- United States

- /

- Electronic Equipment and Components

- /

- NasdaqGS:BELF.A

Three Undiscovered Gems To Enhance Your Investment Portfolio

Reviewed by Simply Wall St

The market is up 2.6% over the last week and has climbed 31% in the past year, with earnings forecast to grow by 15% annually. In this thriving environment, identifying lesser-known stocks with strong growth potential can be a strategic move to enhance your investment portfolio.

Top 10 Undiscovered Gems With Strong Fundamentals In The United States

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Morris State Bancshares | 10.20% | -0.28% | 6.97% | ★★★★★★ |

| River Financial | 122.41% | 16.43% | 18.50% | ★★★★★★ |

| Teekay | NA | -6.48% | 55.79% | ★★★★★★ |

| Mission Bancorp | 25.37% | 16.23% | 20.16% | ★★★★★★ |

| Omega Flex | NA | 1.31% | 3.88% | ★★★★★★ |

| First Northern Community Bancorp | NA | 7.12% | 10.04% | ★★★★★★ |

| Banco Latinoamericano de Comercio Exterior S. A | 311.64% | 21.07% | 24.77% | ★★★★★☆ |

| United Bancorporation of Alabama | 13.34% | 18.86% | 25.45% | ★★★★★☆ |

| Valhi | 38.71% | 2.57% | -19.76% | ★★★★★☆ |

| FRMO | 0.17% | 12.99% | 23.62% | ★★★★☆☆ |

Below we spotlight a couple of our favorites from our exclusive screener.

Bel Fuse (NasdaqGS:BELF.A)

Simply Wall St Value Rating: ★★★★★★

Overview: Bel Fuse Inc. designs, manufactures, markets, and sells products that power, protect, and connect electronic circuits with a market cap of $917.13 million.

Operations: Bel Fuse generates revenue from three primary segments: Magnetic Solutions ($82.92 million), Connectivity Solutions ($214.44 million), and Power Solutions and Protection ($262.63 million). The company's market cap stands at $917.13 million.

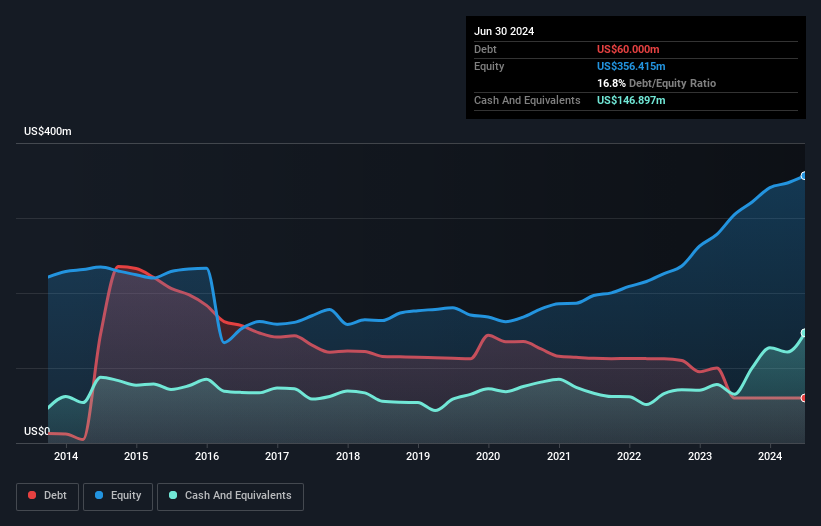

Bel Fuse, a smaller player in the electronics industry, has seen its debt to equity ratio improve significantly from 62.7% to 16.8% over the past five years. Despite negative earnings growth of -9.3% last year, it trades at 20% below estimated fair value and boasts high-quality earnings with more cash than total debt. The company recently repurchased 235,500 shares for US$14.18 million and declared quarterly dividends on both Class A and B shares payable in November 2024.

- Click here and access our complete health analysis report to understand the dynamics of Bel Fuse.

Assess Bel Fuse's past performance with our detailed historical performance reports.

Cricut (NasdaqGS:CRCT)

Simply Wall St Value Rating: ★★★★★★

Overview: Cricut, Inc. designs, markets, and distributes a creativity platform that enables users to transform ideas into professional-looking handmade goods, with a market cap of $1.39 billion.

Operations: Cricut generates revenue primarily through the sale of connected machines, accessories, and materials, as well as subscriptions to its cloud-based software. The company reported a gross profit margin of 48.30% in the most recent period.

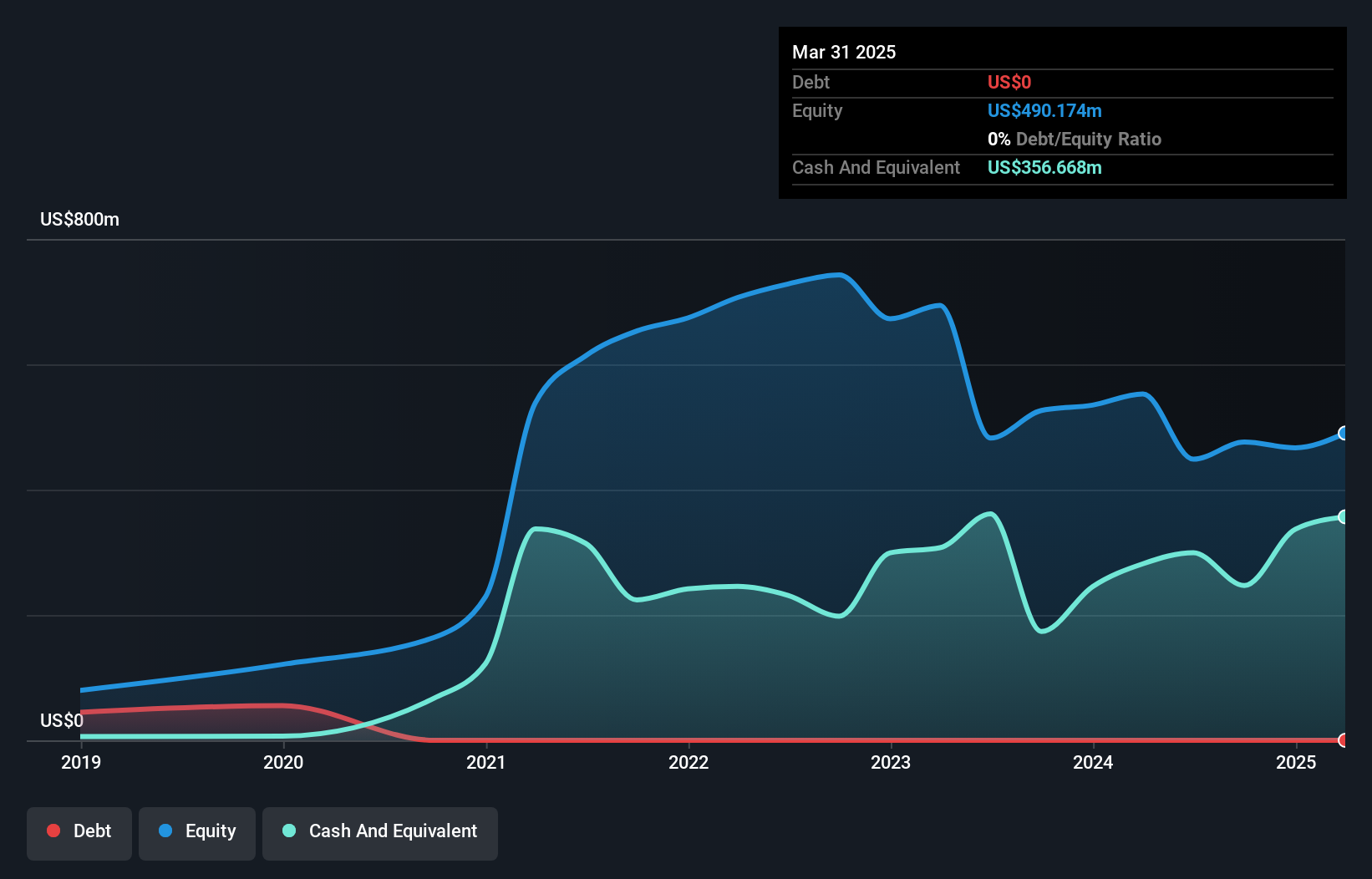

Cricut has shown notable financial performance recently, with earnings growing by 40.2% over the past year, significantly outpacing the Consumer Durables industry. The company is debt-free now, unlike five years ago when its debt to equity ratio was 49.9%. Cricut repurchased 1.41 million shares for US$8.86 million between May and June 2024, indicating confidence in its valuation. Despite a revenue dip to US$167.95 million in Q2 from US$177.77 million last year, net income rose to US$19.77 million from US$16.02 million previously.

Worthington Steel (NYSE:WS)

Simply Wall St Value Rating: ★★★★★☆

Overview: Worthington Steel, Inc. operates as a steel processor in North America with a market cap of approximately $1.73 billion.

Operations: The company's primary revenue stream is from its Metal Processors and Fabrication segment, generating $3.43 billion.

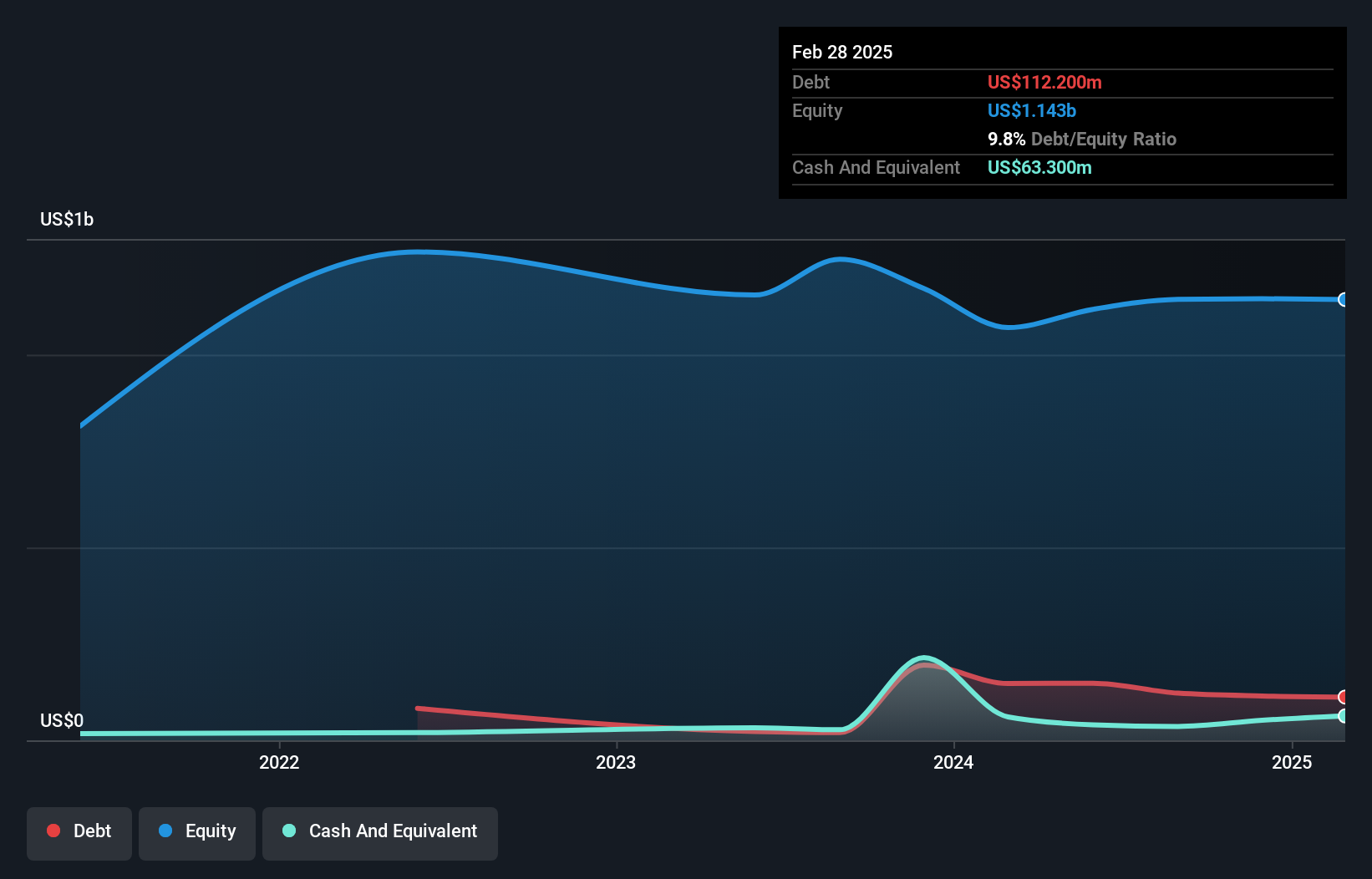

Worthington Steel, a small cap player in the Metals and Mining industry, has demonstrated impressive growth with earnings increasing by 77.6% over the past year. Trading at 37.4% below its estimated fair value, it offers potential for value investors. The company's net debt to equity ratio stands at a satisfactory 9.6%, and its interest payments are well covered by EBIT at 35.9 times coverage. Recent financials show annual sales of US$3.43 billion with net income rising to US$154.7 million from US$87.1 million last year, reflecting high-quality earnings amidst industry challenges.

Summing It All Up

- Gain an insight into the universe of 207 US Undiscovered Gems With Strong Fundamentals by clicking here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Bel Fuse might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:BELF.A

Bel Fuse

Designs, manufactures, markets, and sells products that power, protect, and connect electronic circuits.

Flawless balance sheet and undervalued.