- United States

- /

- Banks

- /

- NasdaqCM:CZNC

Exploring 3 Undervalued Small Caps With Insider Activity Across Global Markets

Reviewed by Simply Wall St

Over the last 7 days, the United States market has remained flat, yet it has experienced a 12% increase over the past year with earnings anticipated to grow by 15% annually in the coming years. In this context, identifying stocks that are potentially undervalued and exhibit insider activity can be an intriguing opportunity for investors looking to capitalize on current market conditions.

Top 10 Undervalued Small Caps With Insider Buying In The United States

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Lindblad Expeditions Holdings | NA | 1.1x | 25.90% | ★★★★★☆ |

| Industrial Logistics Properties Trust | NA | 0.7x | 49.13% | ★★★★★☆ |

| Citizens & Northern | 11.7x | 2.9x | 44.72% | ★★★★☆☆ |

| Southside Bancshares | 10.6x | 3.7x | 38.38% | ★★★★☆☆ |

| S&T Bancorp | 11.4x | 3.9x | 39.72% | ★★★★☆☆ |

| Thryv Holdings | NA | 0.8x | 28.58% | ★★★★☆☆ |

| Montrose Environmental Group | NA | 1.1x | 31.52% | ★★★★☆☆ |

| Standard Motor Products | 12.9x | 0.5x | -2410.47% | ★★★☆☆☆ |

| Farmland Partners | 8.9x | 9.0x | -8.92% | ★★★☆☆☆ |

| Vital Energy | NA | 0.3x | -41.46% | ★★★☆☆☆ |

We're going to check out a few of the best picks from our screener tool.

Citizens & Northern (CZNC)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Citizens & Northern is a community banking institution with operations focused on providing financial services, and it has a market capitalization of approximately $0.36 billion.

Operations: The company's revenue is primarily derived from Community Banking, with recent figures showing $108.11 million. Operating expenses have been significant, reaching $74.997 million in the latest period, with General & Administrative Expenses accounting for $60.63 million of this total. The net income margin has experienced fluctuations over time and was 24.72% in the most recent quarter analyzed.

PE: 11.7x

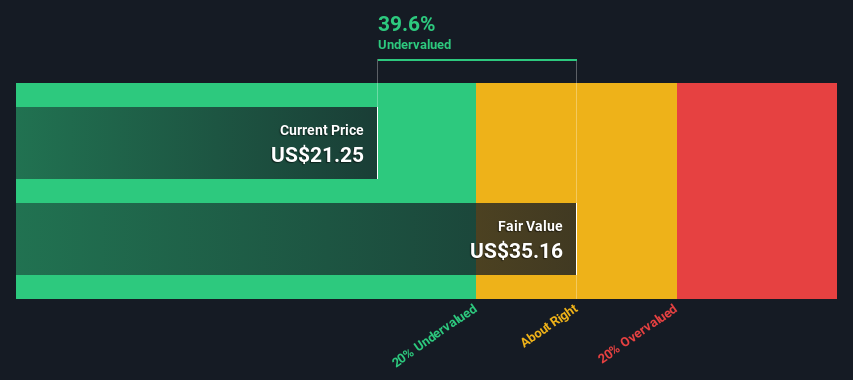

Citizens & Northern, a smaller financial entity in the U.S., shows potential for growth with earnings forecasted to rise by 6.2% annually. Despite a low allowance for bad loans at 84%, insider confidence is evident with recent purchases. The company reported Q1 net interest income of US$19.98 million, up from US$19.04 million year-over-year, and net income increased to US$6.29 million from US$5.31 million previously. A merger with Susquehanna Community Financial could enhance market presence further.

- Take a closer look at Citizens & Northern's potential here in our valuation report.

Evaluate Citizens & Northern's historical performance by accessing our past performance report.

Traeger (COOK)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Traeger operates as a single-brand consumer products company specializing in wood pellet grills, with a market capitalization of approximately $0.44 billion.

Operations: The company generates revenue primarily from its single-brand consumer products business, with recent revenues totaling $602.44 million. The cost of goods sold (COGS) for the same period was $350.08 million, resulting in a gross profit margin of 41.89%. Operating expenses, including sales and marketing as well as general and administrative costs, play a significant role in the company's financial structure.

PE: -8.7x

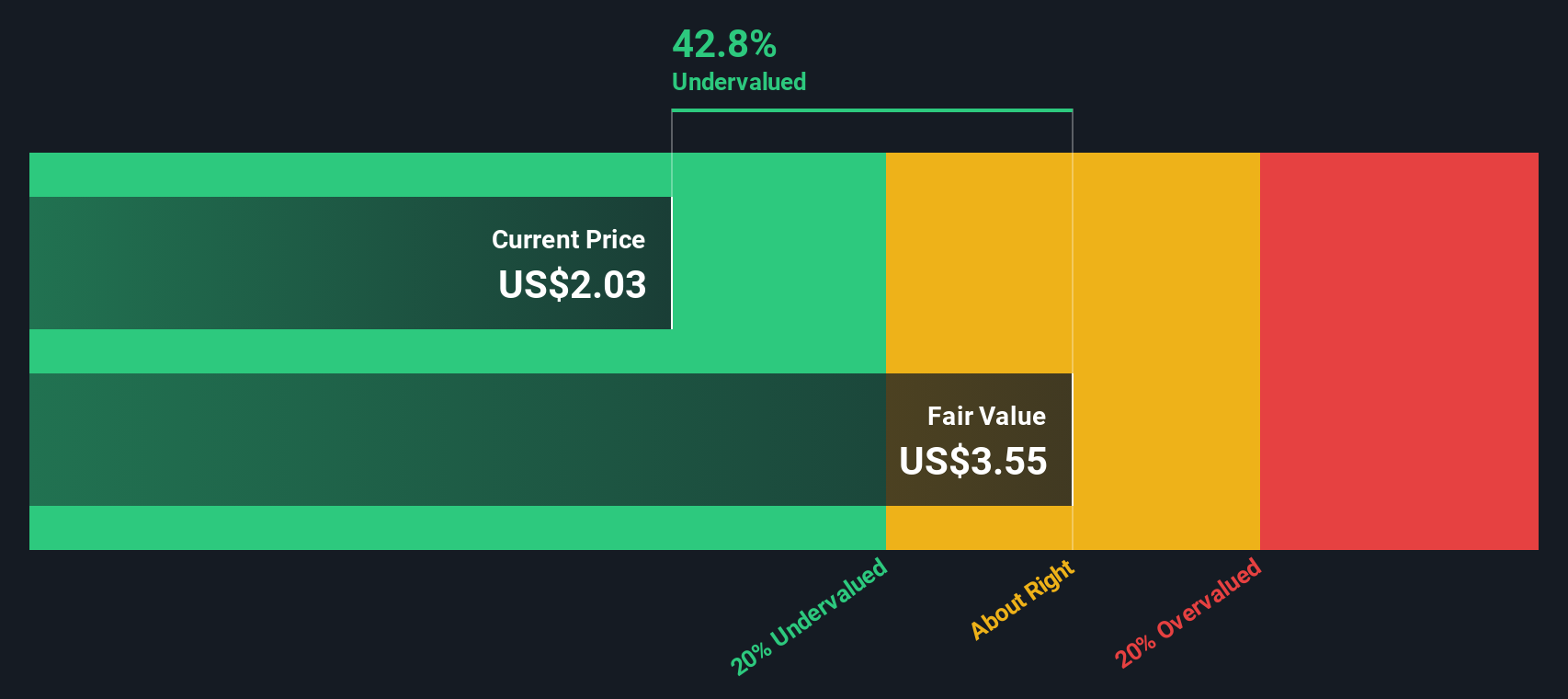

Traeger, a grill manufacturer, has seen insider confidence as Jeremy Andrus purchased 727,187 shares worth approximately US$1 million between April and May 2025. Despite its small size, the company faces challenges with a volatile share price and reliance on external borrowing. Recent earnings showed sales of US$143 million for Q1 2025, with net losses narrowing to US$0.778 million from the previous year's US$4.68 million loss. While not profitable or expected to be soon, insider buying suggests potential value recognition by leadership.

- Delve into the full analysis valuation report here for a deeper understanding of Traeger.

Examine Traeger's past performance report to understand how it has performed in the past.

NexPoint Residential Trust (NXRT)

Simply Wall St Value Rating: ★★★★☆☆

Overview: NexPoint Residential Trust focuses on acquiring, owning, and operating multifamily properties in the southeastern United States with a market cap of approximately $1.50 billion.

Operations: NXRT generates revenue primarily from its investments in real estate, with a recent reported revenue of $255.53 million. The company's gross profit margin has shown an upward trend, reaching 60.27% as of the latest period. Operating expenses and non-operating expenses are significant components of their cost structure, impacting net income outcomes across different periods.

PE: -26.7x

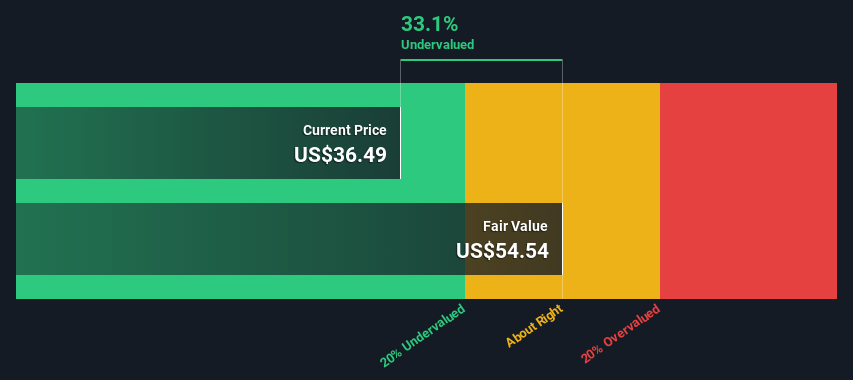

NexPoint Residential Trust's recent inclusion in multiple Russell Growth Benchmarks underscores its potential appeal, despite challenges. The company reported a net loss of US$6.9 million for Q1 2025, contrasting with last year's net income of US$26.3 million, and earnings are forecasted to decline by 0.7% annually over the next three years. Insider confidence is evident as CFO Paul Richards increased their holdings by 35%, purchasing shares worth approximately US$193,275 between January and May 2025. Additionally, the company completed a share buyback of over 223,000 shares for US$7.6 million during this period. While interest payments aren't well covered by earnings and funding relies solely on external borrowing, these strategic moves suggest management's belief in future growth potential amidst current financial pressures.

Key Takeaways

- Gain an insight into the universe of 77 Undervalued US Small Caps With Insider Buying by clicking here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:CZNC

Citizens & Northern

Operates as the bank holding company for Citizens & Northern Bank that provides various banking and related services to individual and corporate customers.

Solid track record with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives