- United States

- /

- Professional Services

- /

- NYSE:NSP

Will Third-Party Validation of HR360’s ROI Transform Insperity’s (NSP) Strategic Growth Story?

Reviewed by Sasha Jovanovic

- Insperity recently announced the results of a commissioned study revealing that its HR360 solution generated significant cost and time savings for clients by offering strategic HR guidance and compliance support.

- The study indicates that customers realized substantial qualitative benefits, such as improved talent acquisition, employee satisfaction, and workforce development, in addition to a strong return on investment.

- With third-party validation of HR360's client benefits and ROI now public, we’ll explore what this means for Insperity’s investment case.

This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

Insperity Investment Narrative Recap

To consider Insperity as an investment, you have to believe that its HR solutions, like HR360, can boost client satisfaction and deliver measurable value despite competitive and macroeconomic pressures. While the newly released third-party validation of HR360's ROI is a positive signal for the product’s relevance, it does not materially change the top short-term catalyst, the upcoming launch of HRScale aimed at the mid-market segment. The biggest risk remains that rising employee benefits and healthcare costs could limit margin recovery, even with enhanced HR offerings.

Among recent company news, Insperity’s July rollout of its refreshed HR solutions portfolio, including the new HRScale solution developed with Workday, stands out as especially relevant. This move directly ties into the company’s growth catalyst of broadening its target market for future revenue and profit potential, and highlights how Insperity is prioritizing platform innovation to drive client engagement and operational leverage.

Yet, despite this renewed product momentum, investors should be mindful that cost pressures tied to healthcare trends could…

Read the full narrative on Insperity (it's free!)

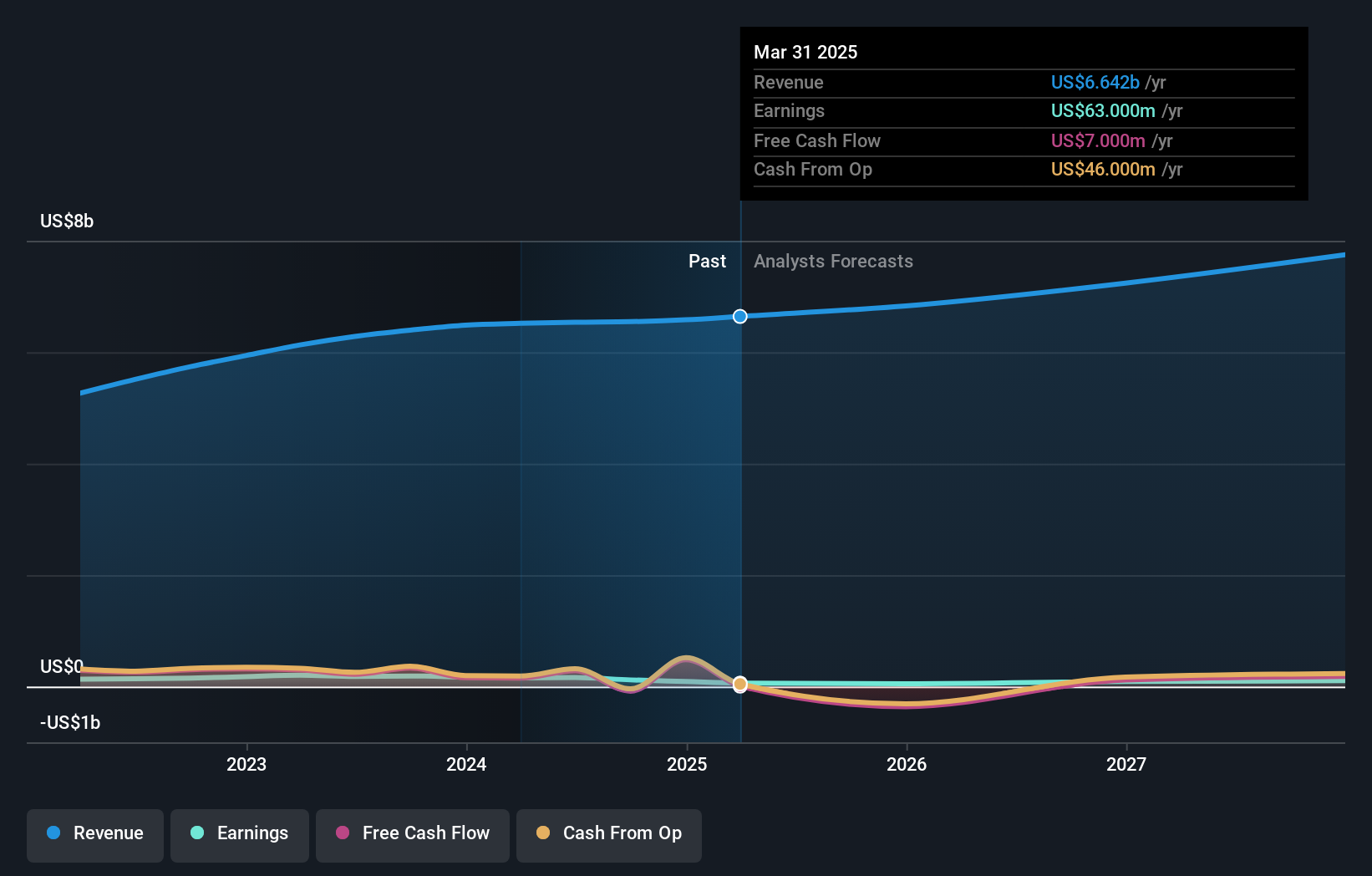

Insperity's outlook forecasts $7.7 billion in revenue and $109.6 million in earnings by 2028. This implies a 5.0% annual revenue growth and an earnings increase of $69.6 million from the current $40.0 million level.

Uncover how Insperity's forecasts yield a $57.75 fair value, a 17% upside to its current price.

Exploring Other Perspectives

The Simply Wall St Community produced two fair value estimates for Insperity, ranging from US$57.75 up to US$253.90 per share. As opinions on future growth and competitive risk vary widely, you can explore additional viewpoints that shed light on diverging expectations for the company’s path forward.

Explore 2 other fair value estimates on Insperity - why the stock might be worth just $57.75!

Build Your Own Insperity Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Insperity research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Insperity research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Insperity's overall financial health at a glance.

Want Some Alternatives?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- Find companies with promising cash flow potential yet trading below their fair value.

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:NSP

Insperity

Engages in the provision of human resources (HR) and business solutions to improve business performance for small and medium-sized businesses primarily in the United States.

Excellent balance sheet with reasonable growth potential and pays a dividend.

Similar Companies

Market Insights

Community Narratives