- United States

- /

- Professional Services

- /

- NYSE:TRU

A Fresh Look at TransUnion (TRU) Valuation Following Major Mortgage Credit Scoring Shake-Up and Product Upgrades

Reviewed by Kshitija Bhandaru

TransUnion (TRU) is shaking up the mortgage credit scoring landscape with a significant policy shift and new product offerings designed to increase competition and open up homeownership to a broader range of consumers.

See our latest analysis for TransUnion.

TransUnion’s momentum is fueled by more than just its latest mortgage initiatives. In recent months, the company expanded major partnerships in tenant screening and rolled out synthetic fraud detection tools in auto lending. Despite these moves, shares have faced stiff headwinds, with a 1-year total shareholder return of -26.96%. That said, its three-year total return of 42.8% highlights the potential for long-term holders, even as the short-term share price has retreated.

If the recent industry shifts have you rethinking your strategy, now’s a perfect opportunity to broaden your watchlist and discover fast growing stocks with high insider ownership

Against this backdrop of strategic change and discounted valuations, investors face a key question: Is TransUnion’s recent underperformance a window to acquire a value play with growth potential, or has the market already factored in what lies ahead?

Most Popular Narrative: 29.9% Undervalued

At $78.39, TransUnion’s share price trades well below the narrative’s implied fair value, raising eyebrows about a potential opportunity in plain sight.

Long-term demand for consumer credit data and risk analytics is being fueled by the digitization of financial services and expansion of the middle class in emerging markets. Management highlights accelerating growth and large market share in India, which is poised for 20%+ annual growth, as well as continued momentum in markets like Africa, Canada, and Latin America. This is likely to support robust organic revenue growth over multiple years.

Want the story behind this ambitious fair value? This narrative hinges on bullish revenue, earnings, and profit assumptions fueled by digitization trends and global expansion. Find out which key numbers, benchmarks, and future catalysts drive this projected upside. Access the full breakdown and see what the experts are betting on.

Result: Fair Value of $111.80 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent regulatory scrutiny and evolving data privacy laws could pressure TransUnion’s growth and margins. These factors act as key risks to the bullish case.

Find out about the key risks to this TransUnion narrative.

Another View: What Do the Price Ratios Say?

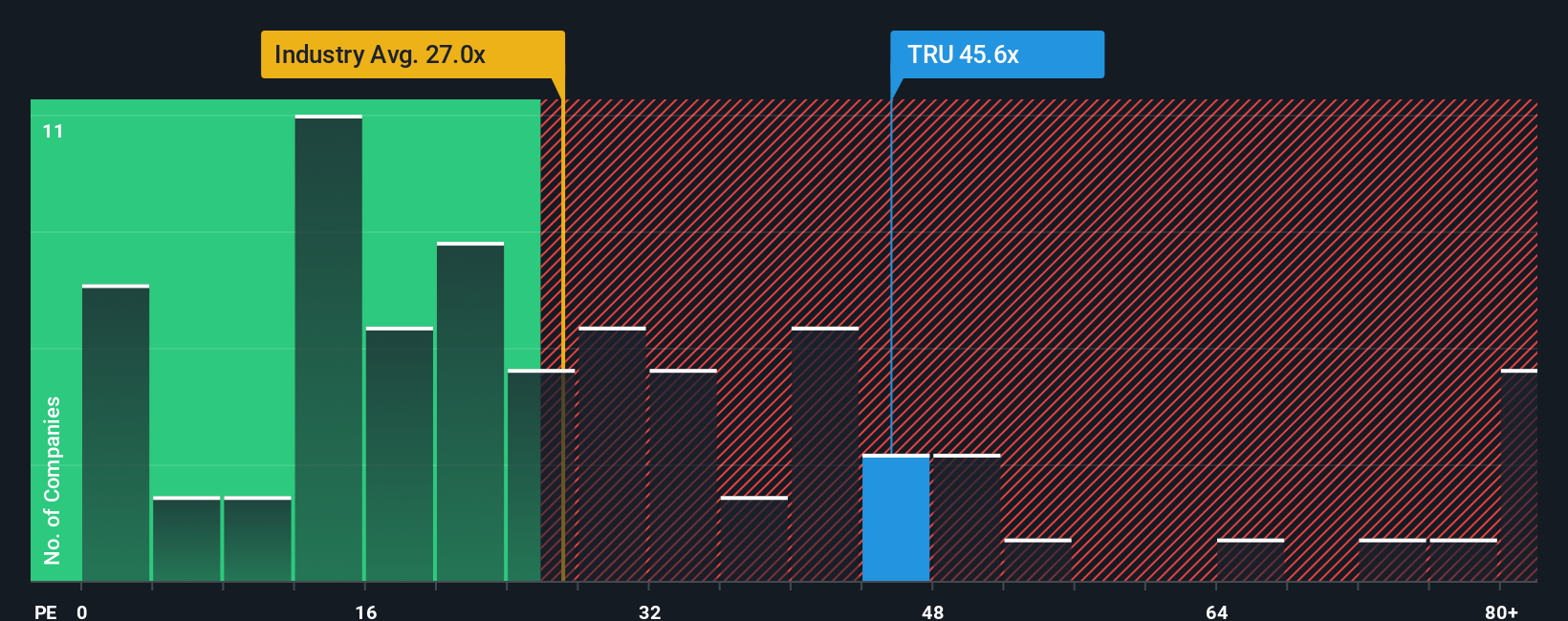

While discounted cash flow points to TransUnion being undervalued, the price-to-earnings ratio tells a different story. At 39x, TransUnion trades above the industry average of 24.9x, its peer group at 24.4x, and even exceeds the fair ratio of 33.6x. This premium suggests investors are pricing in strong future growth. Does it leave room for further upside, or is it a valuation risk to watch?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own TransUnion Narrative

If you think the numbers tell a different story or want to investigate your own angles, you can easily build a custom view in just a few minutes. Do it your way.

A great starting point for your TransUnion research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Smart moves aren’t limited to just one stock. Use the Simply Wall Street Screener to discover companies that could upgrade your portfolio before the market spots them.

- Target reliable passive income picks by checking out these 18 dividend stocks with yields > 3% with yields above 3%, solid fundamentals, and attractive risk-reward profiles.

- Stay ahead of tech disruption by exploring opportunities among these 24 AI penny stocks that harness artificial intelligence in innovative ways across industries.

- Capitalize on hidden value by reviewing these 877 undervalued stocks based on cash flows that might be trading below their fair value based on strong and improving cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if TransUnion might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:TRU

TransUnion

Operates as a global consumer credit reporting agency that provides risk and information solutions.

Moderate growth potential with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives