- United States

- /

- Leisure

- /

- NasdaqGS:SWIM

Latham Group, Inc.'s (NASDAQ:SWIM) 85% Jump Shows Its Popularity With Investors

Latham Group, Inc. (NASDAQ:SWIM) shareholders have had their patience rewarded with a 85% share price jump in the last month. Looking back a bit further, it's encouraging to see the stock is up 80% in the last year.

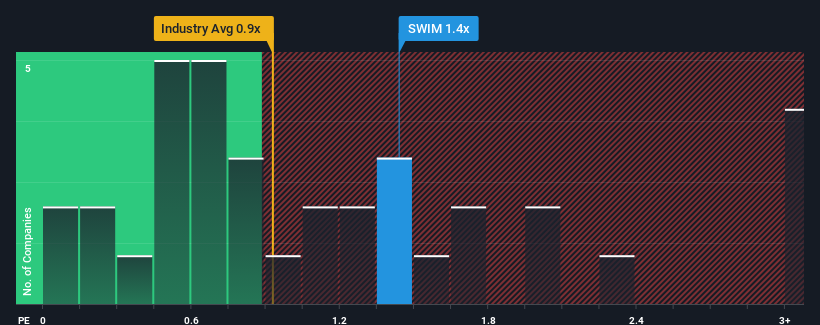

Following the firm bounce in price, when almost half of the companies in the United States' Leisure industry have price-to-sales ratios (or "P/S") below 0.9x, you may consider Latham Group as a stock probably not worth researching with its 1.4x P/S ratio. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's as high as it is.

Check out our latest analysis for Latham Group

What Does Latham Group's P/S Mean For Shareholders?

Recent times haven't been great for Latham Group as its revenue has been falling quicker than most other companies. It might be that many expect the dismal revenue performance to recover substantially, which has kept the P/S from collapsing. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Want the full picture on analyst estimates for the company? Then our free report on Latham Group will help you uncover what's on the horizon.Do Revenue Forecasts Match The High P/S Ratio?

The only time you'd be truly comfortable seeing a P/S as high as Latham Group's is when the company's growth is on track to outshine the industry.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 15%. The last three years don't look nice either as the company has shrunk revenue by 8.2% in aggregate. So unfortunately, we have to acknowledge that the company has not done a great job of growing revenue over that time.

Turning to the outlook, the next year should demonstrate some strength in company's business, generating growth of 1.6% as estimated by the seven analysts watching the company. Meanwhile, the broader industry is forecast to contract by 1.8%, which would indicate the company is doing better than the majority of its peers.

With this in mind, we see why Latham Group's P/S is a cut above its industry peers. At this time, shareholders aren't keen to offload something that is potentially eyeing a much more prosperous future.

The Key Takeaway

The large bounce in Latham Group's shares has lifted the company's P/S handsomely. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

As we anticipated, our review of Latham Group's analyst forecasts shows that the company's better revenue forecast compared to a turbulent industry is a significant contributor to its high price-to-sales ratio. At this stage investors feel the potential for a deterioration in revenue is remote enough to justify paying a premium in the form of a high P/S. Questions could still raised over whether this level of outperformance can continue in the context of a a tumultuous industry climate. Although, if the company's prospects don't change they will continue to provide strong support to the share price.

Before you take the next step, you should know about the 3 warning signs for Latham Group (2 are concerning!) that we have uncovered.

If these risks are making you reconsider your opinion on Latham Group, explore our interactive list of high quality stocks to get an idea of what else is out there.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:SWIM

Latham Group

Designs, manufactures, and markets in-ground residential swimming pools in North America, Australia, and New Zealand.

Adequate balance sheet with moderate growth potential.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)