- United States

- /

- Software

- /

- NasdaqCM:NXTT

US Market's Hidden Opportunities In May 2025

Reviewed by Simply Wall St

Over the last 7 days, the United States market has remained flat, yet it is up 8.0% over the past year with earnings forecast to grow by 14% annually. In this environment, identifying stocks that are not only resilient but also poised for growth can uncover hidden opportunities within the market.

Top 10 Undiscovered Gems With Strong Fundamentals In The United States

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Morris State Bancshares | 9.62% | 4.26% | 5.10% | ★★★★★★ |

| Teekay | NA | -0.89% | 62.53% | ★★★★★★ |

| FineMark Holdings | 122.25% | 2.34% | -26.34% | ★★★★★★ |

| Valhi | 43.01% | 1.55% | -2.64% | ★★★★★☆ |

| Innovex International | 1.49% | 42.69% | 44.34% | ★★★★★☆ |

| Pure Cycle | 5.11% | 1.07% | -4.05% | ★★★★★☆ |

| Reitar Logtech Holdings | 31.39% | 231.46% | 41.38% | ★★★★☆☆ |

| Solesence | 82.42% | 23.41% | -1.04% | ★★★★☆☆ |

| Qudian | 6.38% | -68.48% | -57.47% | ★★★★☆☆ |

We're going to check out a few of the best picks from our screener tool.

Next Technology Holding (NasdaqCM:NXTT)

Simply Wall St Value Rating: ★★★★★★

Overview: Next Technology Holding Inc. offers software development services across the United States, Hong Kong, and Singapore, with a market cap of $1.03 billion.

Operations: Next Technology Holding generates revenue primarily from software development services in the United States, Hong Kong, and Singapore. The company has a market cap of approximately $1.03 billion.

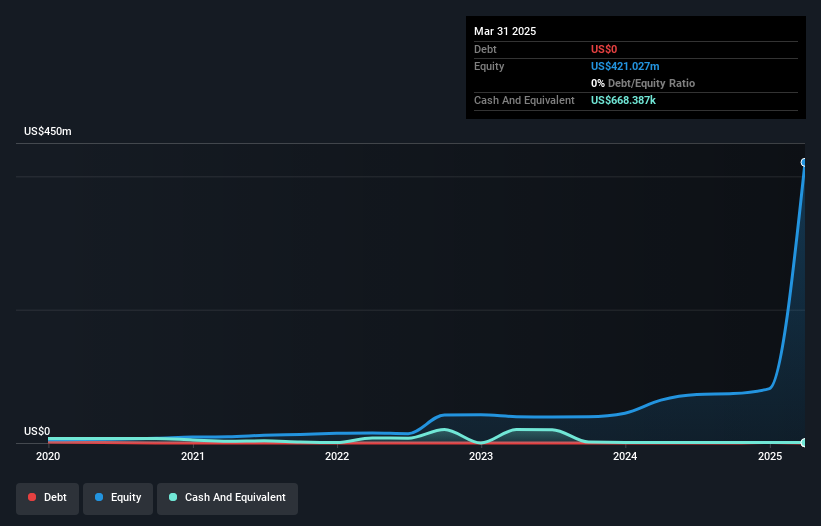

Next Technology Holding, a small player in the software industry, has seen a remarkable earnings growth of 1081.6% over the past year, outpacing the industry's 24.9%. Despite this impressive performance, it faces challenges such as substantial shareholder dilution and volatile share prices recently. The firm's price-to-earnings ratio stands at an attractive 5.3x compared to the US market average of 17.5x, suggesting potential value for investors. However, with net income jumping to US$193 million from US$19 million year-on-year and recent compliance issues with Nasdaq's minimum bid price requirement looming large, its path forward remains uncertain yet intriguing.

Cricut (NasdaqGS:CRCT)

Simply Wall St Value Rating: ★★★★★★

Overview: Cricut, Inc. is a company that designs, markets, and distributes a creativity platform allowing users to create professional-looking handmade goods across various regions including the United States, Canada, and several other global markets; it has a market cap of approximately $1.30 billion.

Operations: Cricut generates revenue primarily through its platform segment, which accounts for $314.68 million, with an additional segment adjustment of $393.10 million.

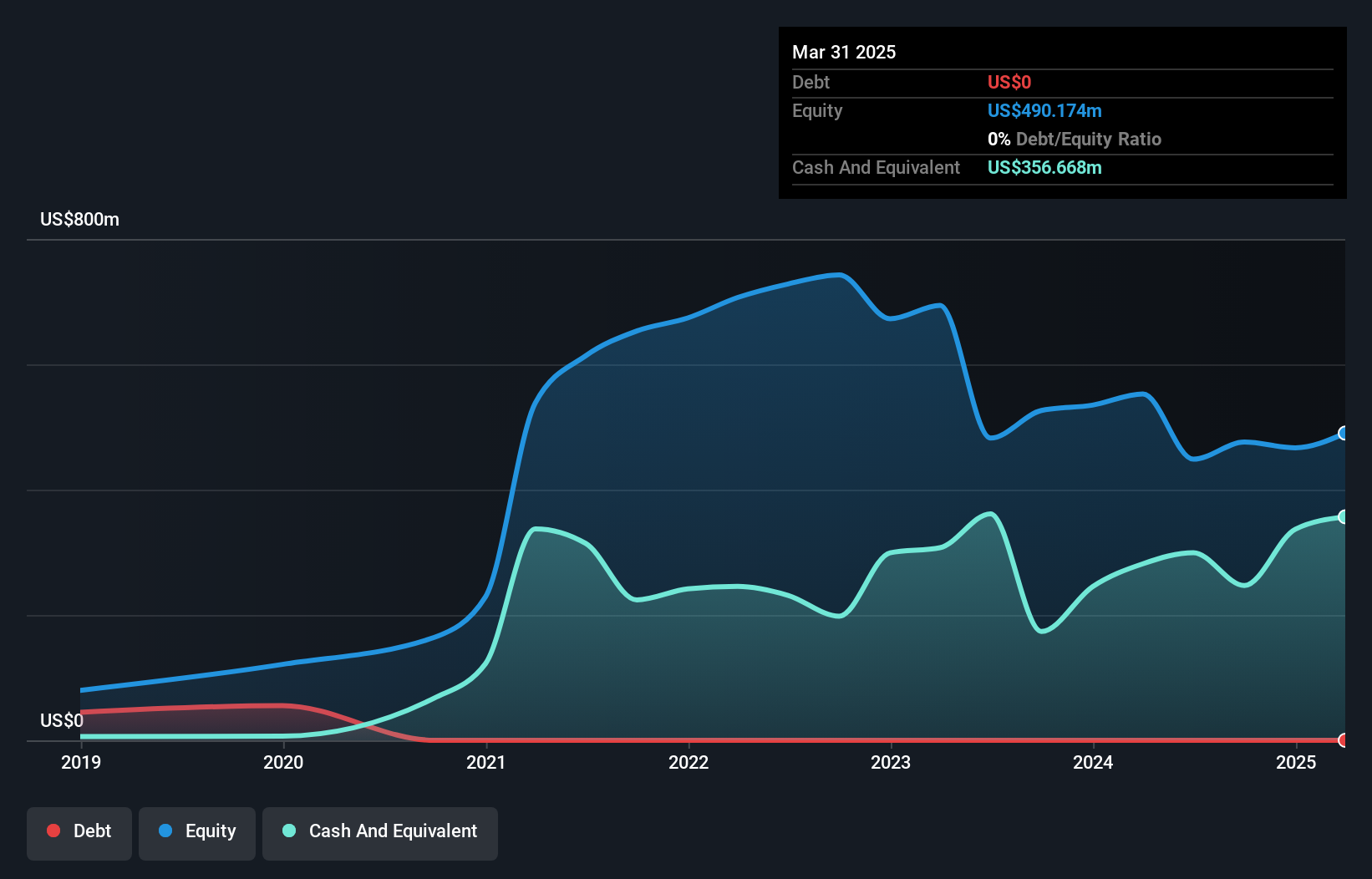

Cricut, a nimble player in the crafting industry, has shown resilience with its debt-free status compared to five years ago when it had a 27.3% debt-to-equity ratio. The company trades at 78% below its estimated fair value, indicating potential for investors. Despite earnings declining by 29.2% annually over the past five years, recent growth of 4.5% outpaced the Consumer Durables sector's -1.7%. Cricut reported Q1 revenue of US$162 million and net income of US$23 million, up from US$20 million last year. A special dividend of $0.75 per share underscores confidence in future prospects amidst executive transitions and product innovations like the faster Cricut Explore® 4 and Maker® 4 machines.

- Click here and access our complete health analysis report to understand the dynamics of Cricut.

Gain insights into Cricut's past trends and performance with our Past report.

Interface (NasdaqGS:TILE)

Simply Wall St Value Rating: ★★★★★★

Overview: Interface, Inc. designs, produces, and sells modular carpet products across multiple continents with a market capitalization of approximately $1.21 billion.

Operations: Interface generates revenue primarily from the Americas, contributing $810.83 million, while Europe, Africa, Asia, and Australia collectively add $512.50 million.

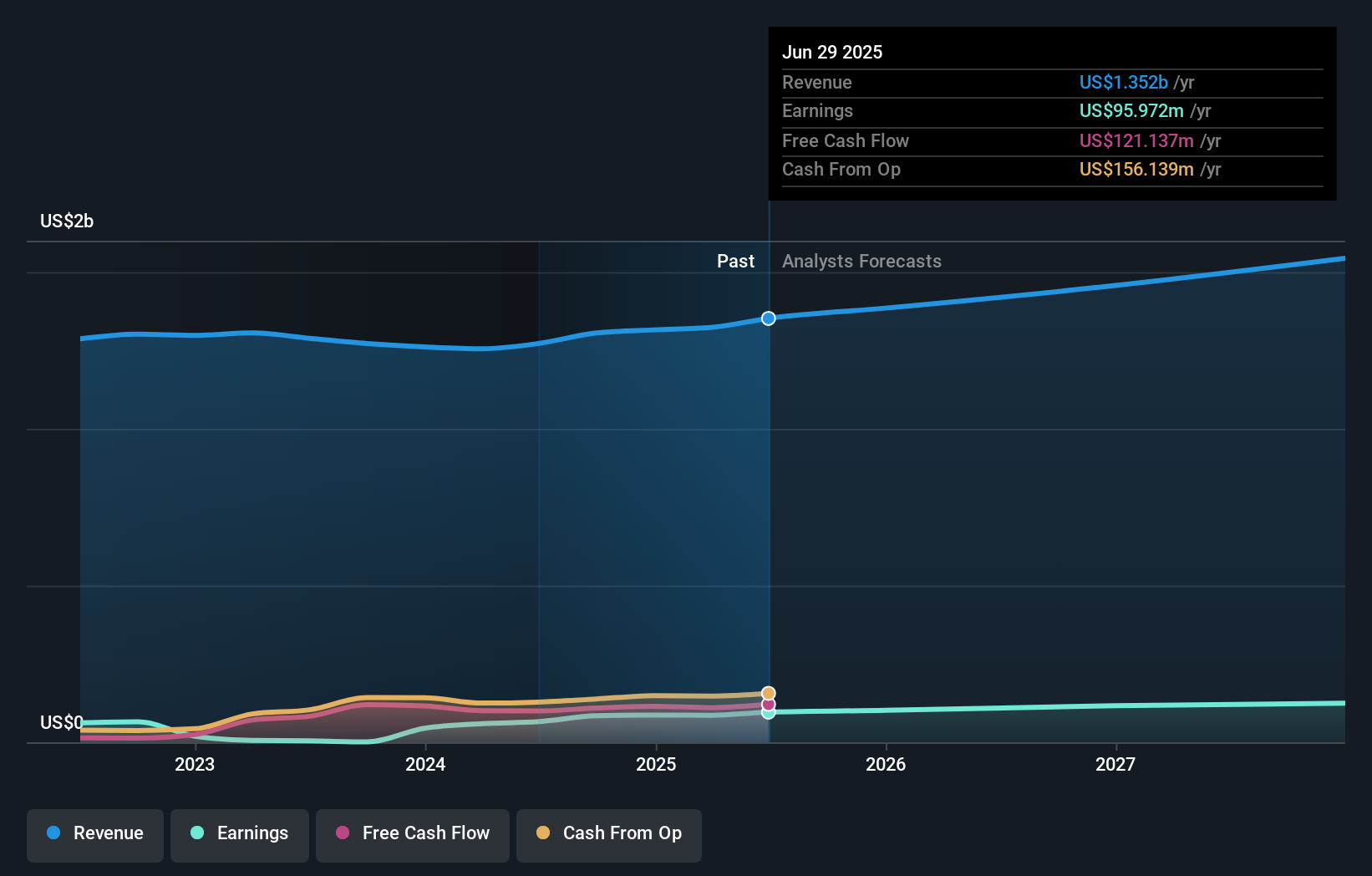

Interface, a modestly sized player in the modular carpet industry, is making strides with its innovative and sustainable product lines. The company recently reported first-quarter sales of US$297 million, up from US$290 million last year, though net income slightly dipped to US$13 million. Interface's earnings growth of 45.6% over the past year surpasses industry averages, showcasing strong performance. Its debt-to-equity ratio has impressively decreased from 259% to 59% over five years, reflecting improved financial health. With a focus on carbon-negative products and expanded market reach through new collections like Terra Nova and Trina Turk X FLOR, Interface is positioning itself for future growth despite potential challenges such as macroeconomic uncertainties and currency fluctuations.

Next Steps

- Navigate through the entire inventory of 280 US Undiscovered Gems With Strong Fundamentals here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Next Technology Holding, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Next Technology Holding might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:NXTT

Next Technology Holding

Provides software development services in the United States, Hong Kong, and Singapore.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives