- United States

- /

- Professional Services

- /

- NasdaqGS:RGP

Here's Why Shareholders Will Not Be Complaining About Resources Connection, Inc.'s (NASDAQ:RGP) CEO Pay Packet

Key Insights

- Resources Connection's Annual General Meeting to take place on 19th of October

- CEO Kate Duchene's total compensation includes salary of US$791.3k

- The total compensation is similar to the average for the industry

- Resources Connection's total shareholder return over the past three years was 35% while its EPS grew by 13% over the past three years

The performance at Resources Connection, Inc. (NASDAQ:RGP) has been quite strong recently and CEO Kate Duchene has played a role in it. Shareholders will have this at the front of their minds in the upcoming AGM on 19th of October. The focus will probably be on the future company strategy as shareholders cast their votes on resolutions such as executive remuneration and other matters. In light of the great performance, we discuss the case why we think CEO compensation is not excessive.

View our latest analysis for Resources Connection

How Does Total Compensation For Kate Duchene Compare With Other Companies In The Industry?

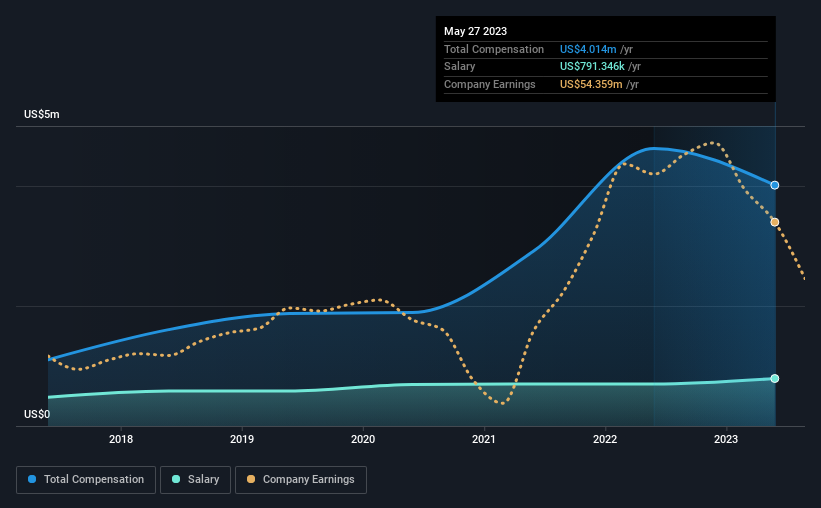

At the time of writing, our data shows that Resources Connection, Inc. has a market capitalization of US$475m, and reported total annual CEO compensation of US$4.0m for the year to May 2023. That's a notable decrease of 13% on last year. We think total compensation is more important but our data shows that the CEO salary is lower, at US$791k.

In comparison with other companies in the American Professional Services industry with market capitalizations ranging from US$200m to US$800m, the reported median CEO total compensation was US$3.3m. From this we gather that Kate Duchene is paid around the median for CEOs in the industry. What's more, Kate Duchene holds US$2.7m worth of shares in the company in their own name, indicating that they have a lot of skin in the game.

| Component | 2023 | 2022 | Proportion (2023) |

| Salary | US$791k | US$700k | 20% |

| Other | US$3.2m | US$3.9m | 80% |

| Total Compensation | US$4.0m | US$4.6m | 100% |

On an industry level, around 14% of total compensation represents salary and 86% is other remuneration. According to our research, Resources Connection has allocated a higher percentage of pay to salary in comparison to the wider industry. It's important to note that a slant towards non-salary compensation suggests that total pay is tied to the company's performance.

Resources Connection, Inc.'s Growth

Resources Connection, Inc. has seen its earnings per share (EPS) increase by 13% a year over the past three years. It saw its revenue drop 10% over the last year.

This demonstrates that the company has been improving recently and is good news for the shareholders. The lack of revenue growth isn't ideal, but it is the bottom line that counts most in business. Moving away from current form for a second, it could be important to check this free visual depiction of what analysts expect for the future.

Has Resources Connection, Inc. Been A Good Investment?

Most shareholders would probably be pleased with Resources Connection, Inc. for providing a total return of 35% over three years. As a result, some may believe the CEO should be paid more than is normal for companies of similar size.

In Summary...

The company's solid performance might have made most shareholders happy, possibly making CEO remuneration the least of the matters to be discussed in the AGM. Instead, investors might be more interested in discussions that would help manage their longer-term growth expectations such as company business strategies and future growth potential.

CEO compensation can have a massive impact on performance, but it's just one element. That's why we did some digging and identified 2 warning signs for Resources Connection that you should be aware of before investing.

Switching gears from Resources Connection, if you're hunting for a pristine balance sheet and premium returns, this free list of high return, low debt companies is a great place to look.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:RGP

Resources Connection

Engages in the provision of consulting services to business customers under the Resources Global Professionals (RGP) name in North America, the Asia Pacific, and Europe.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Butler National (Buks) outperforms.

A tech powerhouse quietly powering the world’s AI infrastructure.

Keppel DC REIT (SGX: AJBU) is a resilient gem in the data center space.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)