- United States

- /

- Healthcare Services

- /

- NasdaqGS:CLOV

3 Promising Penny Stocks With Market Caps Over $1B

Reviewed by Simply Wall St

As the U.S. stock market experiences a rollercoaster ride, with major indices seeing both surges and declines amid economic uncertainties, investors are increasingly looking for opportunities that promise growth potential without excessive risk. Penny stocks, though an old term, continue to represent an intriguing investment area by highlighting smaller or less-established companies that could offer significant value at lower price points. By focusing on those with strong financials and clear growth paths, investors can potentially uncover hidden gems among these stocks.

Top 10 Penny Stocks In The United States

| Name | Share Price | Market Cap | Financial Health Rating |

| BAB (OTCPK:BABB) | $0.83947 | $6.1M | ★★★★★★ |

| Sensus Healthcare (NasdaqCM:SRTS) | $4.65 | $76.7M | ★★★★★★ |

| QuantaSing Group (NasdaqGM:QSG) | $3.08 | $141.07M | ★★★★★★ |

| Safe Bulkers (NYSE:SB) | $3.80 | $398.41M | ★★★★☆☆ |

| Golden Growers Cooperative (OTCPK:GGRO.U) | $4.50 | $67.38M | ★★★★★★ |

| Imperial Petroleum (NasdaqCM:IMPP) | $2.46 | $74.62M | ★★★★★★ |

| Permianville Royalty Trust (NYSE:PVL) | $1.51 | $49.83M | ★★★★★★ |

| CBAK Energy Technology (NasdaqCM:CBAT) | $0.85 | $76.45M | ★★★★★☆ |

| TETRA Technologies (NYSE:TTI) | $3.35 | $443.52M | ★★★★☆☆ |

| Smith Micro Software (NasdaqCM:SMSI) | $0.7455 | $13.25M | ★★★★☆☆ |

Click here to see the full list of 770 stocks from our US Penny Stocks screener.

Let's dive into some prime choices out of the screener.

Clover Health Investments (NasdaqGS:CLOV)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Clover Health Investments, Corp. offers Medicare Advantage plans in the United States and has a market cap of approximately $1.87 billion.

Operations: Clover Health generates revenue primarily from its Insurance segment, totaling approximately $1.37 billion.

Market Cap: $1.87B

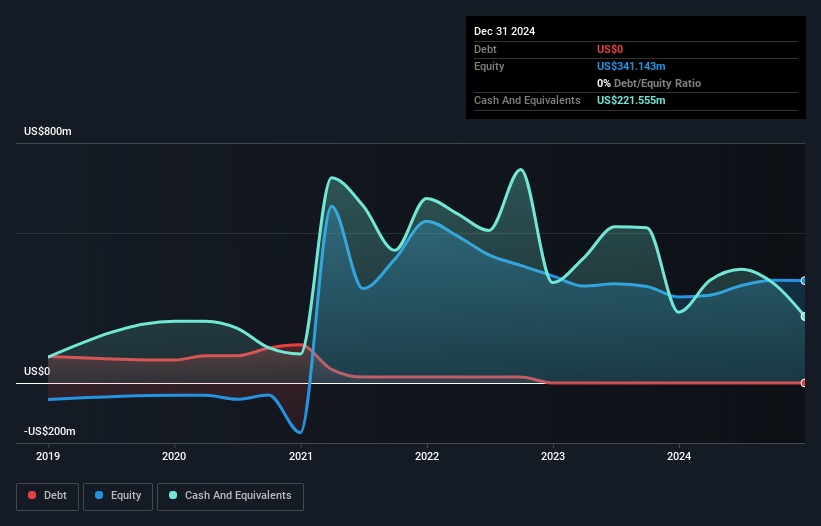

Clover Health Investments, Corp. has faced challenges with profitability, reporting a net loss of US$22.09 million for Q4 2024, though this marks an improvement from the previous year's larger loss. The company is not expected to achieve profitability in the next three years but maintains a strong cash position with a runway exceeding three years due to positive free cash flow. Revenue growth is anticipated at 14.64% annually, supported by guidance projecting insurance revenue between US$1.8 billion and US$1.875 billion for 2025. Despite trading at 62% below estimated fair value, Clover remains debt-free with stable weekly volatility and experienced management and board teams.

- Jump into the full analysis health report here for a deeper understanding of Clover Health Investments.

- Review our growth performance report to gain insights into Clover Health Investments' future.

Marqeta (NasdaqGS:MQ)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Marqeta, Inc. operates a cloud-based open API platform for card issuing and transaction processing services, with a market cap of approximately $2.07 billion.

Operations: The company's revenue is primarily derived from services provided to financial companies, totaling $507 million.

Market Cap: $2.07B

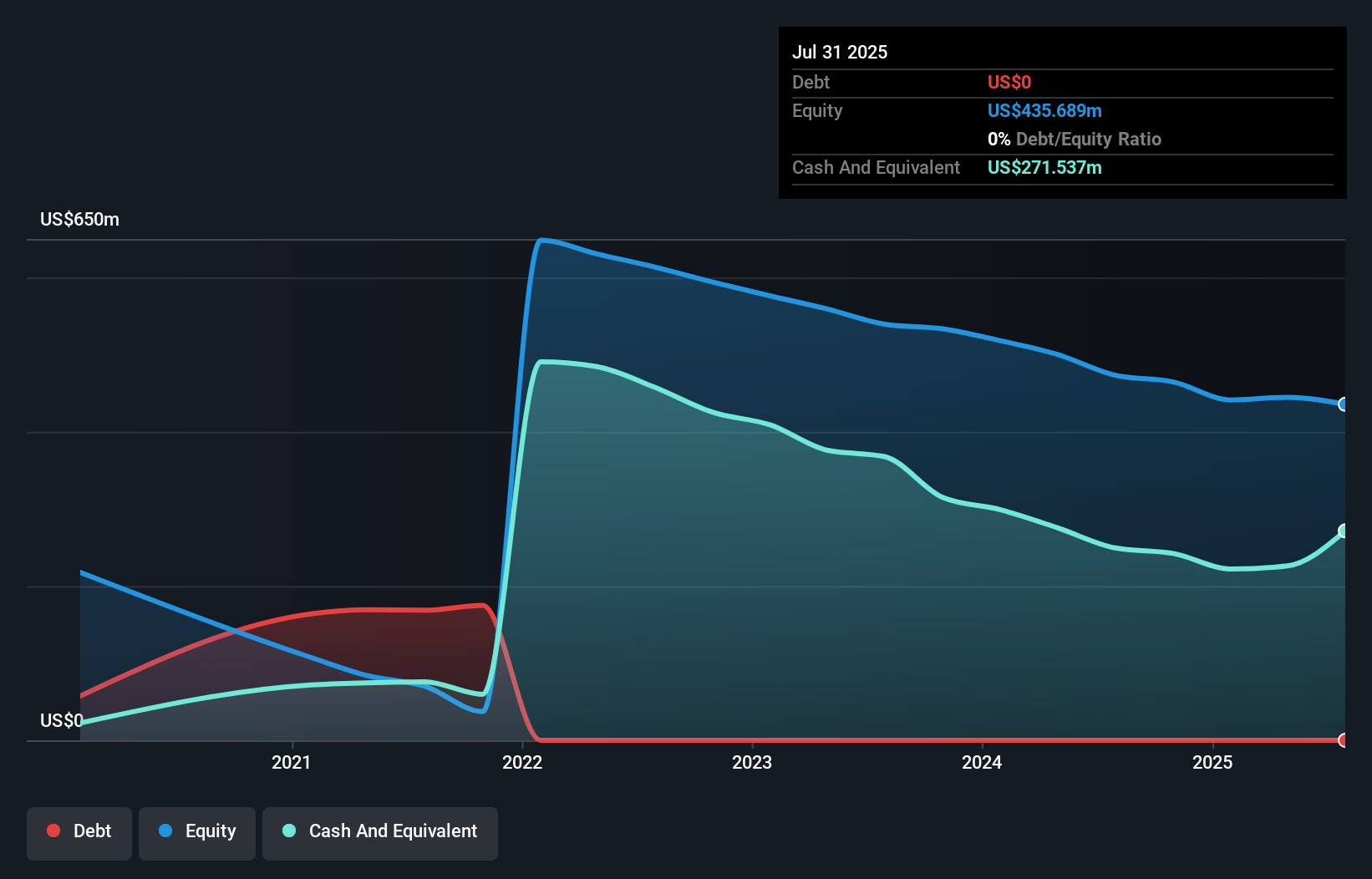

Marqeta, Inc. has recently become profitable with net income of US$27.29 million for 2024, reversing a previous loss. The company anticipates revenue growth between 16% and 18% for 2025, supported by strategic partnerships like the one with Spendesk Financial Services in Europe. Marqeta's debt-free status and strong asset position enhance its financial stability, although its Return on Equity remains low at 2.5%. Recent executive changes include Mike Milotich stepping in as Interim CEO while continuing his CFO duties. Additionally, Marqeta has initiated a share repurchase program worth up to US$300 million to optimize capital allocation.

- Unlock comprehensive insights into our analysis of Marqeta stock in this financial health report.

- Evaluate Marqeta's prospects by accessing our earnings growth report.

Planet Labs PBC (NYSE:PL)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Planet Labs PBC designs, constructs, and launches satellite constellations to provide high cadence geospatial data via an online platform globally, with a market cap of approximately $1.24 billion.

Operations: The company generates revenue from its data processing segment, totaling $241.65 million.

Market Cap: $1.24B

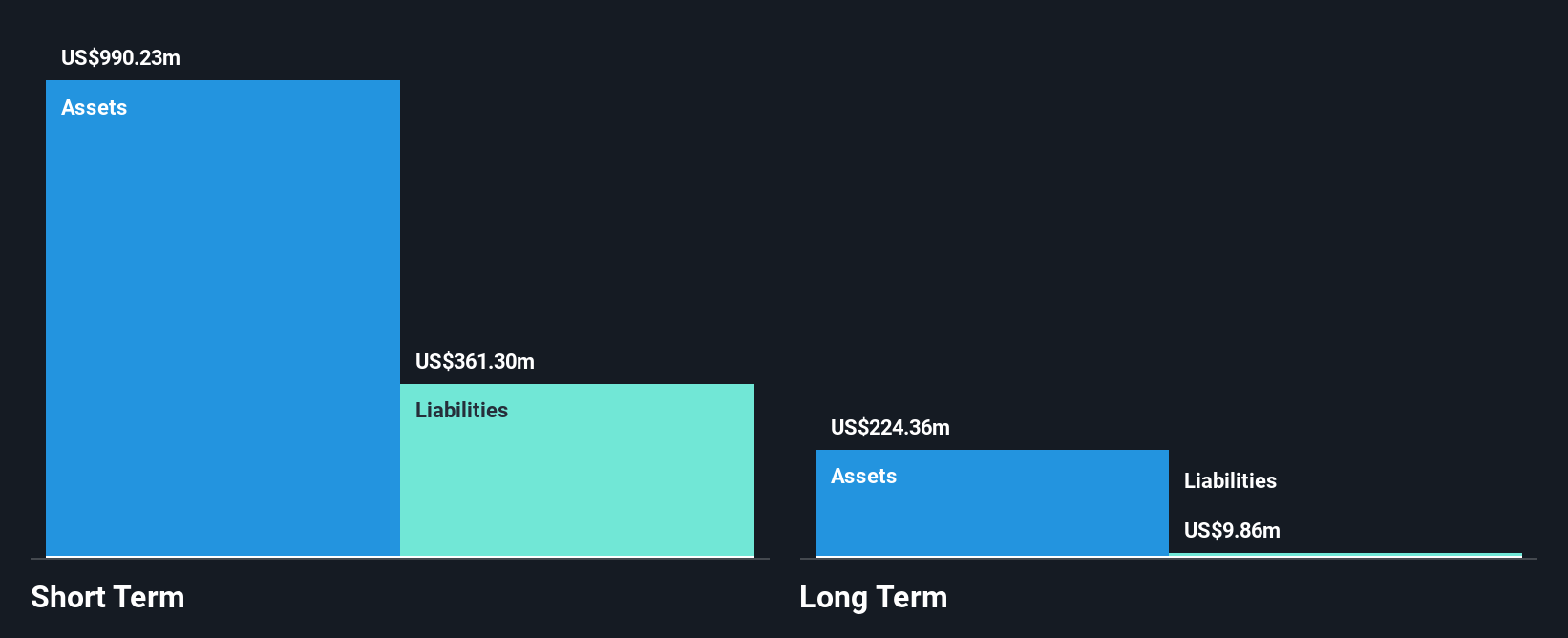

Planet Labs PBC, with a market cap of US$1.24 billion, is leveraging its extensive geospatial data capabilities through strategic partnerships and technological advancements. Recent collaborations include a multi-year agreement with Bayer to enhance agricultural operations using Planet's high-resolution satellite imagery and analytics. The company's integration of Anthropic's Claude AI aims to revolutionize geospatial data analysis for government and commercial users. Despite being unprofitable, Planet maintains financial stability with short-term assets exceeding liabilities by over US$170 million and no debt burden. Revenue is projected to grow annually by 12.95%, supported by expanding global partnerships and innovative product offerings.

- Navigate through the intricacies of Planet Labs PBC with our comprehensive balance sheet health report here.

- Understand Planet Labs PBC's earnings outlook by examining our growth report.

Summing It All Up

- Unlock our comprehensive list of 770 US Penny Stocks by clicking here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CLOV

Clover Health Investments

Provides medicare advantage plans in the United States.

Flawless balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives