- United States

- /

- IT

- /

- NasdaqCM:RSSS

Research Solutions And 2 Other Penny Stocks On The US Market To Watch

Reviewed by Simply Wall St

Stocks in the United States have shown mixed performance recently, with the Dow Jones and S&P 500 nearing record highs amid a flurry of earnings reports. In this context, penny stocks remain an intriguing area for investors due to their potential for growth at lower price points. While often associated with smaller or newer companies, these stocks can offer significant opportunities when backed by strong financials and fundamentals.

Top 10 Penny Stocks In The United States

| Name | Share Price | Market Cap | Financial Health Rating |

| BAB (OTCPK:BABB) | $0.8781 | $6.23M | ★★★★★★ |

| QuantaSing Group (NasdaqGM:QSG) | $3.08 | $120.12M | ★★★★★★ |

| ZTEST Electronics (OTCPK:ZTST.F) | $0.275 | $10.3M | ★★★★★★ |

| Imperial Petroleum (NasdaqCM:IMPP) | $2.99 | $91.9M | ★★★★★★ |

| Permianville Royalty Trust (NYSE:PVL) | $1.42 | $47.19M | ★★★★★★ |

| Golden Growers Cooperative (OTCPK:GGRO.U) | $4.50 | $67.38M | ★★★★★★ |

| BTCS (NasdaqCM:BTCS) | $3.06 | $53.61M | ★★★★★★ |

| Smith Micro Software (NasdaqCM:SMSI) | $1.52 | $23.94M | ★★★★★☆ |

| CBAK Energy Technology (NasdaqCM:CBAT) | $0.91 | $83.05M | ★★★★★☆ |

| SideChannel (OTCPK:SDCH) | $0.03906 | $8.77M | ★★★★★★ |

Click here to see the full list of 702 stocks from our US Penny Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

Research Solutions (NasdaqCM:RSSS)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Research Solutions, Inc. offers a cloud-based software-as-a-service platform and related services for researchers across corporate, academic, government, and individual sectors globally, with a market cap of $117.28 million.

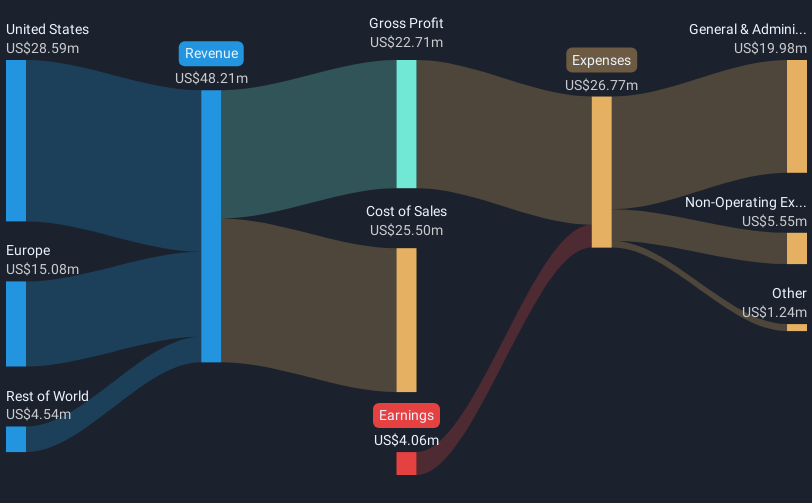

Operations: The company's revenue is primarily derived from its Publishing - Periodicals segment, generating $46.61 million.

Market Cap: $117.28M

Research Solutions, Inc. has shown a promising shift with recent earnings of US$12.04 million for Q1 2024, marking an improvement from the previous year's loss to a net income of US$0.67 million. Despite being unprofitable overall, the company benefits from a stable cash runway exceeding three years due to positive free cash flow growth and no debt burden. The appointment of Sefton Cohen as Chief Revenue Officer aims to drive further revenue growth by leveraging AI capabilities in its platform expansion efforts. Analysts suggest potential undervaluation, with shares trading below estimated fair value and price targets indicating possible upside movement.

- Jump into the full analysis health report here for a deeper understanding of Research Solutions.

- Learn about Research Solutions' future growth trajectory here.

Fossil Group (NasdaqGS:FOSL)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Fossil Group, Inc., along with its subsidiaries, is involved in the design, development, marketing, and distribution of consumer fashion accessories globally and has a market cap of approximately $95.75 million.

Operations: The company's revenue is derived from its operations in Asia ($280.60 million), Europe ($386.37 million), and the Americas ($554.52 million), with a small contribution from corporate activities ($2.47 million).

Market Cap: $95.75M

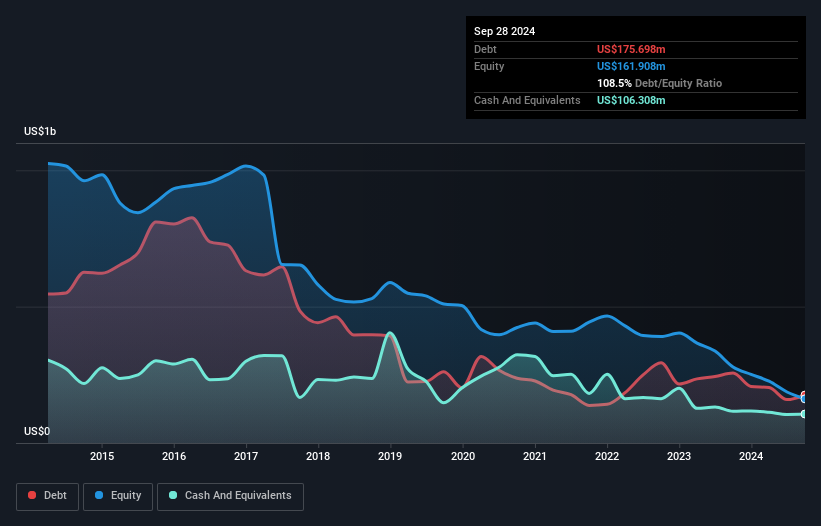

Fossil Group faces challenges as a penny stock with its market cap at approximately US$95.75 million and persistent unprofitability, with losses increasing annually by 19.6% over the past five years. Despite this, the company maintains a strong liquidity position, with short-term assets of US$575.9 million surpassing both short-term and long-term liabilities. Recent executive appointments aim to drive a business turnaround, focusing on digital transformation and global revenue growth strategies. While share price volatility remains high, the company's strategic changes reflect efforts to stabilize operations and improve financial performance amidst ongoing industry pressures.

- Unlock comprehensive insights into our analysis of Fossil Group stock in this financial health report.

- Examine Fossil Group's past performance report to understand how it has performed in prior years.

OraSure Technologies (NasdaqGS:OSUR)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: OraSure Technologies, Inc. operates in the United States, Europe, and internationally, offering point-of-care and home diagnostic tests, specimen collection devices, and microbiome laboratory services with a market cap of $299.12 million.

Operations: The company's revenue is primarily derived from its Diagnostics and Molecular Solutions segment, totaling $224.26 million.

Market Cap: $299.12M

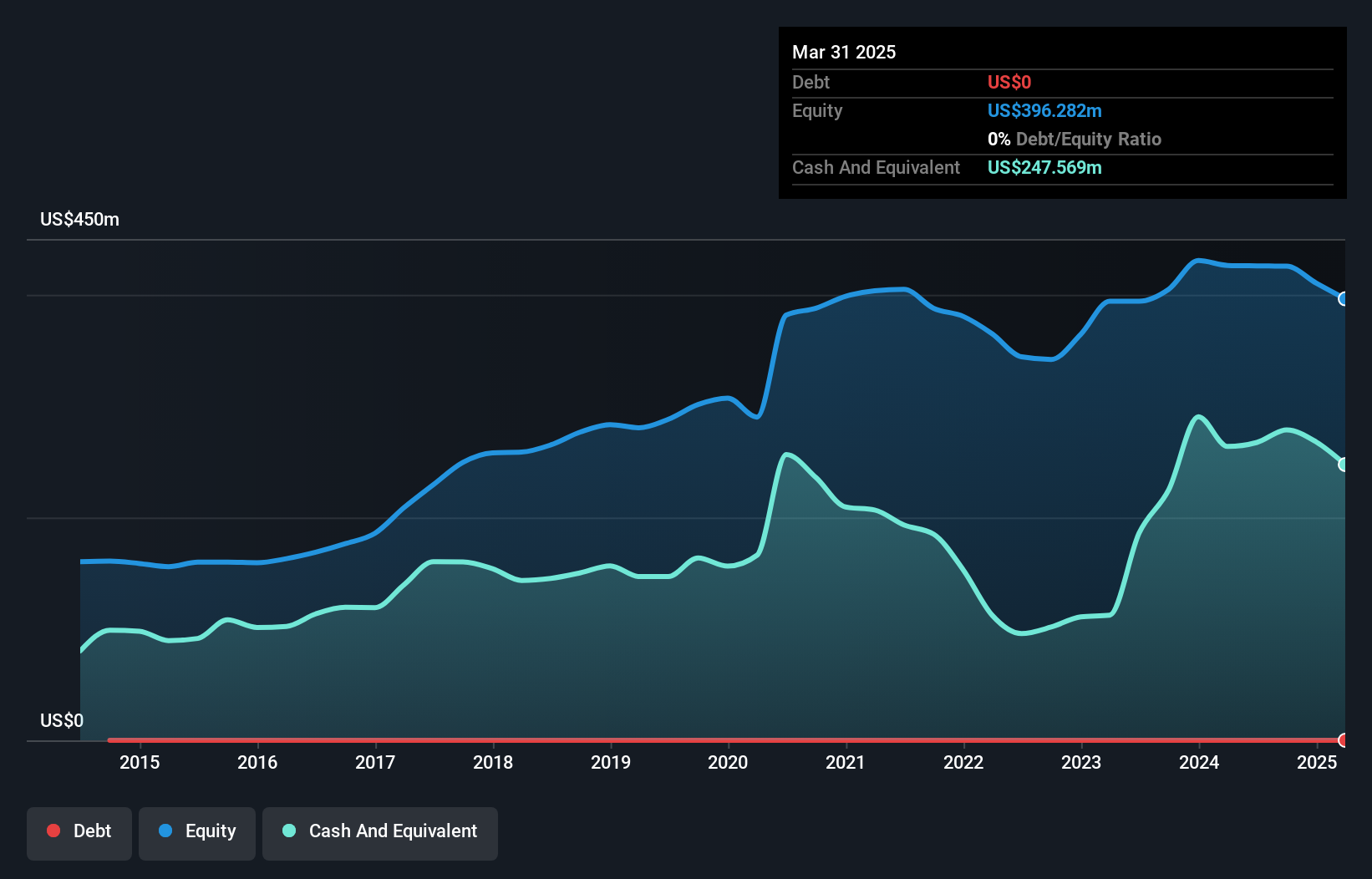

OraSure Technologies, with a market cap of US$299.12 million, faces mixed prospects as a penny stock. While the company is debt-free and maintains strong liquidity with short-term assets of US$350.2 million exceeding liabilities, it struggles with declining earnings and recent legal challenges from NOWDiagnostics over alleged trade secret misappropriation. Despite these hurdles, OraSure seeks growth through acquisitions and innovation in diagnostics, evidenced by FDA approval for expanded use of its HIV self-test and ongoing collaborations for virus detection tests. However, recent revenue declines highlight operational challenges amidst industry competition and evolving market dynamics.

- Navigate through the intricacies of OraSure Technologies with our comprehensive balance sheet health report here.

- Review our growth performance report to gain insights into OraSure Technologies' future.

Turning Ideas Into Actions

- Unlock more gems! Our US Penny Stocks screener has unearthed 699 more companies for you to explore.Click here to unveil our expertly curated list of 702 US Penny Stocks.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:RSSS

Research Solutions

Through its subsidiaries, provides research cloud-based software-as-a-service software platform and related services to corporate, academic, government and individual researchers in the United States, Europe, and internationally.

Excellent balance sheet and fair value.

Market Insights

Community Narratives