- United States

- /

- Professional Services

- /

- NasdaqGS:LZ

LegalZoom.com, Inc.'s (NASDAQ:LZ) 25% Share Price Surge Not Quite Adding Up

Despite an already strong run, LegalZoom.com, Inc. (NASDAQ:LZ) shares have been powering on, with a gain of 25% in the last thirty days. Not all shareholders will be feeling jubilant, since the share price is still down a very disappointing 27% in the last twelve months.

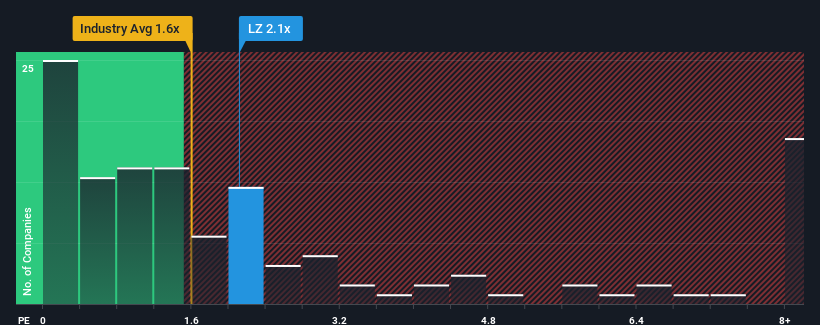

Following the firm bounce in price, you could be forgiven for thinking LegalZoom.com is a stock not worth researching with a price-to-sales ratios (or "P/S") of 2.1x, considering almost half the companies in the United States' Professional Services industry have P/S ratios below 1.6x. However, the P/S might be high for a reason and it requires further investigation to determine if it's justified.

See our latest analysis for LegalZoom.com

How Has LegalZoom.com Performed Recently?

Recent times haven't been great for LegalZoom.com as its revenue has been rising slower than most other companies. One possibility is that the P/S ratio is high because investors think this lacklustre revenue performance will improve markedly. If not, then existing shareholders may be very nervous about the viability of the share price.

Want the full picture on analyst estimates for the company? Then our free report on LegalZoom.com will help you uncover what's on the horizon.Is There Enough Revenue Growth Forecasted For LegalZoom.com?

The only time you'd be truly comfortable seeing a P/S as high as LegalZoom.com's is when the company's growth is on track to outshine the industry.

Taking a look back first, we see that the company managed to grow revenues by a handy 6.4% last year. The latest three year period has also seen a 26% overall rise in revenue, aided somewhat by its short-term performance. So we can start by confirming that the company has actually done a good job of growing revenue over that time.

Shifting to the future, estimates from the eight analysts covering the company suggest revenue should grow by 2.4% over the next year. With the industry predicted to deliver 6.7% growth, the company is positioned for a weaker revenue result.

In light of this, it's alarming that LegalZoom.com's P/S sits above the majority of other companies. It seems most investors are hoping for a turnaround in the company's business prospects, but the analyst cohort is not so confident this will happen. Only the boldest would assume these prices are sustainable as this level of revenue growth is likely to weigh heavily on the share price eventually.

The Final Word

LegalZoom.com's P/S is on the rise since its shares have risen strongly. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

It comes as a surprise to see LegalZoom.com trade at such a high P/S given the revenue forecasts look less than stellar. When we see a weak revenue outlook, we suspect the share price faces a much greater risk of declining, bringing back down the P/S figures. At these price levels, investors should remain cautious, particularly if things don't improve.

A lot of potential risks can sit within a company's balance sheet. Our free balance sheet analysis for LegalZoom.com with six simple checks will allow you to discover any risks that could be an issue.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:LZ

LegalZoom.com

Operates an online platform that supports the legal, compliance, and business management needs of small businesses and consumers in the United States.

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives