- United States

- /

- Leisure

- /

- NYSE:MPX

3 Dividend Stocks In US Yielding Up To 6.1%

Reviewed by Simply Wall St

As 2024 came to a close, the U.S. stock market experienced a mixed finish despite an overall strong year, with major indices like the Nasdaq Composite and S&P 500 posting significant annual gains. In this fluctuating environment, dividend stocks can offer investors a reliable income stream, making them an attractive option for those seeking stability amid market volatility.

Top 10 Dividend Stocks In The United States

| Name | Dividend Yield | Dividend Rating |

| WesBanco (NasdaqGS:WSBC) | 4.55% | ★★★★★★ |

| Columbia Banking System (NasdaqGS:COLB) | 5.33% | ★★★★★★ |

| Peoples Bancorp (NasdaqGS:PEBO) | 5.05% | ★★★★★★ |

| Interpublic Group of Companies (NYSE:IPG) | 4.71% | ★★★★★★ |

| Southside Bancshares (NYSE:SBSI) | 4.60% | ★★★★★★ |

| Dillard's (NYSE:DDS) | 6.02% | ★★★★★★ |

| Farmers National Banc (NasdaqCM:FMNB) | 4.78% | ★★★★★★ |

| First Interstate BancSystem (NasdaqGS:FIBK) | 5.79% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 6.02% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 4.85% | ★★★★★★ |

Click here to see the full list of 156 stocks from our Top US Dividend Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

VAALCO Energy (NYSE:EGY)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: VAALCO Energy, Inc. is an independent energy company focused on the acquisition, exploration, development, and production of crude oil and natural gas in Gabon, Egypt, Equatorial Guinea, and Canada with a market cap of approximately $439.87 million.

Operations: VAALCO Energy's revenue primarily comes from the exploration and production of hydrocarbons, totaling $506.42 million.

Dividend Yield: 5.7%

VAALCO Energy's dividend payments, declared at US$0.0625 per share for Q4 2024, are supported by a low payout ratio of 28.9% and a cash payout ratio of 65.5%, indicating sustainability. Despite only three years of dividend history, payments have been stable with a yield in the top 25% of US payers at 5.72%. Recent earnings growth and production increases bolster its financial position as it embarks on new drilling projects in Gabon for mid-2025.

- Dive into the specifics of VAALCO Energy here with our thorough dividend report.

- Our valuation report unveils the possibility VAALCO Energy's shares may be trading at a discount.

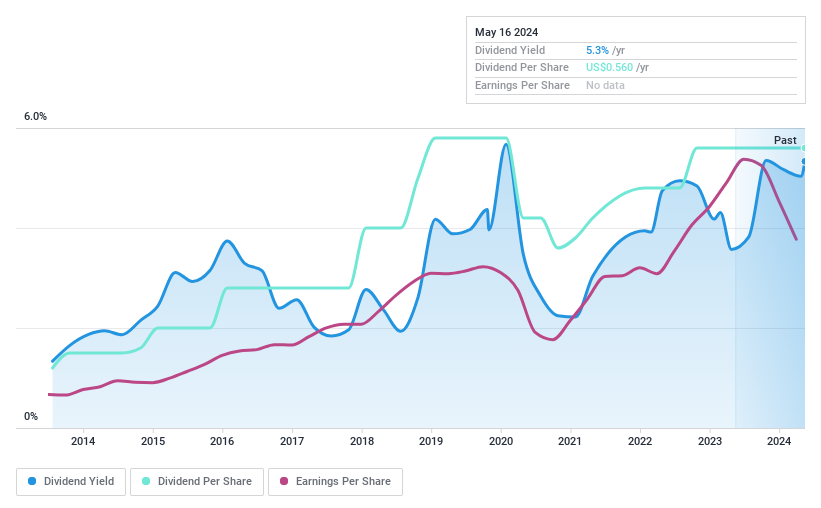

Marine Products (NYSE:MPX)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Marine Products Corporation designs, manufactures, and sells recreational fiberglass powerboats for the sport boat and sport fishing boat markets worldwide, with a market cap of approximately $312.07 million.

Operations: Marine Products Corporation generates revenue primarily through its powerboat manufacturing business, which accounted for $259.61 million.

Dividend Yield: 6.1%

Marine Products' dividend, declared at US$0.14 per share for Q4 2024, offers a high yield of 6.11%, placing it in the top quartile of US dividend payers. However, its payout ratio exceeds earnings at 102%, indicating potential sustainability concerns despite being covered by cash flows with a cash payout ratio of 53.7%. Recent earnings show a decline with Q3 net income at US$3.4 million compared to US$10.4 million last year, highlighting financial challenges amidst volatile dividend history over the past decade.

- Click here to discover the nuances of Marine Products with our detailed analytical dividend report.

- According our valuation report, there's an indication that Marine Products' share price might be on the cheaper side.

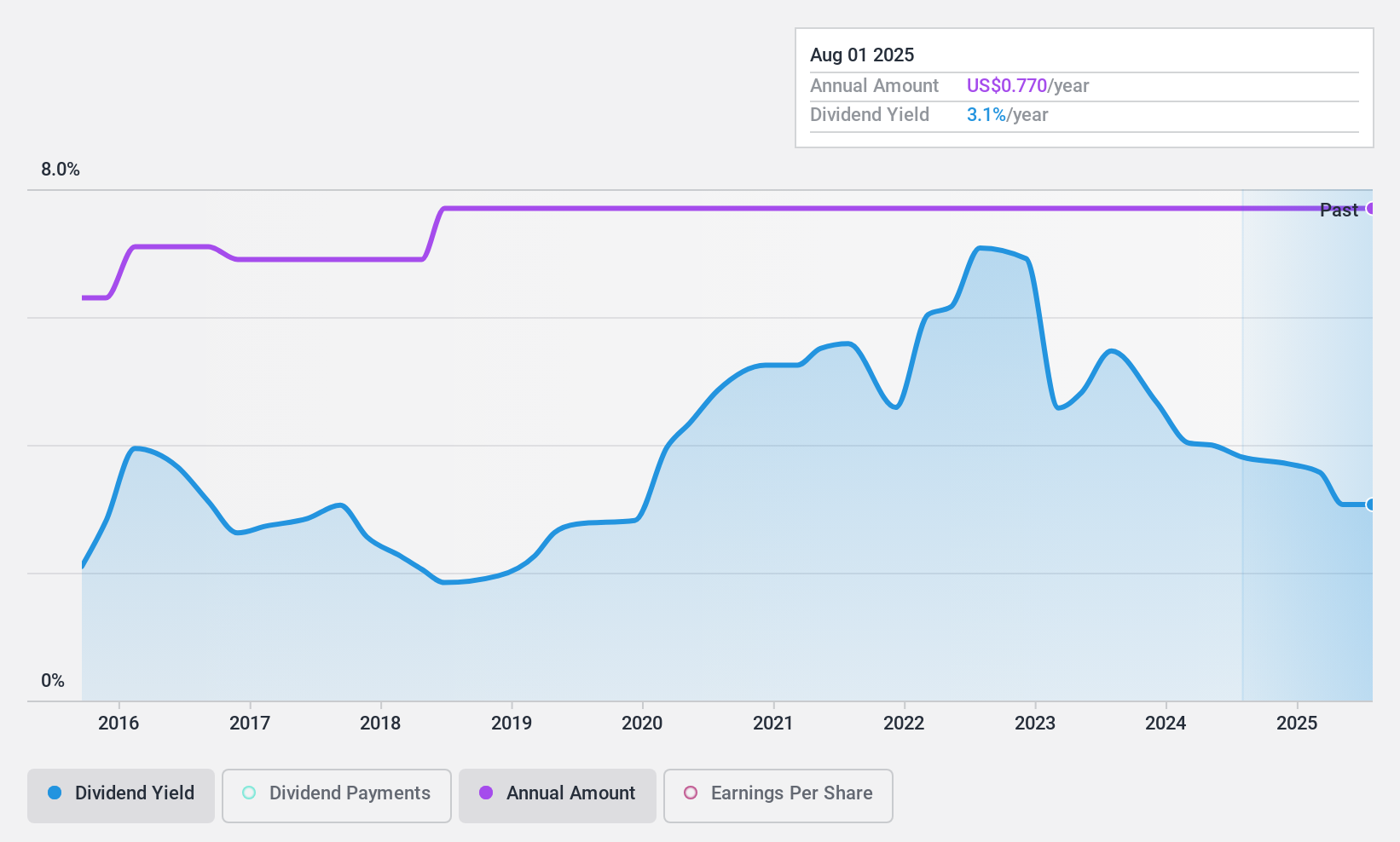

Universal Insurance Holdings (NYSE:UVE)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Universal Insurance Holdings, Inc. operates as an integrated insurance holding company in the United States with a market cap of approximately $581.56 million.

Operations: Universal Insurance Holdings generates revenue primarily from its Property & Casualty insurance segment, amounting to $1.51 billion.

Dividend Yield: 3.7%

Universal Insurance Holdings declared a total dividend of US$0.77 per share in 2024, including a recent special dividend, reflecting stable and reliable payouts over the past decade. Despite a low yield of 3.66%, its dividends are well-covered by earnings and cash flows with payout ratios of 25.2% and 9.4%, respectively, suggesting sustainability. However, significant insider selling raises caution amidst financial challenges like Q3 net loss despite revenue growth to US$387.55 million from US$360.05 million year-on-year.

- Click here and access our complete dividend analysis report to understand the dynamics of Universal Insurance Holdings.

- Our expertly prepared valuation report Universal Insurance Holdings implies its share price may be lower than expected.

Seize The Opportunity

- Explore the 156 names from our Top US Dividend Stocks screener here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:MPX

Marine Products

Designs, manufactures, and sells recreational fiberglass powerboats for the sport boat and sport fishing boat markets worldwide.

Flawless balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives