- United States

- /

- Professional Services

- /

- NYSE:TRU

TransUnion (NYSE:TRU) Declares First Quarter US$0.12 Dividend for 2025

Reviewed by Simply Wall St

TransUnion (NYSE:TRU) recently affirmed a cash dividend of $0.115 per share for the first quarter of 2025, which may lend support to investor sentiment despite a relatively quiet period for significant news. Over the past month, the company's stock rose 21%, a movement that aligns with the broader market's strength, partly fueled by a trade deal between the U.S. and U.K. Additionally, favorable first-quarter earnings and strategic partnerships like the one with K2 Cyber might have bolstered the company's appeal, enhancing its attractiveness amidst a generally buoyant market environment.

TransUnion has 2 weaknesses (and 1 which is potentially serious) we think you should know about.

The recent dividend affirmation by TransUnion (NYSE:TRU), amidst a relatively quiet news period, reinforces confidence among investors, likely contributing to the 21% rise in its stock over the past month. This price movement aligns with the broader market's gains, partly spurred by the U.S.-U.K. trade deal. Over the longer five-year period, TransUnion's total return including dividends reached 19.87%, providing a stable growth outlook, although the company's strategy of technology modernization and international expansion involves inherent risks.

In comparison to the past year's performance, TransUnion outpaced the US Professional Services industry and the overall US market, which returned 7.5% and 7.2% respectively. The optimistic market response might also reflect the company's ongoing technological transformation and acquisitions aimed at enhancing efficiencies and innovation. However, its share price at US$82.43 still sits below the consensus analyst price target of US$104.72, suggesting potential room for growth.

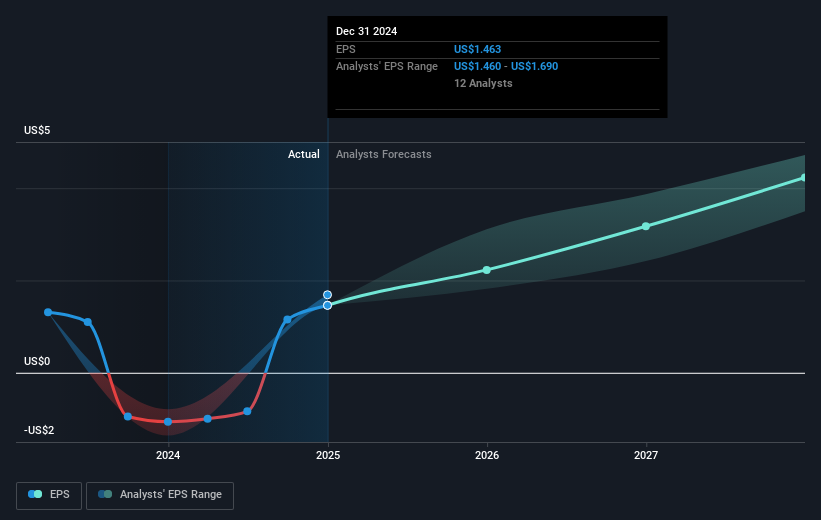

The current positive sentiments and strong quarterly performance might bolster future revenue and earnings forecasts. Still, there remain threats from rising interest rates and economic uncertainties which could impact lending volumes and technology transformation costs affecting margins. For the analysts' projected earnings of US$836.7 million by 2028 to materialize, the company would need to achieve expected revenue growth and operate at a decreased PE ratio of 30.1x, down from 43.8x today, implying expectations for considerable financial improvements in the interim.

Unlock comprehensive insights into our analysis of TransUnion stock in this financial health report.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if TransUnion might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:TRU

TransUnion

Operates as a global consumer credit reporting agency that provides risk and information solutions.

Reasonable growth potential and fair value.

Similar Companies

Market Insights

Community Narratives