- United States

- /

- Professional Services

- /

- NYSE:ULS

UL Solutions (ULS): Reassessing Valuation After $975m Secondary Offering and Major Shareholder Exit

Reviewed by Simply Wall St

UL Solutions (ULS) just wrapped up a $975 million follow on equity offering, with former parent ULSE fully exiting its Class A stake. This secondary sale reshapes the stock’s ownership and narrative.

See our latest analysis for UL Solutions.

Against that backdrop, UL Solutions’ share price at $77.88 still reflects strong momentum, with a robust year to date share price return and solid one year total shareholder return. This suggests investors see durable growth despite recent secondary sale related volatility.

If this kind of ownership reshuffle has you rethinking your watchlist, it could be a good moment to broaden your scope and explore fast growing stocks with high insider ownership.

With growth still outpacing many peers and the stock trading at a modest discount to analyst targets, the key question now is whether UL Solutions is still mispriced or if the market is already factoring in its next leg of expansion.

Most Popular Narrative Narrative: 15.1% Undervalued

With UL Solutions last closing at 77.88 dollars against a narrative fair value of 91.71 dollars, the valuation case leans firmly toward upside potential.

The analysts have a consensus price target of $71.27 for UL Solutions based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $78.0, and the most bearish reporting a price target of just $59.0.

Curious why a business built on steady certifications and advisory work attracts such a rich future earnings multiple and ambitious profit assumptions? The most followed narrative leans on rising margins, accelerating earnings and a premium valuation usually reserved for faster growing sectors. Want to see which specific growth and profitability forecasts are doing the heavy lifting in that 91.71 dollar fair value?

Result: Fair Value of $91.71 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, this upside view still hinges on macro conditions and customer budgets, with geopolitical shocks or delayed innovation potentially slowing demand and earnings momentum.

Find out about the key risks to this UL Solutions narrative.

Another View: Rich Multiples Cloud the Undervaluation Story

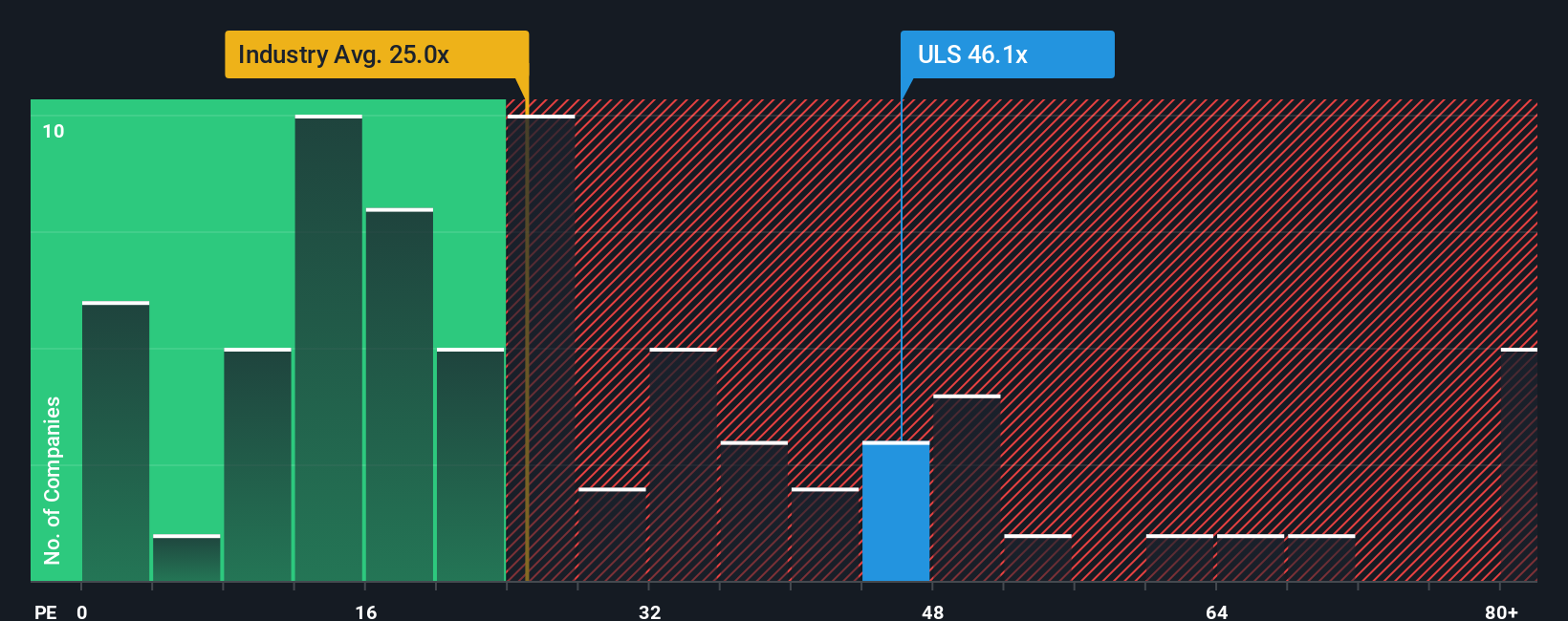

Looking beyond fair value models, UL Solutions appears expensive on an earnings basis. At about 46.1 times earnings versus 25 times for the US Professional Services industry and a 32.3 times peer average, the stock also trades well above its 29.1 times fair ratio. This raises a real risk of de rating if growth cools.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own UL Solutions Narrative

If you see things differently or want to dig into the numbers yourself, you can build a personalized view in minutes: Do it your way.

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding UL Solutions.

Looking for more investment ideas?

Before you move on, explore your next potential opportunity by scanning focused stock ideas that match your risk appetite, income needs and growth ambitions.

- Consider long term upside by targeting high quality businesses trading below their estimated cash flow value through these 903 undervalued stocks based on cash flows.

- Explore powerful trends in automation, data and smart diagnostics by filtering companies at the forefront of these 30 healthcare AI stocks.

- Follow developments in financial innovation by tracking leaders and enablers of digital assets with these 80 cryptocurrency and blockchain stocks.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ULS

UL Solutions

Provides testing, inspection and certification, and related software and advisory services worldwide.

Outstanding track record with excellent balance sheet.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Butler National (Buks) outperforms.

A tech powerhouse quietly powering the world’s AI infrastructure.

Keppel DC REIT (SGX: AJBU) is a resilient gem in the data center space.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)