- United States

- /

- Professional Services

- /

- NYSE:CACI

What CACI International (CACI)'s New Defense Task Orders and Expanded Credit Facility Mean For Shareholders

Reviewed by Sasha Jovanovic

- CACI International Inc. recently announced two multi-year U.S. defense task orders worth up to US$145 million with the Navy’s Portsmouth Naval Shipyard and up to US$79 million with the Army’s C5ISR Center, extending its role in undersea engineering, electronic warfare, and spectrum-focused support.

- Together with a new Second Amended and Restated Credit Agreement providing a US$1.25 billion term loan and US$2.00 billion revolving facility maturing in 2030, these awards highlight CACI’s deep integration into mission-critical defense work while expanding its financial flexibility for future investment and contract execution.

- We’ll now examine how these fresh Navy and Army task orders, supported by expanded credit capacity, may influence CACI’s existing investment narrative.

Find companies with promising cash flow potential yet trading below their fair value.

CACI International Investment Narrative Recap

To own CACI, you need to believe in long term U.S. defense and intelligence spending and the company’s ability to win and execute complex, tech heavy contracts. The new Navy and Army awards slightly strengthen the near term contract backlog story, while the enlarged credit facility raises the stakes on CACI’s existing high debt risk and its sensitivity to any slowdown or disruption in federal budgets.

The Second Amended and Restated Credit Agreement, with a US$1.25 billion term loan and US$2.00 billion revolver maturing in 2030, is most relevant here. It underpins CACI’s capacity to fund large, mission critical programs like the new undersea engineering and C5ISR task orders, directly tying balance sheet flexibility to the key catalyst of securing and executing high value government technology contracts.

Yet beneath the new awards and financing capacity, CACI’s heavy dependence on U.S. government budgets remains a risk investors should be aware of...

Read the full narrative on CACI International (it's free!)

CACI International's narrative projects $10.4 billion revenue and $634.1 million earnings by 2028. This requires 6.5% yearly revenue growth and about a $134.3 million earnings increase from $499.8 million today.

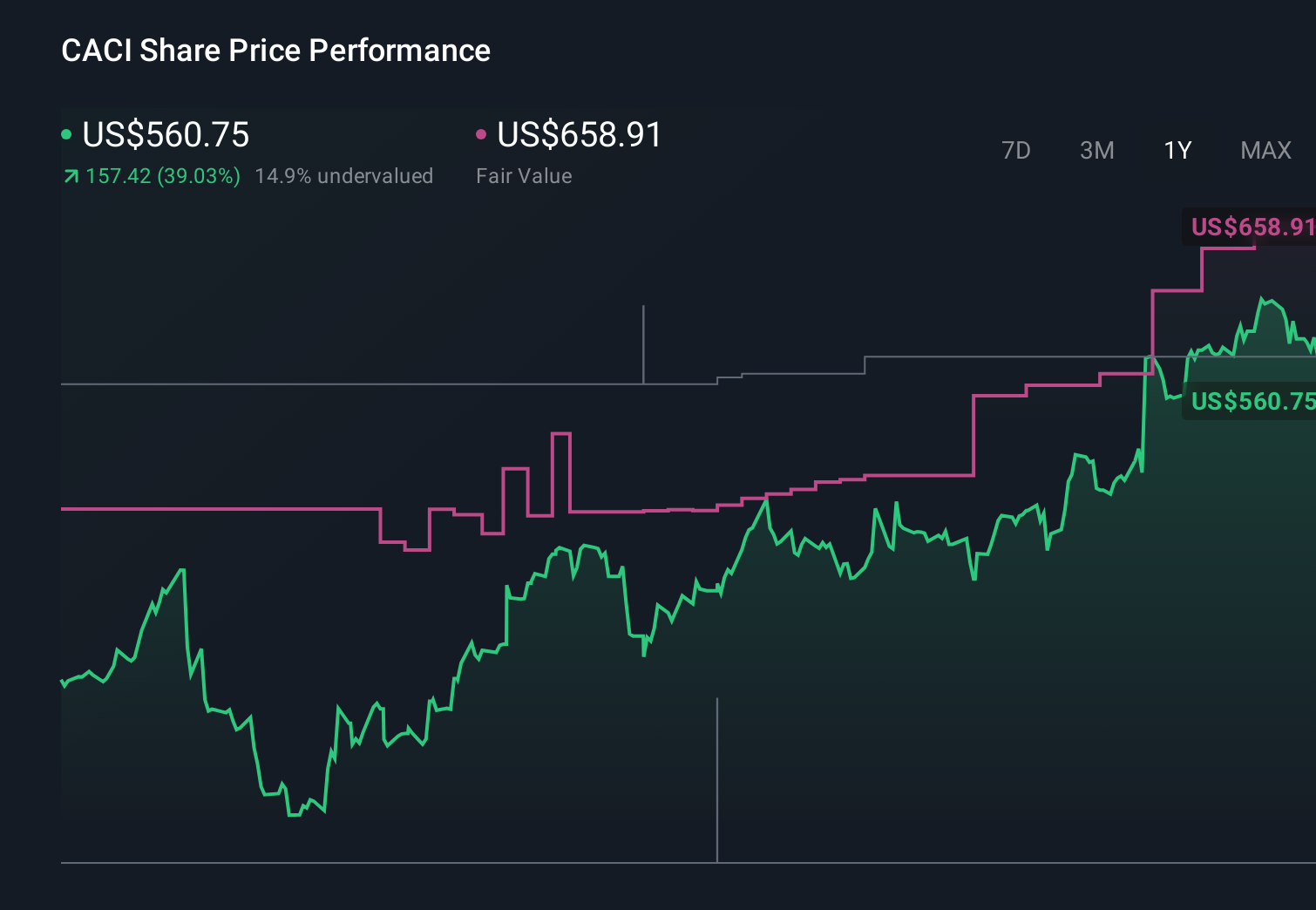

Uncover how CACI International's forecasts yield a $658.91 fair value, a 15% upside to its current price.

Exploring Other Perspectives

Four fair value estimates from the Simply Wall St Community span roughly US$456.91 to US$732.45, reflecting very different expectations. You can weigh those views against CACI’s concentration in U.S. defense and intelligence spending and consider how that reliance might affect future performance.

Explore 4 other fair value estimates on CACI International - why the stock might be worth as much as 28% more than the current price!

Build Your Own CACI International Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your CACI International research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free CACI International research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate CACI International's overall financial health at a glance.

No Opportunity In CACI International?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- Rare earth metals are the new gold rush. Find out which 36 stocks are leading the charge.

- We've found 13 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CACI

CACI International

Through its subsidiaries, provides expertise and technology solutions in the United States, the United Kingdom, rest of Europe, and internationally.

Good value with proven track record.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Butler National (Buks) outperforms.

A tech powerhouse quietly powering the world’s AI infrastructure.

Keppel DC REIT (SGX: AJBU) is a resilient gem in the data center space.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)