- United States

- /

- Luxury

- /

- NasdaqGS:CROX

Crocs (NasdaqGS:CROX) Sees 5% Dip In One Month After Executive Resignation Announcement

Reviewed by Simply Wall St

In recent developments, Crocs (NasdaqGS:CROX) announced the resignation of Adam Michaels, its Executive Vice President and Chief Digital Officer, effective May 2025. This leadership change coincides with a 5% decline in Crocs's share price over the last month, a period that also saw significant market turmoil driven by new global tariffs, with major indices experiencing considerable drops. The Dow Jones, for example, fell by roughly 4% amid growing fears of a trade war, dragging down broader market sentiment. These market conditions, coupled with Crocs’s internal leadership changes, contributed to the company's recent stock performance.

Be aware that Crocs is showing 3 risks in our investment analysis and 1 of those can't be ignored.

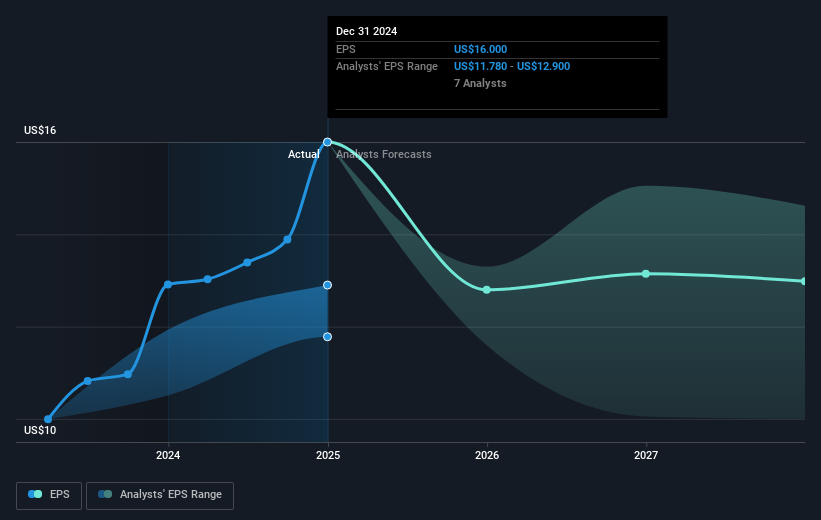

The past five years have seen Crocs deliver a very large total return of 360.51%. This substantial growth was fueled by the company's strategic international expansion and innovative product offerings. Crocs ventured into less-penetrated markets like China and India, aiming to diversify its market base and boost revenue despite tariff challenges. Enhancements to their product lines, including new iterations like the Classic Clog, have aimed to tap into new customer demographics and increase brand engagement.

Additionally, Crocs has actively repurchased shares, expanding their buyback program by US$1 billion to support shareholder value enhancement. On the product development front, ventures such as launching 'Pet Crocs' have kept the brand fresh and relevant. Despite this progress, Crocs underperformed compared to the US Luxury industry, which experienced a 24.2% decline over the past year, highlighting persistent challenges in maintaining growth momentum in a complex market landscape.

Our valuation report unveils the possibility Crocs' shares may be trading at a discount.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Crocs, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CROX

Crocs

Designs, develops, manufactures, markets, distributes, and sells casual lifestyle footwear and accessories for men, women, and children under the Crocs and HEYDUDE Brands in the United States and internationally.

Very undervalued with solid track record.

Similar Companies

Market Insights

Community Narratives