- United States

- /

- Professional Services

- /

- NasdaqGS:EXLS

ExlService (EXLS): Assessing Valuation After a Year of Share Price Weakness vs. Solid Earnings Growth

Reviewed by Simply Wall St

ExlService Holdings (EXLS) has quietly slipped this year, with the stock down around 12% over the past year even as revenue and net income each grew roughly 11% annually, creating an interesting disconnect.

See our latest analysis for ExlService Holdings.

Despite this weak patch, the mood around ExlService has steadied a bit. A 1 month share price return of 2.88 percent has lifted the stock to about 40.77 dollars, while its 5 year total shareholder return of 140.08 percent shows long term holders are still well ahead even as shorter term momentum has faded.

If you want to see how other tech enabled names are being priced, this could be a useful moment to explore high growth tech and AI stocks as potential next ideas.

So with fundamentals still compounding while the share price stalls and ExlService trading at a meaningful discount to analyst targets, is this a mispriced compounder, or is the market already baking in years of growth?

Most Popular Narrative Narrative: 22% Undervalued

With ExlService last closing at 40.77 dollars versus a narrative fair value of 52.29 dollars, the valuation case leans firmly toward upside potential.

The analysts have a consensus price target of $54.143 for ExlService Holdings based on their expectations of its future earnings growth, profit margins and other risk factors.

In order for you to agree with the analyst's consensus, you would need to believe that by 2028, revenues will be $2.7 billion, earnings will come to $326.3 million, and it would be trading on a PE ratio of 33.2x, assuming you use a discount rate of 7.1%.

Curious what kind of growth and margins could back a valuation multiple above the industry norm, even after discounting future profits at a meaningful rate? Read on.

Result: Fair Value of $52.29 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, rising talent costs and stricter global data regulations could compress margins and slow scaling, which may challenge the upbeat earnings and valuation narrative.

Find out about the key risks to this ExlService Holdings narrative.

Another Angle on Valuation

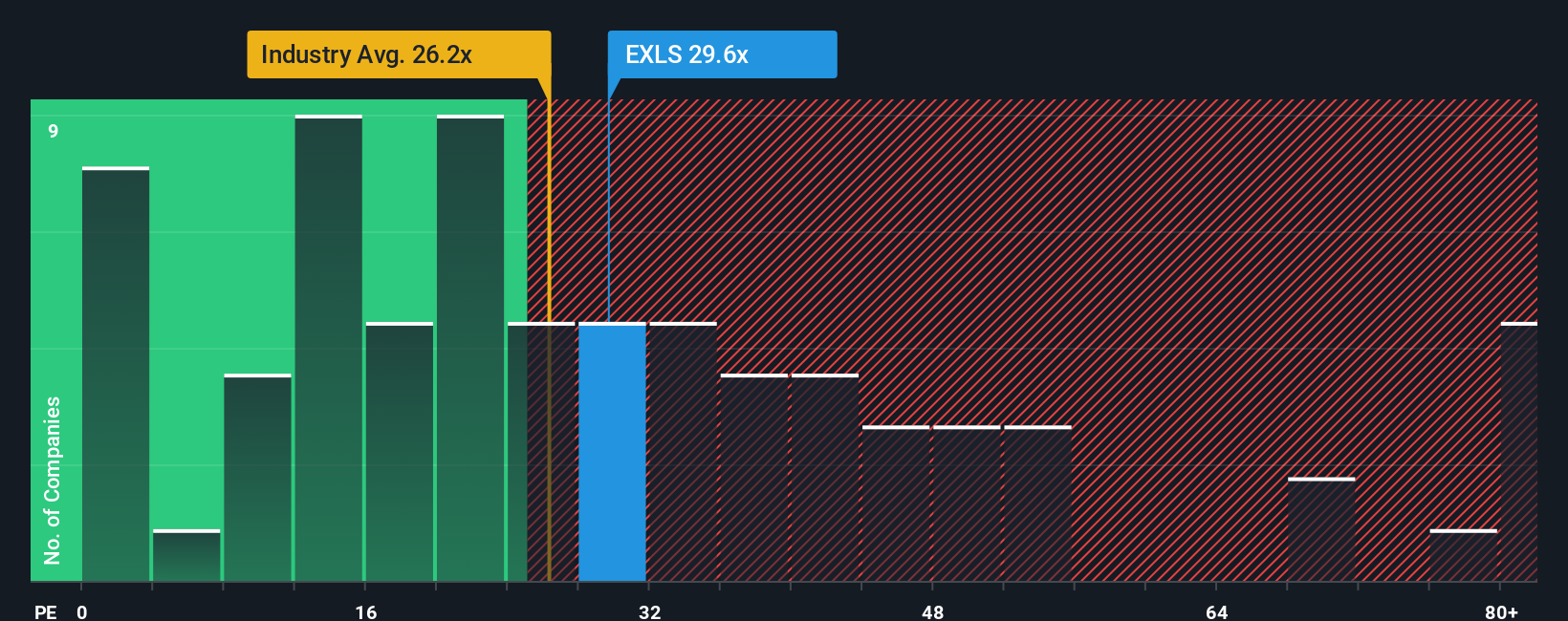

On earnings, the story looks less forgiving. ExlService trades on about 26.8 times earnings versus roughly 24.9 times for the US Professional Services group and a fair ratio nearer 24.2 times, which hints that investors are already paying up and leaving less room for error if growth disappoints.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own ExlService Holdings Narrative

If you see things differently or want to dig into the numbers yourself, you can build a custom view in just minutes: Do it your way.

A great starting point for your ExlService Holdings research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Before markets move on without you, put Simply Wall Street's powerful screener to work and uncover focused opportunities that match your goals, risk tolerance and curiosity.

- Capture potential mispricings by targeting companies that look cheap on future cash flows using these 904 undervalued stocks based on cash flows before the crowd catches up.

- Ride structural technology shifts by zeroing in on innovators at the intersection of healthcare and artificial intelligence through these 30 healthcare AI stocks.

- Position yourself for the next wave of financial infrastructure by filtering listed businesses exposed to digital assets with these 81 cryptocurrency and blockchain stocks.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if ExlService Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:EXLS

ExlService Holdings

Operates as a data analytics, and digital operations and solutions company in the United States and internationally.

Outstanding track record with excellent balance sheet.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Unicycive Therapeutics (Nasdaq: UNCY) – Preparing for a Second Shot at Bringing a New Kidney Treatment to Market (TEST)

Rocket Lab USA Will Ignite a 30% Revenue Growth Journey

Dollar general to grow

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026