- United States

- /

- Professional Services

- /

- NYSE:TRU

TransUnion (TRU) Valuation Check After Expanding Attribution with National CineMedia Cinema Data Integration

Reviewed by Simply Wall St

TransUnion (TRU) just deepened its footprint in data driven marketing by incorporating National CineMedia’s theatrical exposure data into its cross platform attribution, enabling investors to better gauge how cinema fits into the broader ad effectiveness story.

See our latest analysis for TransUnion.

That backdrop helps explain why TransUnion’s recent integration push lands at an interesting moment, with the share price at $84.21 and a 30 day share price return of 5.35 percent contrasting with a softer year to date share price return and a one year total shareholder return of negative 13.98 percent. At the same time, the three year total shareholder return of 43.85 percent suggests longer term momentum has been stronger than the recent wobble.

If this kind of data driven marketing story has your attention, it could be a good moment to see what else is setting up for growth among high growth tech and AI stocks.

Yet with revenue and earnings still growing, and the stock trading at a meaningful discount to analyst targets and intrinsic value estimates, investors now face a key question: Is TransUnion attractively valued at current levels, or is its future growth already fully reflected in the share price?

Most Popular Narrative: 21.3% Undervalued

With TransUnion's fair value estimate sitting comfortably above the last close, the prevailing narrative leans toward upside potential driven by improving fundamentals.

With technology modernization and operational transformation investments ending in 2025, management projects free cash flow conversion to rise significantly (from 70% in 2025 to 90%+ in 2026), providing a catalyst for future shareholder returns through buybacks, acquisitions, or reinvestment, and supporting a step-change in long-term earnings growth.

Curious how rising free cash flow, expanding margins, and ambitious earnings targets all come together in one valuation story? Want to see the full playbook behind that upside case?

Result: Fair Value of $106.95 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, sustained regulatory pressure or a major cyber incident could slow growth, lift costs, and quickly challenge even today’s seemingly conservative upside case.

Find out about the key risks to this TransUnion narrative.

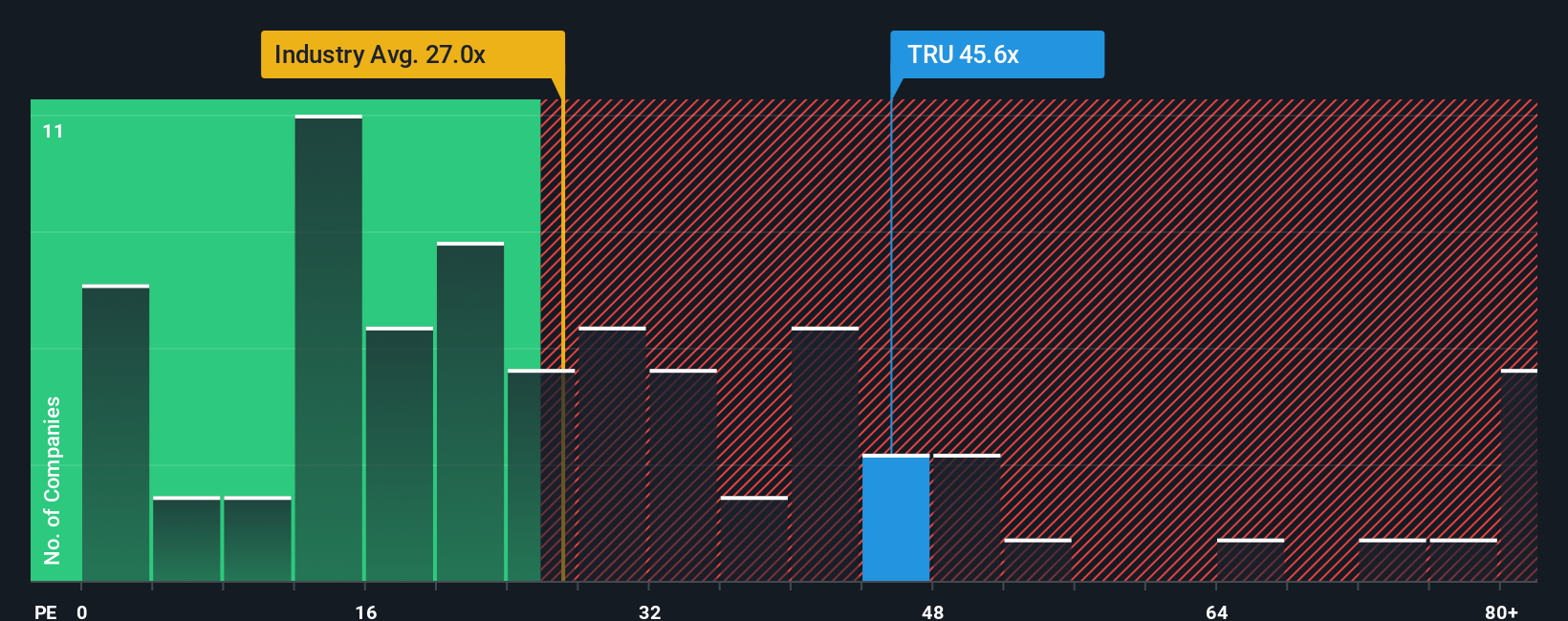

Another Lens on Value: Earnings Multiple Sends a Caution Flag

While the narrative and fair value estimate suggest upside, the earnings multiple paints a tougher picture. TransUnion trades at about 38.5 times earnings, richer than both peers at 35.6 times and the industry at 24.3 times, and above its 32.4 times fair ratio. Could optimism already be priced in?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own TransUnion Narrative

If you see the story differently or want to stress test the numbers yourself, you can build a personalized view in just minutes: Do it your way.

A great starting point for your TransUnion research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more high conviction investment ideas?

Before you move on, consider your next moves with fresh opportunities that could complement or even outperform TransUnion in the coming years.

- Capitalize on mispriced potential by scanning these 907 undervalued stocks based on cash flows that combine solid fundamentals with attractive valuations before the market fully catches on.

- Explore the next wave of innovation by targeting these 26 AI penny stocks positioned at the forefront of automation, data intelligence, and transformative software solutions.

- Enhance your income strategy by pinpointing these 14 dividend stocks with yields > 3% that may offer more reliable cash returns than simply waiting on capital gains.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if TransUnion might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:TRU

TransUnion

Operates as a global consumer credit reporting agency that provides risk and information solutions.

Proven track record and fair value.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

TXT will see revenue grow 26% with a profit margin boost of almost 40%

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026