- United States

- /

- Professional Services

- /

- NYSE:TRU

A Fresh Look at TransUnion (TRU) Valuation After Joining the S&P 1000 Index

Reviewed by Kshitija Bhandaru

TransUnion (NYSE:TRU) just grabbed headlines with its addition to the S&P 1000 Index, a move that typically turns some heads. For investors who track indexes or watch for portfolio flows, joining the S&P 1000 often marks a meaningful shift. It can unlock a larger pool of potential buyers, especially as index funds and ETFs may now have to include TransUnion in their holdings, which can impact both liquidity and demand for the stock.

Looking at the stock’s performance, it has been a mixed year. TransUnion’s share price is down nearly 18% over the past year, with negative returns both in the past month and quarter. Short-term momentum is still muted, even as the company reported double-digit annual growth in both revenue and net income. Industry buzz around automation, AI, and credit trends also continues to swirl, creating both challenges and opportunities for firms like TransUnion.

After the latest index inclusion, investors face a big question: does this present an undervalued entry point, or is the market already pricing in future growth for TransUnion?

Most Popular Narrative: 24.7% Undervalued

According to the most widely followed narrative, TransUnion is trading well below its estimated fair value, offering a potential upside for investors willing to look past near-term volatility.

Long-term demand for consumer credit data and risk analytics is being fueled by the digitization of financial services and expansion of the middle class in emerging markets. Management has highlighted accelerating growth and a large market share in India, poised for 20%+ annual growth, as well as continued momentum in markets like Africa, Canada, and Latin America. This is likely to support robust organic revenue growth over multiple years.

Just how bold are the growth assumptions driving this valuation? The narrative points to aggressive revenue expansion and margin gains, underpinned by major bets on global market share and digital transformation. Curious what financial leaps and profit projections justify this target? Do not miss the full narrative for details that could shift your perspective on TransUnion’s potential.

Result: Fair Value of $113.15 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, intensifying regulatory scrutiny or technology integration challenges could quickly shift the outlook and limit TransUnion’s ability to deliver on these growth expectations.

Find out about the key risks to this TransUnion narrative.Another View: Market Multiples Tell a Different Story

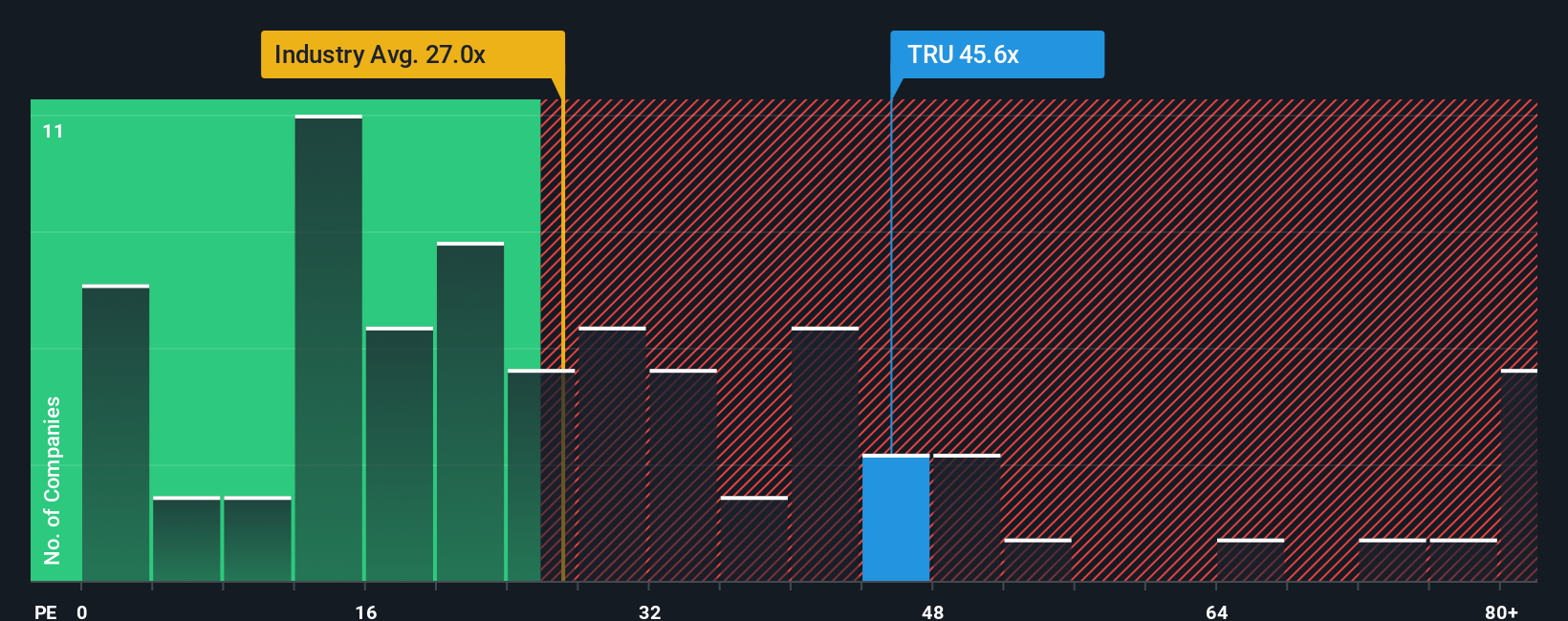

While earnings-based models suggest TransUnion is undervalued, looking at how the stock is priced compared to others in its industry leads to a less optimistic result. In this analysis, TransUnion appears expensive. Which perspective is closer to reality?

See what the numbers say about this price — find out in our valuation breakdown.

Stay updated when valuation signals shift by adding TransUnion to your watchlist or portfolio. Alternatively, explore our screener to discover other companies that fit your criteria.

Build Your Own TransUnion Narrative

If you want to challenge the consensus or dig into the numbers yourself, it's quick and easy to craft your own perspective. Do it your way.

A great starting point for your TransUnion research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Don’t miss out on powerful opportunities to level up your investing strategy and spot the next big trend before everyone else. Use these unique screens to get ahead:

- Spot fast-rising tech underdogs by scanning for penny stocks with strong financials that are shaking up their industries with rapid growth and surprising financial strength.

- Uncover niche opportunities in healthcare innovation, where healthcare AI stocks are transforming patient care and diagnostics through smart, data-driven breakthroughs.

- Boost your potential income by targeting dividend stocks with yields > 3% that offer compelling yields and reliable payouts to reward long-term holders.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if TransUnion might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:TRU

TransUnion

Operates as a global consumer credit reporting agency that provides risk and information solutions.

Fair value with moderate growth potential.

Similar Companies

Market Insights

Community Narratives