- United States

- /

- Leisure

- /

- NasdaqGS:CLAR

Clarus Corporation (NASDAQ:CLAR) Analysts Are Reducing Their Forecasts For Next Year

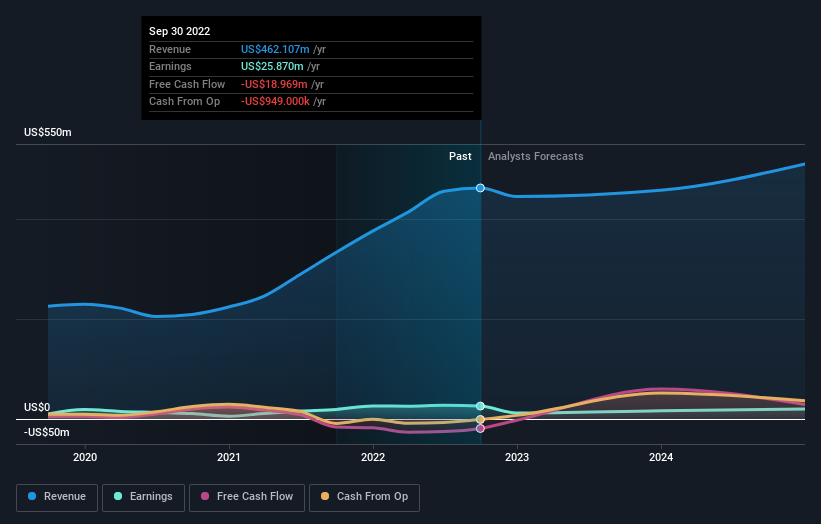

Market forces rained on the parade of Clarus Corporation (NASDAQ:CLAR) shareholders today, when the analysts downgraded their forecasts for next year. Both revenue and earnings per share (EPS) forecasts went under the knife, suggesting the analysts have soured majorly on the business.

Following the latest downgrade, Clarus' nine analysts currently expect revenues in 2023 to be US$457m, approximately in line with the last 12 months. Statutory earnings per share are supposed to crater 39% to US$0.42 in the same period. Before this latest update, the analysts had been forecasting revenues of US$514m and earnings per share (EPS) of US$0.83 in 2023. Indeed, we can see that the analysts are a lot more bearish about Clarus' prospects, administering a substantial drop in revenue estimates and slashing their EPS estimates to boot.

Check out the opportunities and risks within the US Leisure industry.

It'll come as no surprise then, to learn that the analysts have cut their price target 49% to US$16.00. There's another way to think about price targets though, and that's to look at the range of price targets put forward by analysts, because a wide range of estimates could suggest a diverse view on possible outcomes for the business. The most optimistic Clarus analyst has a price target of US$28.00 per share, while the most pessimistic values it at US$9.00. We would probably assign less value to the forecasts in this situation, because such a wide range of estimates could imply that the future of this business is difficult to value accurately. As a result it might not be possible to derive much meaning from the consensus price target, which is after all just an average of this wide range of estimates.

Another way we can view these estimates is in the context of the bigger picture, such as how the forecasts stack up against past performance, and whether forecasts are more or less bullish relative to other companies in the industry. We would highlight that sales are expected to reverse, with a forecast 0.8% annualised revenue decline to the end of 2023. That is a notable change from historical growth of 20% over the last five years. By contrast, our data suggests that other companies (with analyst coverage) in the same industry are forecast to see their revenue grow 4.5% annually for the foreseeable future. It's pretty clear that Clarus' revenues are expected to perform substantially worse than the wider industry.

The Bottom Line

The biggest issue in the new estimates is that analysts have reduced their earnings per share estimates, suggesting business headwinds lay ahead for Clarus. Regrettably, they also downgraded their revenue estimates, and the latest forecasts imply the business will grow sales slower than the wider market. Given the scope of the downgrades, it would not be a surprise to see the market become more wary of the business.

After a downgrade like this, it's pretty clear that previous forecasts were too optimistic. What's more, we've spotted several possible issues with Clarus' business, like recent substantial insider selling. For more information, you can click here to discover this and the 2 other flags we've identified.

Of course, seeing company management invest large sums of money in a stock can be just as useful as knowing whether analysts are downgrading their estimates. So you may also wish to search this free list of stocks that insiders are buying.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:CLAR

Clarus

Designs, develops, manufactures, and distributes outdoor equipment and lifestyle products in the United States, Australia, China, Austria, and internationally.

Excellent balance sheet and slightly overvalued.

Similar Companies

Market Insights

Community Narratives