- United States

- /

- Professional Services

- /

- NYSE:EFX

Equifax (EFX): Is the Current Valuation Offering a Compelling Entry Point for Long-Term Investors?

Reviewed by Simply Wall St

Equifax (EFX) shares have moved just above flat this week, reflecting mild investor sentiment as broader market conditions unfold. Although recent returns dip over the past month, the company’s longer-term growth story remains a point of interest.

See our latest analysis for Equifax.

After a steady start to the year, Equifax’s share price has slipped recently, down 10.25% over the past month, with sentiment cooling despite a strong long-term total shareholder return of nearly 70% over five years. Momentum in the short term is clearly taking a breather. This sometimes creates interesting valuation resets or potential entry points for patient investors looking toward the company’s historical growth trajectory.

If you’re keen to keep an eye on other movers catching fresh momentum, consider expanding your search and discover fast growing stocks with high insider ownership

With shares trading near their recent lows and a notable gap below analyst price targets, the question is whether Equifax now presents a genuine buying opportunity or if the market has already priced in future growth prospects.

Most Popular Narrative: 16.9% Undervalued

Equifax’s last close of $230.64 sits well below what the most widely followed narrative estimates as the current fair value. This sets the stage for a closer look at the catalysts and market expectations that underpin its valuation.

Accelerating customer adoption of new multi-data product solutions (for example, TWN indicator, Single Data Fabric, EFX.AI) and continued high NPI (New Product Introduction) rates are expanding Equifax's value proposition. This is positioning the company to capture incremental market share and drive sustained organic revenue growth above historical levels.

Want to know what powers that bold fair value? Forecasts are built on forward-looking growth, margin leaps, and a profit multiple typically seen in market leaders. What drives these ambitious projections? The full narrative uncovers the facts behind this optimistic outlook.

Result: Fair Value of $277.70 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent litigation costs and unpredictable state-level government budgets could still weigh on Equifax’s growth expectations and put pressure on upcoming earnings targets.

Find out about the key risks to this Equifax narrative.

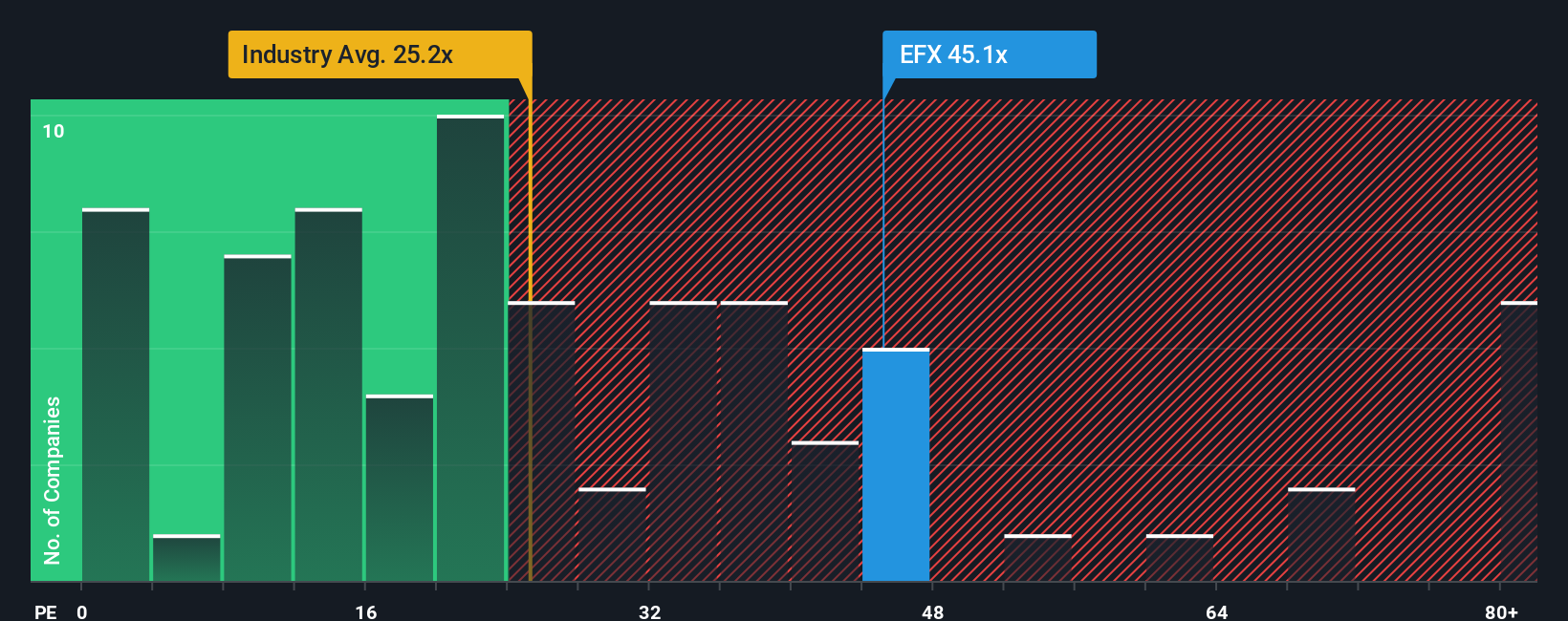

Another View: Market Multiples Raise Questions

Looking at where Equifax sits versus other companies in its industry, its price-to-earnings ratio of 42.9 times earnings is much higher than both the US Professional Services average of 26.3 and a fair ratio of 35.3. This signals the market is demanding a premium for the stock, which may build in some valuation risk if expectations fall short. Does this gap mean investors are paying up for future growth or overestimating the company’s prospects?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Equifax Narrative

If you’d rather dig into the fundamentals yourself or challenge the consensus, crafting your own view is quick and straightforward. Do it your way

A great starting point for your Equifax research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Ready for More Smart Investing Opportunities?

Don’t stop at one stock. Give yourself an edge by tapping into handpicked ideas that could set you apart from the crowd. Simply choose where you want to get ahead.

- Spot momentum early and catch up-and-coming companies with strong financials using these 3577 penny stocks with strong financials shaping tomorrow’s market.

- Grow your portfolio with companies at the forefront of artificial intelligence breakthroughs by checking out these 26 AI penny stocks designed to fuel your future returns.

- Boost your income stream and target greater stability through these 17 dividend stocks with yields > 3% that offer consistently attractive yields for long-term peace of mind.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Equifax might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:EFX

Reasonable growth potential average dividend payer.

Similar Companies

Market Insights

Community Narratives