- United States

- /

- Consumer Durables

- /

- NYSE:LEN

Will Lennar's (LEN) Lowered Home Delivery Guidance Signal a Shift in Its Market Positioning?

Reviewed by Sasha Jovanovic

- In recent days, Lennar lowered its full-year home delivery guidance due to affordability challenges and shifting economic conditions impacting housing demand in the U.S. housing market.

- Analysts expressed concern that additional new home supply and political uncertainty, including an ongoing government shutdown and rising recession risk, could further strain business conditions for major homebuilders.

- Let's explore how Lennar's cautious outlook on home deliveries and affordability pressures could shift the company's investment narrative.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Lennar Investment Narrative Recap

To be a Lennar shareholder, you need to believe the company can maintain healthy margins and consistent volumes through cycles by balancing just-in-time construction with disciplined cost controls, even when affordability challenges and political uncertainty persist. The recently lowered home delivery guidance highlights how quick shifts in housing demand can threaten short-term sales volume, which remains the biggest near-term catalyst, while rising new home supply and consumer caution add to downside risks; this latest update materially elevates concerns about further delivery declines if market headwinds persist.

Among Lennar’s recent updates, the Q3 earnings report released on September 18 stands out, revealing a decrease in both revenue and net income year-over-year. These results reinforce the immediate pressure on margins and volumes that follow reduced guidance, placing added focus on how Lennar navigates affordability headwinds and operational efficiency in the quarters ahead.

By contrast, investors should also be mindful of political risks and growing supply pressures that could...

Read the full narrative on Lennar (it's free!)

Lennar is projected to generate $40.2 billion in revenue and $2.5 billion in earnings by 2028. This outlook is based on an assumed 4.3% annual revenue growth rate and represents a $0.7 billion decrease in earnings from the current $3.2 billion level.

Uncover how Lennar's forecasts yield a $129.07 fair value, a 9% upside to its current price.

Exploring Other Perspectives

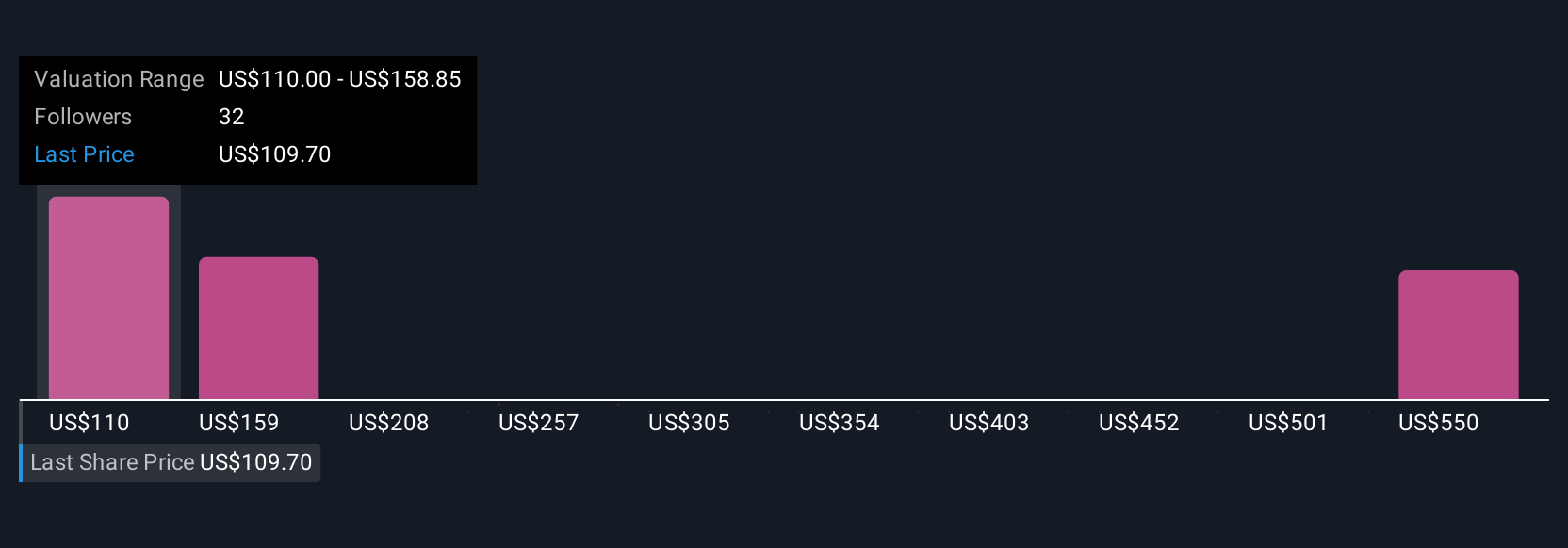

Eight fair value estimates from the Simply Wall St Community span US$81.68 to US$189.60, reflecting the breadth of individual investor opinion. As many expect further margin pressure due to affordability and new supply challenges, you can see why viewpoints differ so much, compare several opinions yourself for broader context.

Explore 8 other fair value estimates on Lennar - why the stock might be worth 31% less than the current price!

Build Your Own Lennar Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Lennar research is our analysis highlighting 1 key reward and 3 important warning signs that could impact your investment decision.

- Our free Lennar research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Lennar's overall financial health at a glance.

Looking For Alternative Opportunities?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- These 10 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:LEN

Lennar

Operates as a homebuilder primarily under the Lennar brand in the United States.

Excellent balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives