- United States

- /

- Health Care REITs

- /

- NYSE:CTRE

3 US Stocks Estimated To Be Trading Below Fair Value In November 2024

Reviewed by Simply Wall St

As the U.S. stock market navigates through a period of volatility, with major indices like the Dow Jones and Nasdaq experiencing fluctuations amid tech earnings and economic data releases, investors are keenly observing potential opportunities. In this environment, identifying stocks that are trading below their perceived fair value can be particularly appealing for those looking to capitalize on market inefficiencies.

Top 10 Undervalued Stocks Based On Cash Flows In The United States

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Atlanticus Holdings (NasdaqGS:ATLC) | $37.19 | $72.49 | 48.7% |

| Cadence Bank (NYSE:CADE) | $33.43 | $64.68 | 48.3% |

| WEX (NYSE:WEX) | $172.60 | $343.98 | 49.8% |

| Constellium (NYSE:CSTM) | $11.10 | $21.63 | 48.7% |

| Okta (NasdaqGS:OKTA) | $71.89 | $138.69 | 48.2% |

| Reddit (NYSE:RDDT) | $119.30 | $230.13 | 48.2% |

| AeroVironment (NasdaqGS:AVAV) | $214.96 | $419.99 | 48.8% |

| Bowhead Specialty Holdings (NYSE:BOW) | $29.11 | $56.49 | 48.5% |

| Verra Mobility (NasdaqCM:VRRM) | $25.97 | $50.05 | 48.1% |

| Vertex Pharmaceuticals (NasdaqGS:VRTX) | $475.98 | $917.19 | 48.1% |

Let's take a closer look at a couple of our picks from the screened companies.

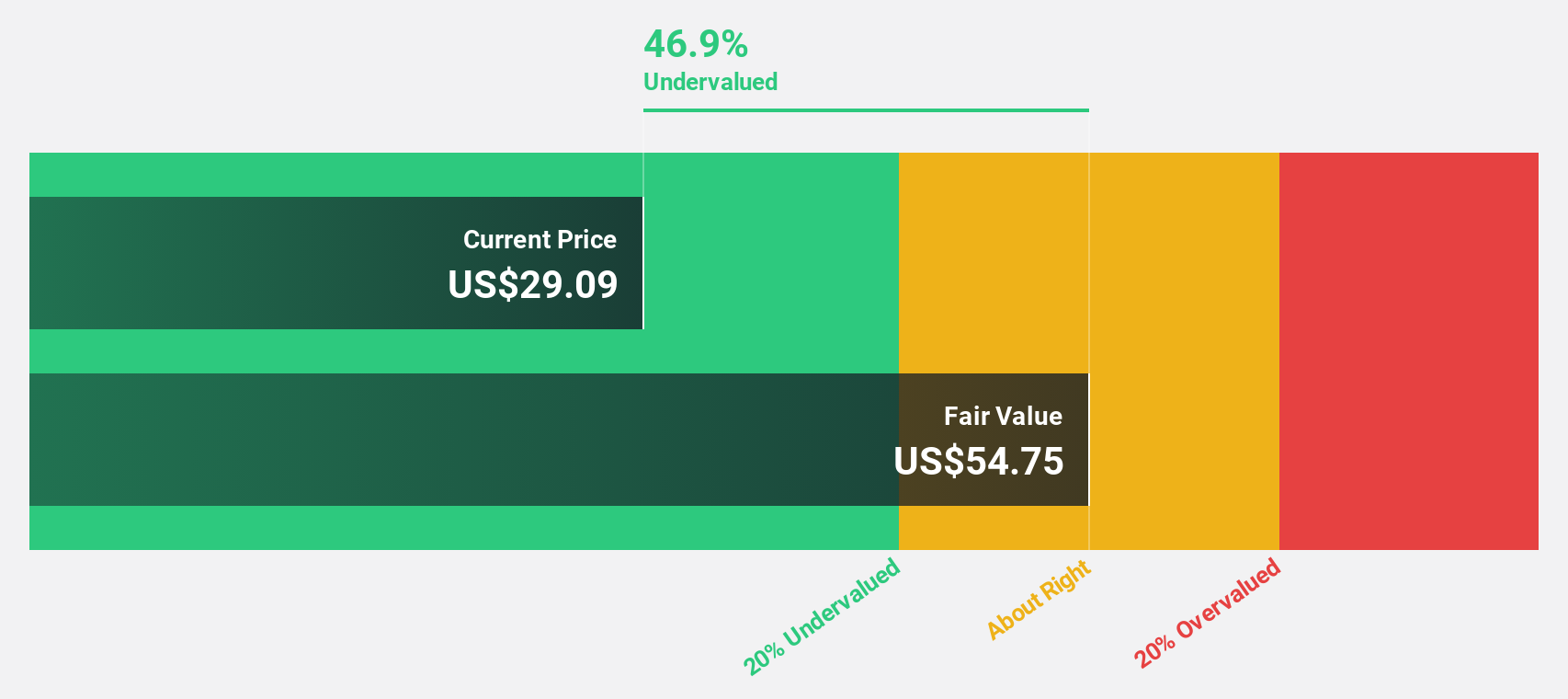

CareTrust REIT (NYSE:CTRE)

Overview: CareTrust REIT, Inc. focuses on acquiring, financing, developing and owning real estate properties leased to third-party tenants in the healthcare sector with a market cap of approximately $6.05 billion.

Operations: The company's revenue primarily comes from investments in healthcare-related real estate assets, totaling $269.08 million.

Estimated Discount To Fair Value: 18.1%

CareTrust REIT is trading at US$32.67, below its estimated fair value of US$39.87, despite strong earnings growth of 138.6% over the past year and forecasted annual profit growth of 37%. The company recently raised US$441.6 million through a follow-on equity offering and acquired a skilled nursing portfolio for US$74.7 million, enhancing its asset base but diluting existing shareholders significantly in the process.

- Upon reviewing our latest growth report, CareTrust REIT's projected financial performance appears quite optimistic.

- Click here to discover the nuances of CareTrust REIT with our detailed financial health report.

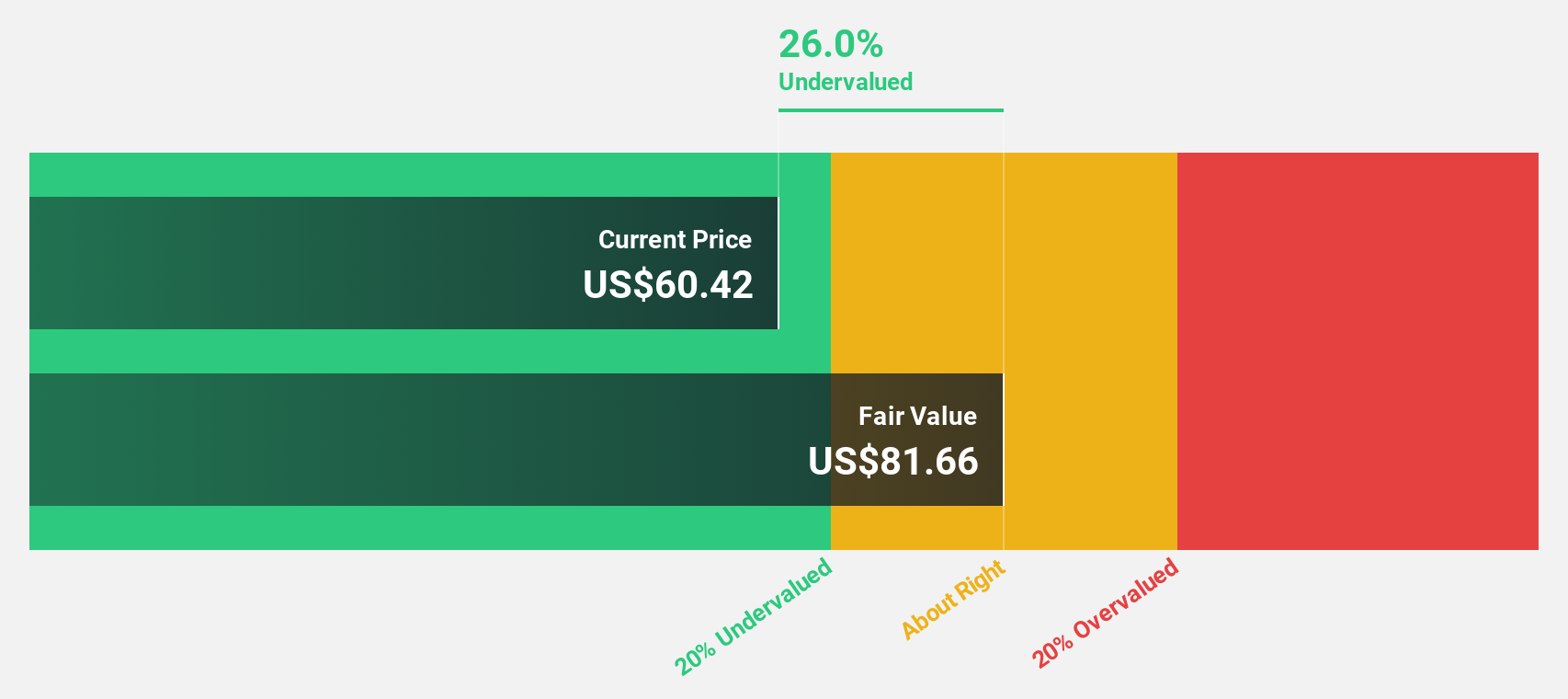

Dayforce (NYSE:DAY)

Overview: Dayforce Inc. is a human capital management software company operating in the United States, Canada, and internationally, with a market cap of approximately $11.19 billion.

Operations: The company generates revenue from its Human Capital Management (HCM) segment, amounting to $1.69 billion.

Estimated Discount To Fair Value: 15.4%

Dayforce, trading at US$70.95, is undervalued compared to its fair value of US$83.85, with earnings expected to grow significantly by 44.4% annually over the next three years, outpacing the market's growth rate. Recent Q3 results showed revenue increased to US$440 million from US$377.5 million year-over-year, and a shift to net income of US$2 million from a loss previously reported, indicating improving financial health despite recent index exclusion challenges.

- According our earnings growth report, there's an indication that Dayforce might be ready to expand.

- Click here and access our complete balance sheet health report to understand the dynamics of Dayforce.

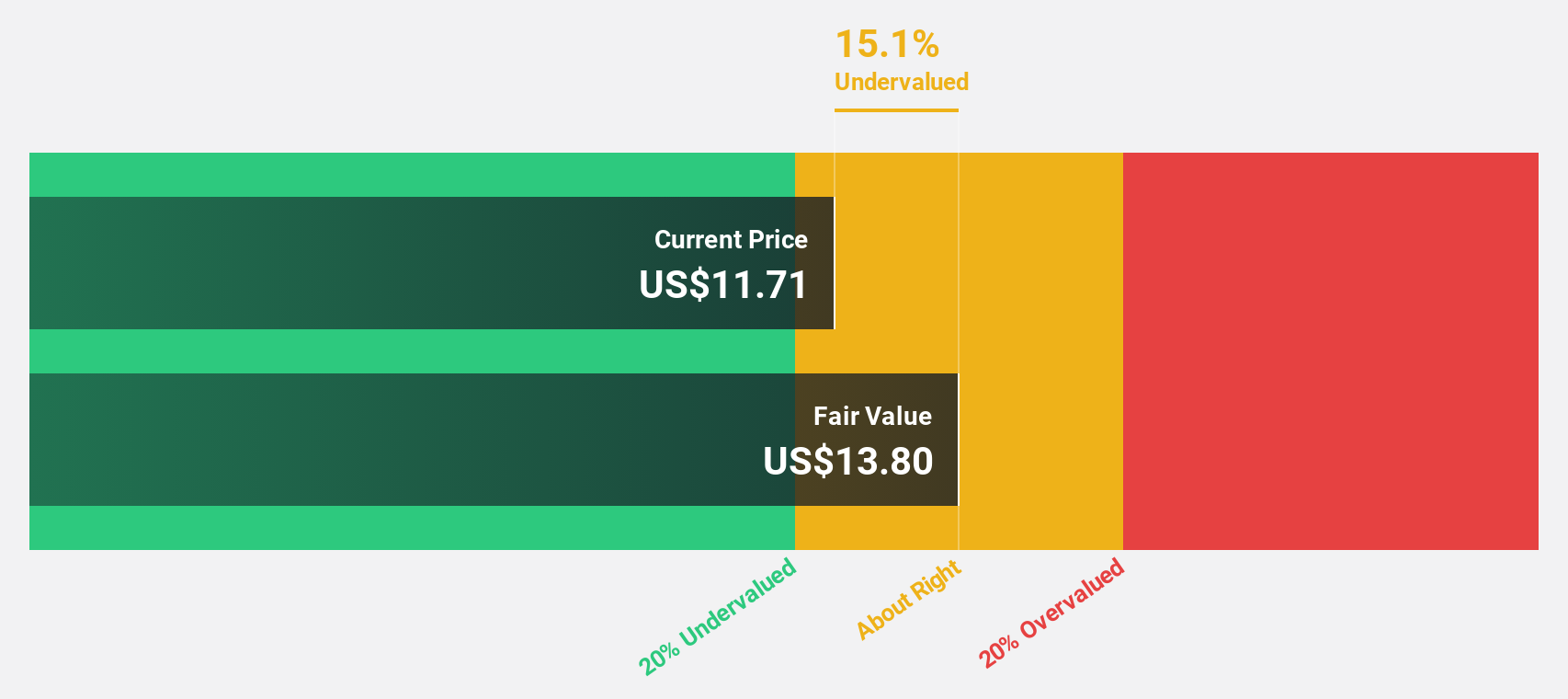

V.F (NYSE:VFC)

Overview: V.F. Corporation, along with its subsidiaries, is involved in the design, procurement, marketing, and distribution of branded lifestyle apparel, footwear, and accessories for men, women, and children across the Americas, Europe, and the Asia-Pacific regions with a market cap of approximately $8.06 billion.

Operations: The company's revenue is segmented into Work ($857.11 million), Active ($3.83 billion), and Outdoor ($5.41 billion) categories, focusing on branded lifestyle apparel, footwear, and accessories across various regions.

Estimated Discount To Fair Value: 37.3%

V.F. Corporation's recent earnings report highlights a return to profitability with net income of US$52.18 million, contrasting last year's loss, despite sales declining to US$2.76 billion from US$2.92 billion year-over-year. Trading at US$20.71, it is undervalued relative to its fair value estimate of US$33.03 and is expected to achieve high annual profit growth over the next three years, although revenue growth remains below market averages amidst a volatile share price environment.

- The analysis detailed in our V.F growth report hints at robust future financial performance.

- Delve into the full analysis health report here for a deeper understanding of V.F.

Turning Ideas Into Actions

- Navigate through the entire inventory of 185 Undervalued US Stocks Based On Cash Flows here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CTRE

CareTrust REIT

CareTrust REIT is a self-administered, publicly-traded real estate investment trust engaged in the ownership, acquisition, development and leasing of seniors housing and healthcare-related properties.

High growth potential with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives