- United States

- /

- Personal Products

- /

- NYSE:YSG

Planet Image International Leads 3 US Penny Stocks To Consider

Reviewed by Simply Wall St

As the Federal Reserve holds interest rates steady, the U.S. stock market has seen fluctuations, with major indices experiencing both gains and losses amid ongoing earnings reports from big tech companies. For investors looking beyond these large-cap stocks, penny stocks—often representing smaller or newer companies—remain a relevant area of interest despite their somewhat outdated label. These stocks can offer a blend of affordability and growth potential, especially when backed by robust financials, making them an intriguing option for those seeking opportunities outside the mainstream market narrative.

Top 10 Penny Stocks In The United States

| Name | Share Price | Market Cap | Financial Health Rating |

| QuantaSing Group (NasdaqGM:QSG) | $3.08 | $121.14M | ★★★★★★ |

| BAB (OTCPK:BABB) | $0.9115 | $6.53M | ★★★★★★ |

| ZTEST Electronics (OTCPK:ZTST.F) | $0.27829 | $10.41M | ★★★★★★ |

| Permianville Royalty Trust (NYSE:PVL) | $1.47 | $48.18M | ★★★★★★ |

| North European Oil Royalty Trust (NYSE:NRT) | $4.54 | $42M | ★★★★★★ |

| Imperial Petroleum (NasdaqCM:IMPP) | $2.76 | $82.81M | ★★★★★★ |

| BTCS (NasdaqCM:BTCS) | $3.09 | $53.96M | ★★★★★★ |

| Golden Growers Cooperative (OTCPK:GGRO.U) | $4.50 | $67.38M | ★★★★★★ |

| CBAK Energy Technology (NasdaqCM:CBAT) | $0.891 | $80.95M | ★★★★★☆ |

| Smith Micro Software (NasdaqCM:SMSI) | $1.29 | $22.88M | ★★★★★☆ |

Click here to see the full list of 711 stocks from our US Penny Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

Planet Image International (NasdaqCM:YIBO)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Planet Image International Limited, with a market cap of $276.95 million, manufactures and sells compatible toner cartridges under white-label or third-party brands across North America, Europe, and other international markets.

Operations: The company generates revenue of $153.28 million from its Printers & Related Products segment.

Market Cap: $276.95M

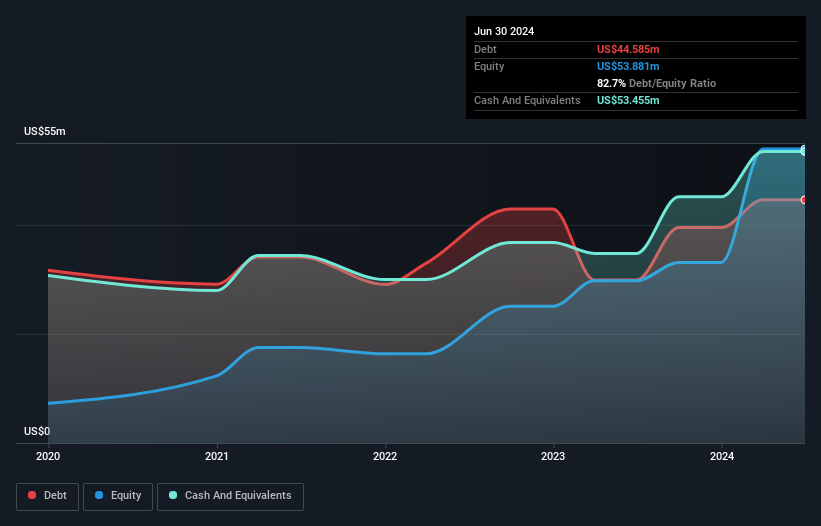

Planet Image International, with a market cap of US$276.95 million, presents both opportunities and challenges typical of penny stocks. The company's short-term assets of US$129.2 million comfortably cover its liabilities, indicating sound financial health in the near term. Despite this stability, the stock has experienced high volatility over the past three months and increased weekly volatility over the past year. Trading at 47.2% below estimated fair value suggests potential undervaluation; however, earnings growth has decelerated recently to 1.6%, underperforming industry averages. The board is experienced but lacks comprehensive data on management tenure for further insights into leadership stability.

- Jump into the full analysis health report here for a deeper understanding of Planet Image International.

- Explore historical data to track Planet Image International's performance over time in our past results report.

Shattuck Labs (NasdaqGS:STTK)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Shattuck Labs, Inc. is a clinical-stage biotechnology company focused on developing therapeutics for cancer and autoimmune diseases in the United States, with a market cap of $56.33 million.

Operations: The company generates its revenue from the biotechnology segment, amounting to $6.44 million.

Market Cap: $56.33M

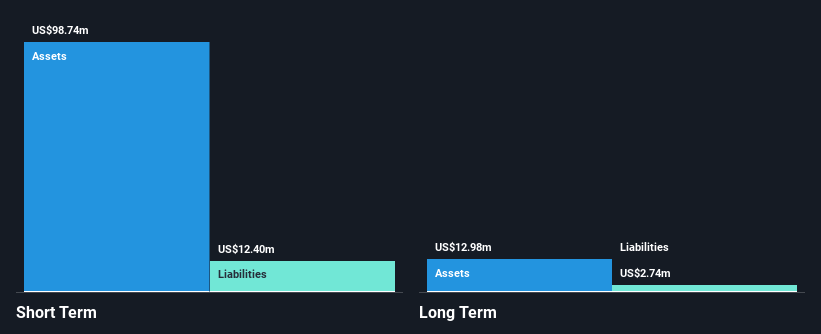

Shattuck Labs, with a market cap of US$56.33 million, exemplifies the volatility and risk associated with penny stocks. The company's financial position is bolstered by short-term assets of US$98.7 million surpassing its liabilities, yet it remains unprofitable with significant losses over the past five years. Although debt-free and trading at 95.5% below estimated fair value, Shattuck faces challenges such as declining earnings forecasts and less than a year of cash runway if current trends continue. Recent presentations at major healthcare conferences highlight efforts to engage stakeholders amid ongoing financial hurdles in achieving profitability.

- Get an in-depth perspective on Shattuck Labs' performance by reading our balance sheet health report here.

- Gain insights into Shattuck Labs' future direction by reviewing our growth report.

Yatsen Holding (NYSE:YSG)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Yatsen Holding Limited, with a market cap of approximately $329.18 million, develops and sells beauty products under various brands such as Perfect Diary and Little Ondine in the People’s Republic of China.

Operations: The company generates revenue of CN¥3.32 billion from its operations in the People's Republic of China.

Market Cap: $329.18M

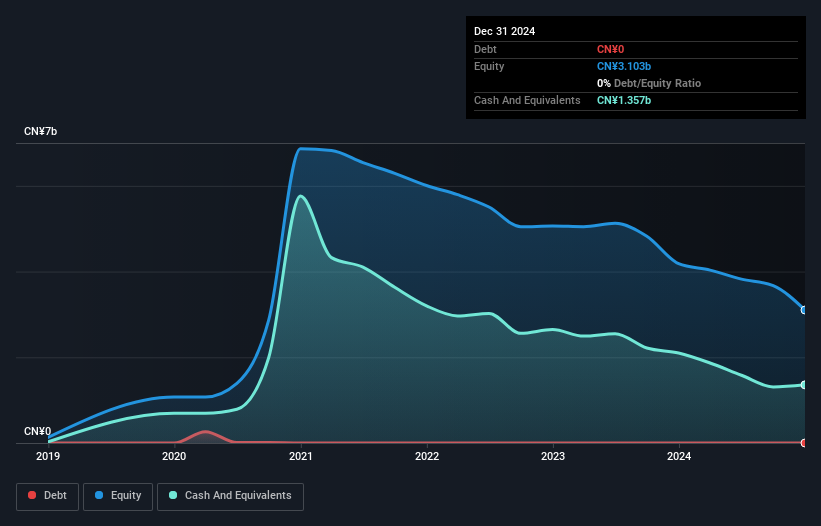

Yatsen Holding Limited, with a market cap of approximately US$329.18 million, operates in the beauty products sector and is characteristic of penny stocks due to its current unprofitability and reduced sales year-over-year. Despite being debt-free and having short-term assets (CN¥2.4 billion) that cover both short-term (CN¥576.3 million) and long-term liabilities (CN¥213.4 million), the company faces challenges with a negative return on equity (-22.5%). Recent executive changes may impact strategic direction, while financial guidance for Q4 2024 indicates modest revenue growth expectations amidst ongoing efforts to reduce losses over time.

- Unlock comprehensive insights into our analysis of Yatsen Holding stock in this financial health report.

- Evaluate Yatsen Holding's prospects by accessing our earnings growth report.

Taking Advantage

- Click here to access our complete index of 711 US Penny Stocks.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:YSG

Yatsen Holding

Engages in the development and sale of beauty products in the People’s Republic of China.

Excellent balance sheet and good value.

Market Insights

Community Narratives