- United States

- /

- Professional Services

- /

- NYSE:FC

Capital Allocation Trends At Franklin Covey (NYSE:FC) Aren't Ideal

If we're looking to avoid a business that is in decline, what are the trends that can warn us ahead of time? Businesses in decline often have two underlying trends, firstly, a declining return on capital employed (ROCE) and a declining base of capital employed. This indicates to us that the business is not only shrinking the size of its net assets, but its returns are falling as well. In light of that, from a first glance at Franklin Covey (NYSE:FC), we've spotted some signs that it could be struggling, so let's investigate.

Understanding Return On Capital Employed (ROCE)

If you haven't worked with ROCE before, it measures the 'return' (pre-tax profit) a company generates from capital employed in its business. Analysts use this formula to calculate it for Franklin Covey:

Return on Capital Employed = Earnings Before Interest and Tax (EBIT) ÷ (Total Assets - Current Liabilities)

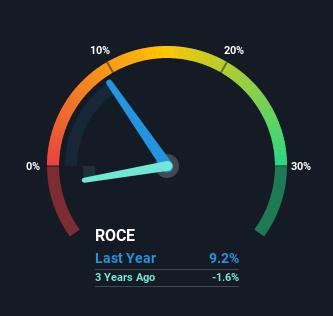

0.092 = US$9.9m ÷ (US$213m - US$105m) (Based on the trailing twelve months to May 2021).

Thus, Franklin Covey has an ROCE of 9.2%. On its own, that's a low figure but it's around the 11% average generated by the Professional Services industry.

See our latest analysis for Franklin Covey

In the above chart we have measured Franklin Covey's prior ROCE against its prior performance, but the future is arguably more important. If you'd like to see what analysts are forecasting going forward, you should check out our free report for Franklin Covey.

What The Trend Of ROCE Can Tell Us

In terms of Franklin Covey's historical ROCE trend, it isn't fantastic. The company used to generate 12% on its capital five years ago but it has since fallen noticeably. On top of that, the business is utilizing 21% less capital within its operations. The combination of lower ROCE and less capital employed can indicate that a business is likely to be facing some competitive headwinds or seeing an erosion to its moat. Typically businesses that exhibit these characteristics aren't the ones that tend to multiply over the long term, because statistically speaking, they've already gone through the growth phase of their life cycle.

While on the subject, we noticed that the ratio of current liabilities to total assets has risen to 49%, which has impacted the ROCE. If current liabilities hadn't increased as much as they did, the ROCE could actually be even lower. And with current liabilities at these levels, suppliers or short-term creditors are effectively funding a large part of the business, which can introduce some risks.

Our Take On Franklin Covey's ROCE

In short, lower returns and decreasing amounts capital employed in the business doesn't fill us with confidence. The market must be rosy on the stock's future because even though the underlying trends aren't too encouraging, the stock has soared 158%. Regardless, we don't feel too comfortable with the fundamentals so we'd be steering clear of this stock for now.

On a final note, we found 4 warning signs for Franklin Covey (1 can't be ignored) you should be aware of.

While Franklin Covey may not currently earn the highest returns, we've compiled a list of companies that currently earn more than 25% return on equity. Check out this free list here.

If you’re looking to trade Franklin Covey, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NYSE:FC

Franklin Covey

Provides training and consulting services in the areas of execution, sales performance, productivity, customer loyalty, leadership, and educational improvement for organizations and individuals worldwide.

Excellent balance sheet with proven track record.

Similar Companies

Market Insights

Community Narratives