- United States

- /

- Consumer Durables

- /

- NYSE:LEN

A Piece Of The Puzzle Missing From Lennar Corporation's (NYSE:LEN) Share Price

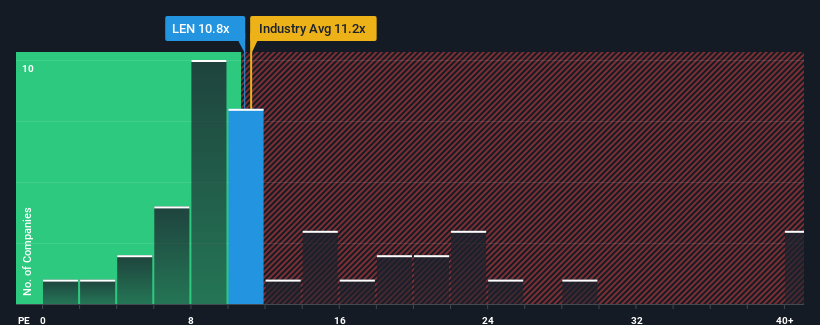

When close to half the companies in the United States have price-to-earnings ratios (or "P/E's") above 18x, you may consider Lennar Corporation (NYSE:LEN) as an attractive investment with its 10.8x P/E ratio. However, the P/E might be low for a reason and it requires further investigation to determine if it's justified.

Recent times haven't been advantageous for Lennar as its earnings have been falling quicker than most other companies. It seems that many are expecting the dismal earnings performance to persist, which has repressed the P/E. You'd much rather the company wasn't bleeding earnings if you still believe in the business. If not, then existing shareholders will probably struggle to get excited about the future direction of the share price.

See our latest analysis for Lennar

Is There Any Growth For Lennar?

Lennar's P/E ratio would be typical for a company that's only expected to deliver limited growth, and importantly, perform worse than the market.

Retrospectively, the last year delivered a frustrating 12% decrease to the company's bottom line. Still, the latest three year period has seen an excellent 47% overall rise in EPS, in spite of its unsatisfying short-term performance. Accordingly, while they would have preferred to keep the run going, shareholders would probably welcome the medium-term rates of earnings growth.

Turning to the outlook, the next three years should generate growth of 11% each year as estimated by the analysts watching the company. Meanwhile, the rest of the market is forecast to expand by 10.0% per year, which is not materially different.

In light of this, it's peculiar that Lennar's P/E sits below the majority of other companies. Apparently some shareholders are doubtful of the forecasts and have been accepting lower selling prices.

The Key Takeaway

While the price-to-earnings ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of earnings expectations.

Our examination of Lennar's analyst forecasts revealed that its market-matching earnings outlook isn't contributing to its P/E as much as we would have predicted. When we see an average earnings outlook with market-like growth, we assume potential risks are what might be placing pressure on the P/E ratio. At least the risk of a price drop looks to be subdued, but investors seem to think future earnings could see some volatility.

Before you settle on your opinion, we've discovered 1 warning sign for Lennar that you should be aware of.

If you're unsure about the strength of Lennar's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:LEN

Lennar

Operates as a homebuilder primarily under the Lennar brand in the United States.

Flawless balance sheet, undervalued and pays a dividend.

Similar Companies

Market Insights

Community Narratives