- United States

- /

- Professional Services

- /

- NYSE:NOTE

FiscalNote Holdings, Inc. (NYSE:NOTE) Stock's 50% Dive Might Signal An Opportunity But It Requires Some Scrutiny

To the annoyance of some shareholders, FiscalNote Holdings, Inc. (NYSE:NOTE) shares are down a considerable 50% in the last month, which continues a horrid run for the company. The recent drop completes a disastrous twelve months for shareholders, who are sitting on a 87% loss during that time.

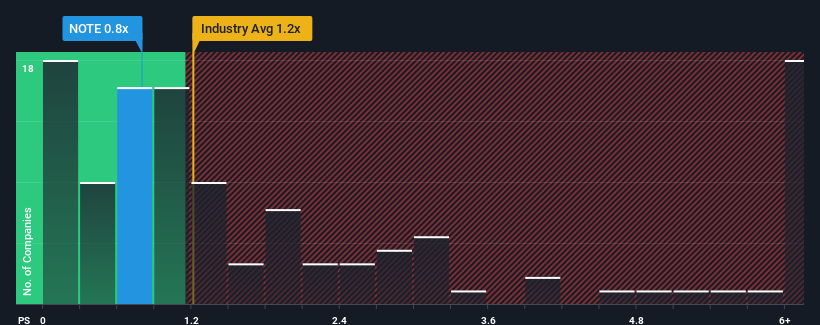

In spite of the heavy fall in price, there still wouldn't be many who think FiscalNote Holdings' price-to-sales (or "P/S") ratio of 0.8x is worth a mention when the median P/S in the United States' Professional Services industry is similar at about 1.2x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

View our latest analysis for FiscalNote Holdings

How FiscalNote Holdings Has Been Performing

Recent times have been advantageous for FiscalNote Holdings as its revenues have been rising faster than most other companies. It might be that many expect the strong revenue performance to wane, which has kept the P/S ratio from rising. If not, then existing shareholders have reason to be feeling optimistic about the future direction of the share price.

Keen to find out how analysts think FiscalNote Holdings' future stacks up against the industry? In that case, our free report is a great place to start.Do Revenue Forecasts Match The P/S Ratio?

In order to justify its P/S ratio, FiscalNote Holdings would need to produce growth that's similar to the industry.

Taking a look back first, we see that the company grew revenue by an impressive 22% last year. Pleasingly, revenue has also lifted 99% in aggregate from three years ago, thanks to the last 12 months of growth. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

Turning to the outlook, the next year should generate growth of 9.8% as estimated by the six analysts watching the company. Meanwhile, the rest of the industry is forecast to only expand by 6.9%, which is noticeably less attractive.

In light of this, it's curious that FiscalNote Holdings' P/S sits in line with the majority of other companies. It may be that most investors aren't convinced the company can achieve future growth expectations.

The Final Word

Following FiscalNote Holdings' share price tumble, its P/S is just clinging on to the industry median P/S. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

Despite enticing revenue growth figures that outpace the industry, FiscalNote Holdings' P/S isn't quite what we'd expect. Perhaps uncertainty in the revenue forecasts are what's keeping the P/S ratio consistent with the rest of the industry. This uncertainty seems to be reflected in the share price which, while stable, could be higher given the revenue forecasts.

Having said that, be aware FiscalNote Holdings is showing 4 warning signs in our investment analysis, and 1 of those doesn't sit too well with us.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:NOTE

FiscalNote Holdings

Operates as technology company North America, Europe, Australia, and Asia.

Low with imperfect balance sheet.

Market Insights

Community Narratives