- United States

- /

- Professional Services

- /

- NYSE:ULS

Assessing UL Solutions’s Valuation After New Robotics Lab and Fire Science Center Investments

Reviewed by Simply Wall St

If you have been tracking UL Solutions (NYSE:ULS), you know the stock has attracted fresh interest following two back-to-back announcements. The company revealed it is launching its first commercial and service robot testing laboratory just outside Seoul, directly targeting the rapidly expanding service robotics market. Almost immediately after, UL Solutions announced the groundbreaking of a Global Fire Science Center of Excellence at its headquarters in the US, signaling major investments in next-generation safety testing. For investors, these are not routine developments. Together, they point to a strategy focused on growth areas that could reshape its long-term outlook.

These announcements arrive after a dynamic period for UL Solutions. The stock has climbed 31% over the past year, with much of that momentum building in recent months before a slight dip in the past month. Earlier moves included positioning at high-profile conferences and expanding its footprint in sectors demanding rigorous safety standards. This push into robotics and upgraded testing centers fits with a broader shift toward advanced, tech-driven services. These actions could potentially support further gains or affect perceptions around future earnings streams.

So with this year’s gains and recent pullback, is UL Solutions offering a smart entry point now, or are investors already factoring in the growth from these expansions?

Most Popular Narrative: 10.4% Undervalued

According to the most widely followed narrative, UL Solutions shares appear undervalued, with a fair value that suggests meaningful upside for investors if projected growth materializes.

"UL Solutions' robust revenue growth, strong profitability, strategic investments, and stable income streams position the company for sustained success and future expansion. The recurring revenue model from ongoing product certifications, which can yield additional revenue from product redesigns and manufacturing shifts, suggests a stable, reliable income stream that could support consistent earnings."

Curious what drives this double-digit discount to fair value? The narrative is betting big on persistent margin gains, relentlessly steady income streams, and an ambitious multi-year earnings trajectory. Want to see which financial leapfrogs could close the gap between today’s share price and analyst targets? Explore the specific forecasts and financial moves projected to propel UL Solutions higher.

Result: Fair Value of $71.27 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, global economic uncertainty or rising tax rates could slow product demand and earnings. This may potentially challenge the upbeat outlook for UL Solutions.

Find out about the key risks to this UL Solutions narrative.Another View: Multiples Tell a Different Story

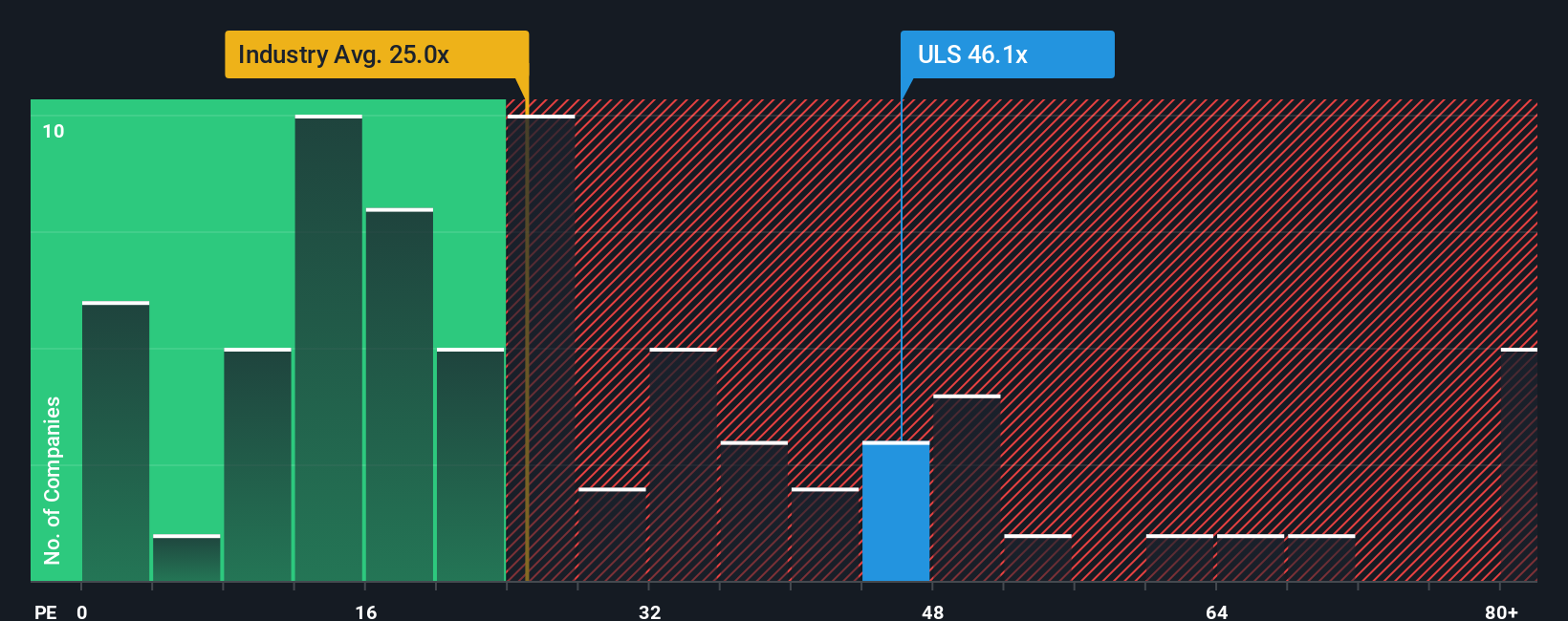

Looking from a different angle, market pricing based on earnings places UL Solutions above sector averages. This suggests the current stock price may be less of a bargain than the growth narrative implies. So, is the value debate really settled?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own UL Solutions Narrative

If you want to dig into the numbers yourself or put your own spin on the investment story, you can build a narrative in just a few minutes. Do it your way

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding UL Solutions.

Looking for More Smart Investment Ideas?

Don’t let standout opportunities slip by. Use the Simply Wall Street Screener to tap into unique stock ideas and keep your portfolio steps ahead of the crowd:

- Uncover up-and-coming businesses shaking up their industries with untapped potential using penny stocks with strong financials.

- Target overlooked stocks trading well below their cash flow value through undervalued stocks based on cash flows and explore possible bargains now.

- Spot tech disruptors harnessing machine learning and automation that could reshape tomorrow’s markets with AI penny stocks.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Kshitija Bhandaru

Kshitija (or Keisha) Bhandaru is an Equity Analyst at Simply Wall St and has over 6 years of experience in the finance industry and describes herself as a lifelong learner driven by her intellectual curiosity. She previously worked with Market Realist for 5 years as an Equity Analyst.

About NYSE:ULS

UL Solutions

Provides testing, inspection and certification, and related software and advisory services worldwide.

Outstanding track record with excellent balance sheet.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Butler National (Buks) outperforms.

A tech powerhouse quietly powering the world’s AI infrastructure.

Keppel DC REIT (SGX: AJBU) is a resilient gem in the data center space.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)