimated value.

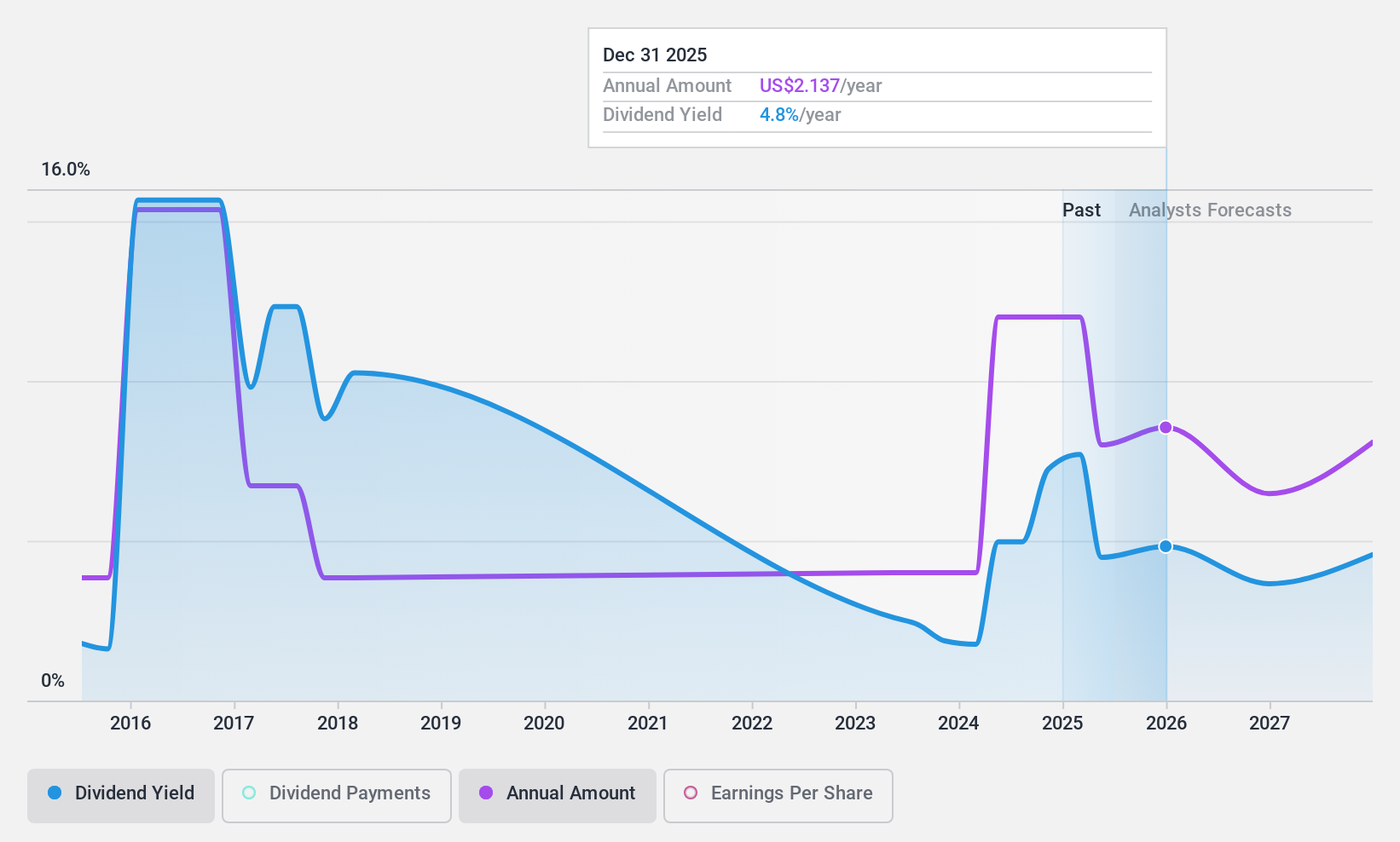

Teekay Tankers (NYSE:TNK)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Teekay Tankers Ltd. offers crude oil and marine transportation services to the oil industry both in Bermuda and internationally, with a market cap of $1.41 billion.

Operations: Teekay Tankers Ltd. generates revenue primarily through its tanker segment, which amounted to $1.19 billion.

Dividend Yield: 7.1%

Teekay Tankers' dividend yield ranks in the top 25% of US payers, but its history shows volatility and unreliability. Despite this, dividends are well-covered by both earnings and cash flows due to a low payout ratio of 8.1% and a cash payout ratio of 23.6%. Trading significantly below estimated fair value suggests potential for capital appreciation, though forecasted earnings decline may impact future payouts. Recent board changes aim to streamline operations within the Teekay Group.

- Get an in-depth perspective on Teekay Tankers' performance by reading our dividend report here.

- Our comprehensive valuation report raises the possibility that Teekay Tankers is priced lower than what may be justified by its financials.

Summing It All Up

- Delve into our full catalog of 132 Top US Dividend Stocks here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CFG

Citizens Financial Group

Operates as the bank holding company that provides retail and commercial banking products and services to individuals, small businesses, middle-market companies, corporations, and institutions in the United States.

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives