- United States

- /

- Professional Services

- /

- NasdaqGS:PAYX

Paychex (NasdaqGS:PAYX) Third-Quarter Earnings Rise

Reviewed by Simply Wall St

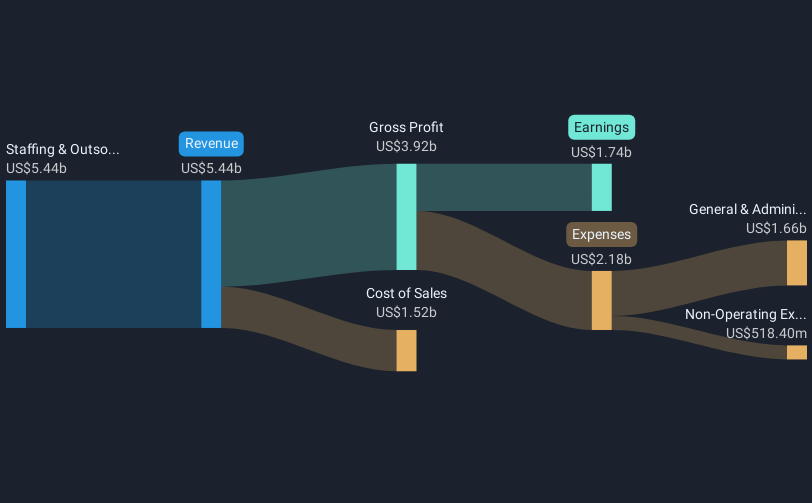

Paychex (NasdaqGS:PAYX) recently announced its third-quarter earnings, reporting a rise in revenue and net income compared to the prior year. However, despite the strong earnings, the company's share price experienced a 2% decline over the last quarter. This movement coincided with broader market turbulence, as the S&P 500 fell 12% following tariff-related uncertainties that rattled investor confidence. The company's announcement of no recent share buybacks also aligned with these challenging market conditions. Consequently, while Paychex's financial performance was positive, external market pressures likely contributed to the stock's muted return.

Buy, Hold or Sell Paychex? View our complete analysis and fair value estimate and you decide.

The recently announced earnings and subsequent share price dip present an interesting narrative for Paychex. Despite strong financial performance, the market's broader uncertainty, evidenced by a 12% decline in the S&P 500, likely influenced investor sentiment, resulting in the company's 2% share price decline over the last quarter. However, over a more extended period of five years, Paychex's total returns, including dividends, have seen a significant increase of 139%, demonstrating resilience in its long-term value proposition.

In the past year, Paychex outperformed both the US market and its Professional Services industry peers, which experienced declines of 3.8% and 3.5%, respectively. This highlights its relative strength in a challenging market environment. The acquisition of Paycor and investments in AI tools are expected to bolster revenue growth and efficiency, influencing future earnings forecasts positively. Analysts forecast a gradual annual revenue growth of 5.8% and earnings growth of 5.8% over the next few years, though with a slight contraction in profit margins to 31.9% from 32%.

The current share price of $154.59 represents a small premium over the analysts' consensus price target of $145.01, suggesting the market may currently price in optimistic growth expectations. Yet, the modest difference indicates a perception of fair valuation, prompting investors to weigh future growth prospects against potential risks like integration challenges with Paycor. As Paychex continues to focus on expanding its HCM solutions and enhancing client value through AI-driven tools, the unfolding impact on its revenue and earnings will determine the alignment with analyst expectations.

Assess Paychex's previous results with our detailed historical performance reports.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:PAYX

Paychex

Provides integrated human capital management solutions (HCM) for payroll, benefits, human resources (HR), and insurance services for small to medium-sized businesses in the United States, Europe, and India.

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives