- United States

- /

- Consumer Durables

- /

- NYSE:CCS

Possible Bearish Signals With Century Communities Insiders Disposing Stock

The fact that multiple Century Communities, Inc. (NYSE:CCS) insiders offloaded a considerable amount of shares over the past year could have raised some eyebrows amongst investors. Knowing whether insiders are buying is usually more helpful when evaluating insider transactions, as insider selling can have various explanations. However, shareholders should take a deeper look if several insiders are selling stock over a specific time period.

Although we don't think shareholders should simply follow insider transactions, we would consider it foolish to ignore insider transactions altogether.

The Last 12 Months Of Insider Transactions At Century Communities

In the last twelve months, the biggest single sale by an insider was when the CEO, President & Director, Robert Francescon, sold US$4.6m worth of shares at a price of US$92.64 per share. While we don't usually like to see insider selling, it's more concerning if the sales take place at a lower price. The good news is that this large sale was at well above current price of US$52.37. So it is hard to draw any strong conclusion from it.

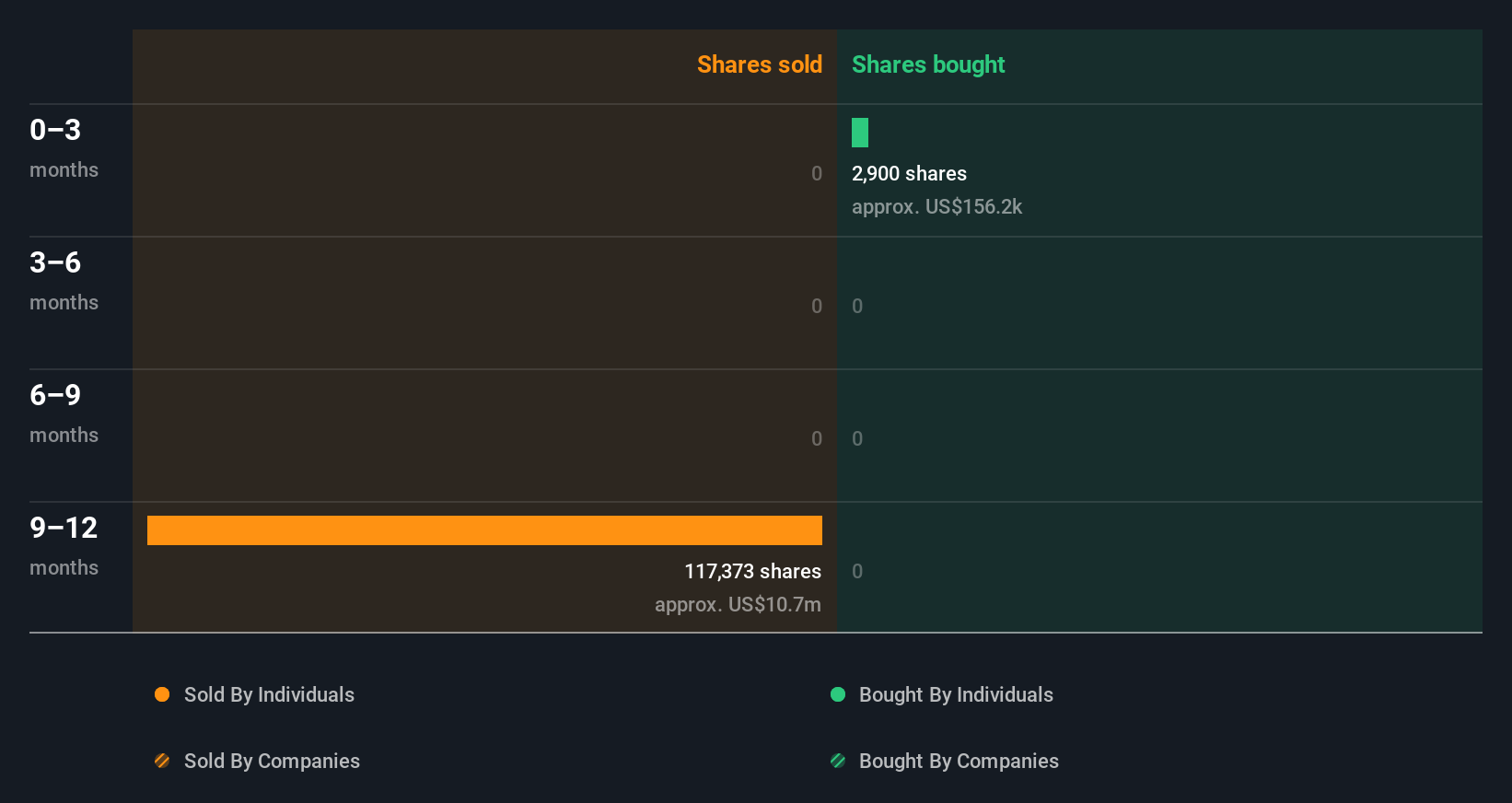

Over the last year we saw more insider selling of Century Communities shares, than buying. You can see a visual depiction of insider transactions (by companies and individuals) over the last 12 months, below. By clicking on the graph below, you can see the precise details of each insider transaction!

View our latest analysis for Century Communities

If you like to buy stocks that insiders are buying, rather than selling, then you might just love this free list of companies. (Hint: Most of them are flying under the radar).

Century Communities Insiders Bought Stock Recently

Over the last quarter, Century Communities insiders have spent a meaningful amount on shares. Specifically, Independent Director Elisa Zuniga Ramirez bought US$158k worth of shares in that time, and we didn't record any sales whatsoever. That shows some optimism about the company's future.

Insider Ownership

For a common shareholder, it is worth checking how many shares are held by company insiders. A high insider ownership often makes company leadership more mindful of shareholder interests. Century Communities insiders own 15% of the company, currently worth about US$246m based on the recent share price. I like to see this level of insider ownership, because it increases the chances that management are thinking about the best interests of shareholders.

So What Does This Data Suggest About Century Communities Insiders?

The recent insider purchase is heartening. On the other hand the transaction history, over the last year, isn't so positive. Overall, we'd prefer see a more sustained buying from directors, but with a significant insider holding and more recent purchases, Century Communities insiders are reasonably well aligned, and optimistic for the future. While it's good to be aware of what's going on with the insider's ownership and transactions, we make sure to also consider what risks are facing a stock before making any investment decision. At Simply Wall St, we've found that Century Communities has 3 warning signs (2 are a bit unpleasant!) that deserve your attention before going any further with your analysis.

Of course Century Communities may not be the best stock to buy. So you may wish to see this free collection of high quality companies.

For the purposes of this article, insiders are those individuals who report their transactions to the relevant regulatory body. We currently account for open market transactions and private dispositions of direct interests only, but not derivative transactions or indirect interests.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:CCS

Century Communities

Engages in the design, development, construction, marketing, and sale of single-family attached and detached homes.

Adequate balance sheet and fair value.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

A case for USD $14.81 per share based on book value. Be warned, this is a micro-cap dependent on a single mine.

Occidental Petroleum to Become Fairly Priced at $68.29 According to Future Projections

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)