- United States

- /

- Professional Services

- /

- NYSE:TRU

A Look at TransUnion’s (TRU) Valuation Following FICO’s Disruptive Direct Access Announcement

Reviewed by Kshitija Bhandaru

TransUnion (TRU) shares took a sharp turn after Fair Isaac revealed a plan for mortgage lenders and resellers to access FICO scores directly by bypassing established credit bureaus. This marks a significant industry shift for investors.

See our latest analysis for TransUnion.

TransUnion’s share price saw major turbulence after Fair Isaac revealed plans to cut credit bureaus out of the mortgage score equation. That shock sent TRU shares tumbling double digits, followed by a partial rebound as investors digested the longer-term implications for both revenue and industry clout. With a 1-year total shareholder return of -0.26%, momentum has clearly faded compared to earlier years, and the valuation debate has intensified as the competitive landscape shifts rapidly.

If you’re rethinking your strategy in light of these industry shakeups, now may be a good time to expand your search and discover fast growing stocks with high insider ownership

With shares still well below their recent highs and analysts debating the impact of looming competition, the critical question is whether TransUnion is trading at a bargain or if the market has already accounted for the challenges ahead.

Most Popular Narrative: 30.8% Undervalued

TransUnion's widely followed narrative assigns a materially higher fair value than its recent closing price, spotlighting optimism about future growth drivers and operational shifts on the horizon.

Strategic innovation investments, including AI, machine learning, and the roll-out of the global cloud-native OneTru platform, are driving efficiency, faster product launches, better cross-sell opportunities, and improved customer retention. This positions TransUnion to grow earnings with higher operating leverage and net margins as technology transformation costs subside post-2025.

Curious what bold profit assumptions are fueling this valuation? The surprising pillar: a projected margin surge and powerful growth levers baked into the future model. Want to see which game-changing forecasts put TransUnion's fair value well above today's price? Dive into the full narrative and uncover the financial story that could shift the market's perception.

Result: Fair Value of $111.8 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, increased regulatory scrutiny and integration challenges from past acquisitions could quickly change TransUnion’s growth outlook. This may test the optimism behind current valuations.

Find out about the key risks to this TransUnion narrative.

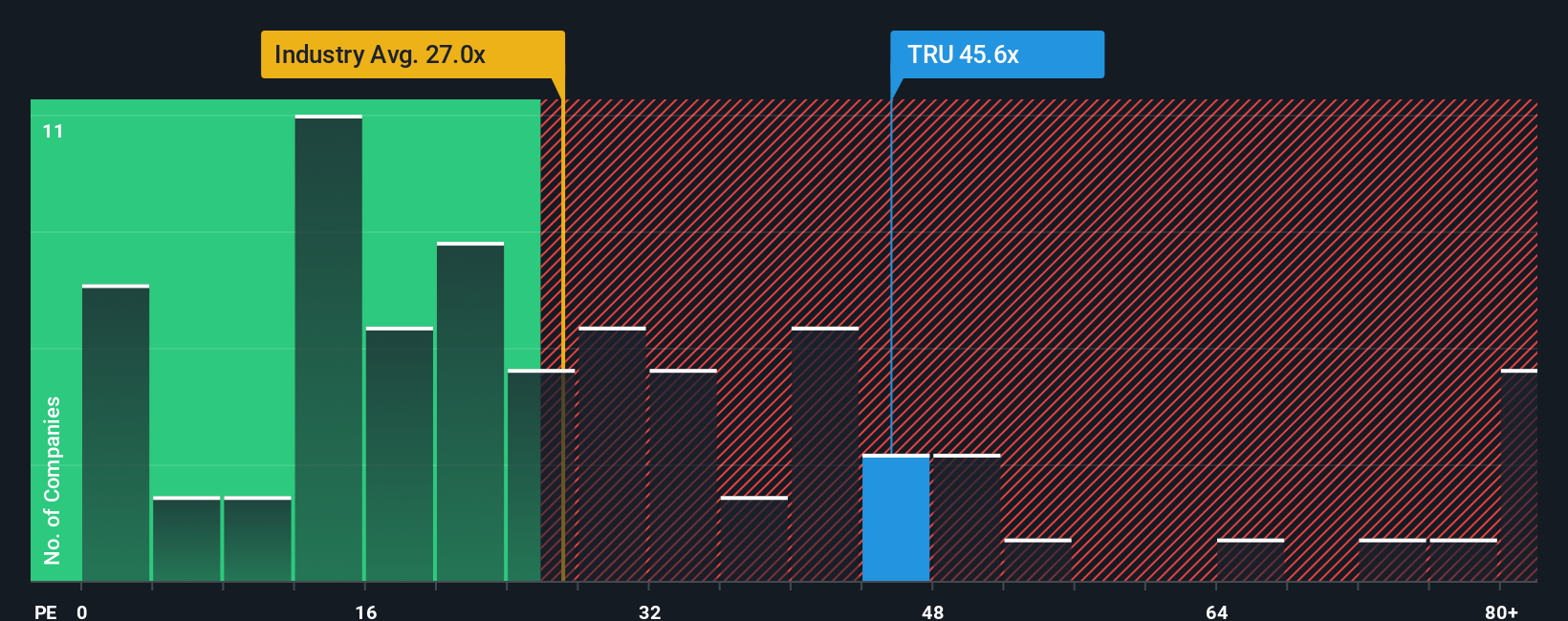

Another View: Earnings Multiple Raises Caution

Looking at valuation from a different angle, TransUnion’s price-to-earnings ratio stands tall at 38.4 times earnings. This is significantly higher than both the industry average of 26.8x and the peer average of 24.5x. Even when compared to its fair ratio of 34x, the stock appears expensive. This raises important questions about future return potential if sentiment changes quickly. Is the market paying too much for growth before it arrives?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own TransUnion Narrative

If you have a different view on TransUnion’s outlook or want to dive into the numbers directly, you can construct your own take on the story in just a few minutes, so why not Do it your way

A great starting point for your TransUnion research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Smart Investment Ideas?

Your investing journey doesn’t stop here. Take your next step with confidence and check out handpicked stock ideas that match today’s evolving opportunities.

- Maximize your portfolio’s income potential by evaluating these 19 dividend stocks with yields > 3%. These options offer attractive yields and steady cash flow, even in turbulent markets.

- Tap into the future of medicine by checking out these 32 healthcare AI stocks. Here, technology and healthcare intersect to shape breakthrough growth stories.

- Ride the wave of crypto-driven innovation by exploring these 78 cryptocurrency and blockchain stocks and get ahead of global trends transforming payments, security, and digital assets.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if TransUnion might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:TRU

TransUnion

Operates as a global consumer credit reporting agency that provides risk and information solutions.

Moderate growth potential with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives