- United States

- /

- Banks

- /

- NasdaqGS:SBCF

3 Stocks That May Be Undervalued By Up To 46.9% According To Intrinsic Estimates

Reviewed by Simply Wall St

As the U.S. stock market navigates a landscape of trade uncertainties and fluctuating indices, investors are keenly observing how these factors might influence economic growth and corporate profits. Amidst this backdrop, identifying potentially undervalued stocks becomes crucial for those looking to capitalize on market inefficiencies, especially when intrinsic value estimates suggest significant upside potential.

Top 10 Undervalued Stocks Based On Cash Flows In The United States

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Simulations Plus (SLP) | $16.83 | $32.76 | 48.6% |

| SharkNinja (SN) | $105.94 | $210.75 | 49.7% |

| Roku (ROKU) | $88.06 | $173.23 | 49.2% |

| Lyft (LYFT) | $16.07 | $31.20 | 48.5% |

| Hess Midstream (HESM) | $37.83 | $73.39 | 48.5% |

| Definitive Healthcare (DH) | $4.03 | $7.85 | 48.7% |

| Carter Bankshares (CARE) | $17.93 | $35.50 | 49.5% |

| Camden National (CAC) | $43.03 | $83.04 | 48.2% |

| BioLife Solutions (BLFS) | $21.81 | $42.50 | 48.7% |

| Atlantic Union Bankshares (AUB) | $33.01 | $65.54 | 49.6% |

We'll examine a selection from our screener results.

Seacoast Banking Corporation of Florida (SBCF)

Overview: Seacoast Banking Corporation of Florida, with a market cap of $2.51 billion, operates as the bank holding company for Seacoast National Bank, offering integrated financial services to retail and commercial customers in Florida.

Operations: Seacoast National Bank generates revenue of $506.38 million from its commercial banking operations, providing financial services to both retail and commercial clients in Florida.

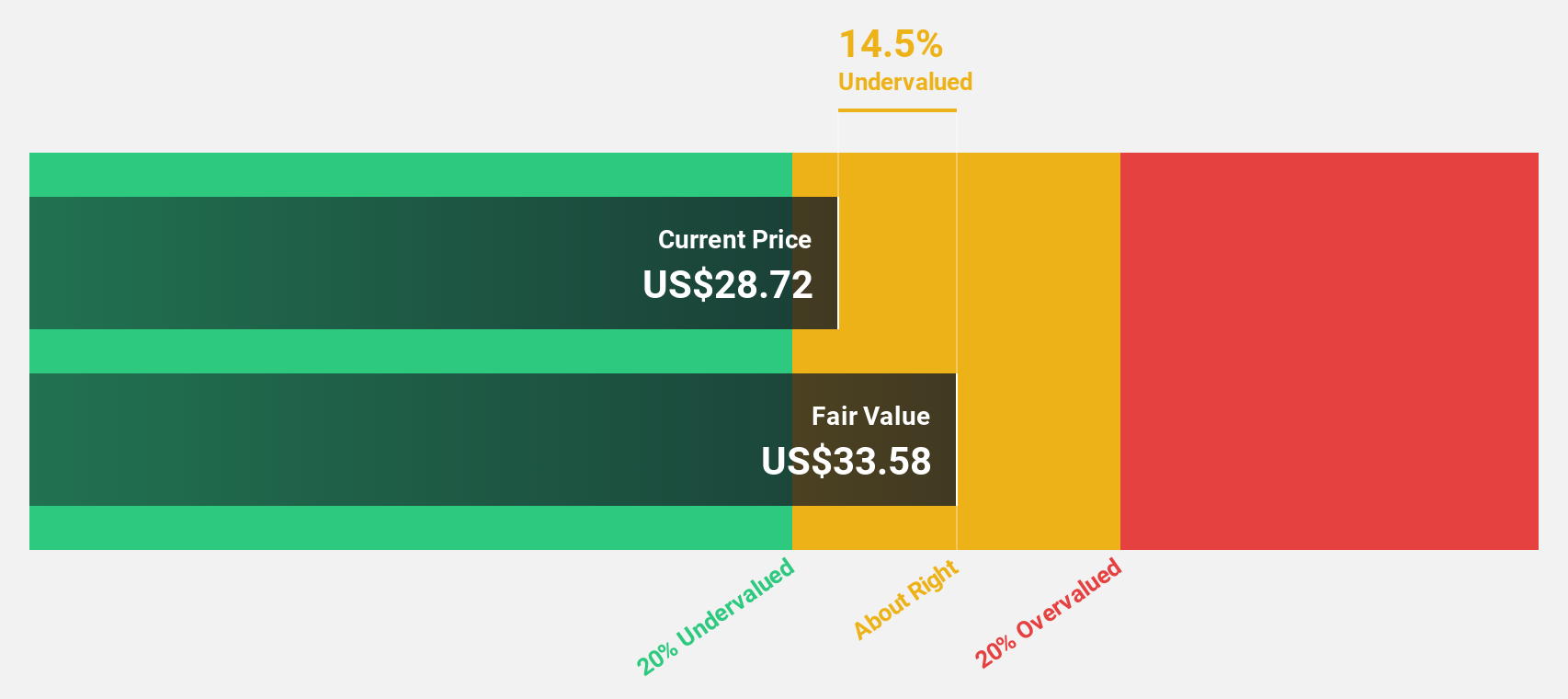

Estimated Discount To Fair Value: 13.6%

Seacoast Banking Corporation of Florida's stock is trading at US$29.03, below its estimated fair value of US$33.58, suggesting it may be undervalued based on cash flows. The company's earnings are forecast to grow significantly at 51.7% annually, outpacing the broader U.S. market's growth rate of 14.7%. Recent earnings reports show increased net income and interest income compared to last year, despite higher net charge-offs in the first quarter of 2025.

- Upon reviewing our latest growth report, Seacoast Banking Corporation of Florida's projected financial performance appears quite optimistic.

- Unlock comprehensive insights into our analysis of Seacoast Banking Corporation of Florida stock in this financial health report.

Tetra Tech (TTEK)

Overview: Tetra Tech, Inc. is a consulting and engineering firm specializing in water, environment, and sustainable infrastructure services with a market cap of approximately $9.64 billion.

Operations: The company's revenue is primarily derived from its Government Services Group, which generated $2.15 billion, and the Commercial/International Services Group, contributing $2.44 billion.

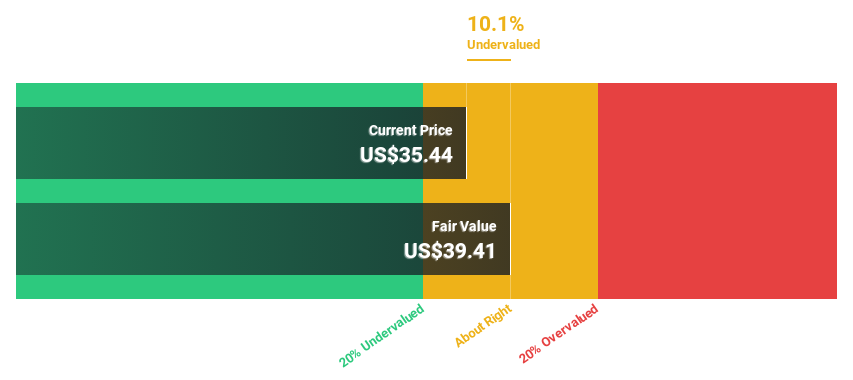

Estimated Discount To Fair Value: 32.6%

Tetra Tech is trading at US$36.4, significantly below its estimated fair value of US$54.02, indicating potential undervaluation based on cash flows. The company's earnings are expected to grow at 22% annually, surpassing the U.S. market's growth rate of 14.7%. However, recent earnings show a decline in net income due to large one-off impairment charges and lower profit margins compared to last year. Despite high debt levels, Tetra Tech secured a $248 million contract with the U.S. Army Corps of Engineers for European projects, potentially enhancing future revenue streams.

- According our earnings growth report, there's an indication that Tetra Tech might be ready to expand.

- Delve into the full analysis health report here for a deeper understanding of Tetra Tech.

Wolverine World Wide (WWW)

Overview: Wolverine World Wide, Inc. is involved in designing, manufacturing, sourcing, marketing, licensing and distributing footwear, apparel and accessories across various regions including the United States and several international markets; it has a market cap of approximately $1.62 billion.

Operations: The company's revenue segments consist of $440 million from the Work Group and $1.28 billion from the Active Group.

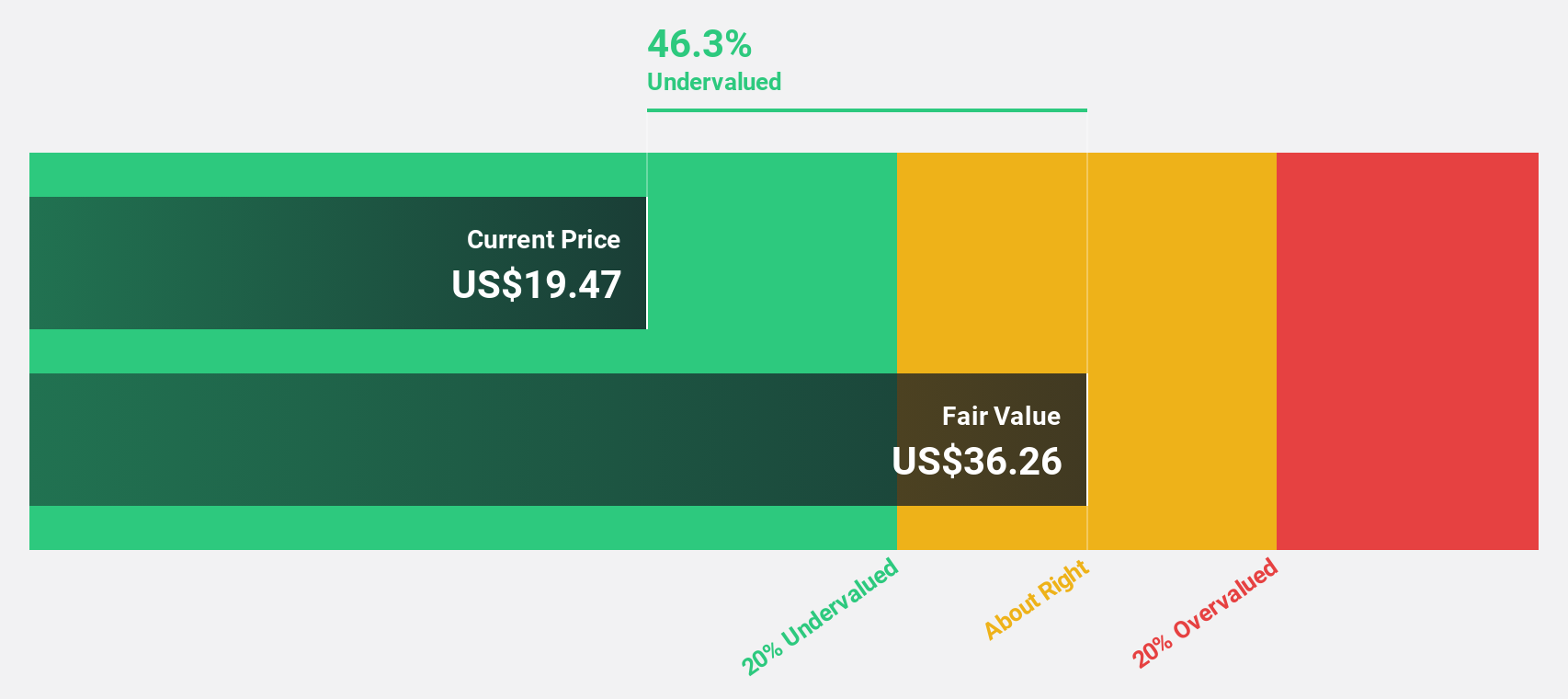

Estimated Discount To Fair Value: 46.9%

Wolverine World Wide is trading at US$19.54, well below its estimated fair value of US$36.77, suggesting it may be undervalued based on cash flows. The company's earnings are forecast to grow significantly at 24.6% annually, outpacing the U.S. market's growth rate of 14.7%. Despite this positive outlook, Wolverine faces challenges with debt coverage from operating cash flow and slower revenue growth compared to the market average of 8.7%. Recent product expansions like Merrell's ProMorph and a commitment to American manufacturing could support future performance improvements.

- Our earnings growth report unveils the potential for significant increases in Wolverine World Wide's future results.

- Click here to discover the nuances of Wolverine World Wide with our detailed financial health report.

Seize The Opportunity

- Gain an insight into the universe of 175 Undervalued US Stocks Based On Cash Flows by clicking here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:SBCF

Seacoast Banking Corporation of Florida

Operates as the bank holding company for Seacoast National Bank that provides integrated financial services to retail and commercial customers in Florida.

Flawless balance sheet with solid track record.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Jackson Financial Stock: When Insurance Math Meets a Shifting Claims Landscape

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)