- United States

- /

- Software

- /

- NasdaqCM:OSPN

Three Noteworthy Dividend Stocks To Consider

As February begins, U.S. stock markets have surged, with the Dow Jones Industrial Average climbing by 515 points and the S&P 500 nearing a record high. In this dynamic market environment, dividend stocks can offer investors a blend of income stability and potential growth, making them an attractive consideration amidst fluctuating economic conditions.

Top 10 Dividend Stocks In The United States

Click here to see the full list of 96 stocks from our Top US Dividend Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

OneSpan (OSPN)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: OneSpan Inc. offers digital security, authentication, identity solutions, electronic signature, and digital workflow products globally with a market cap of approximately $427.81 million.

Operations: OneSpan Inc.'s revenue is primarily derived from two segments: Digital Agreements, which generated $63.71 million, and Security Solutions, contributing $177.73 million.

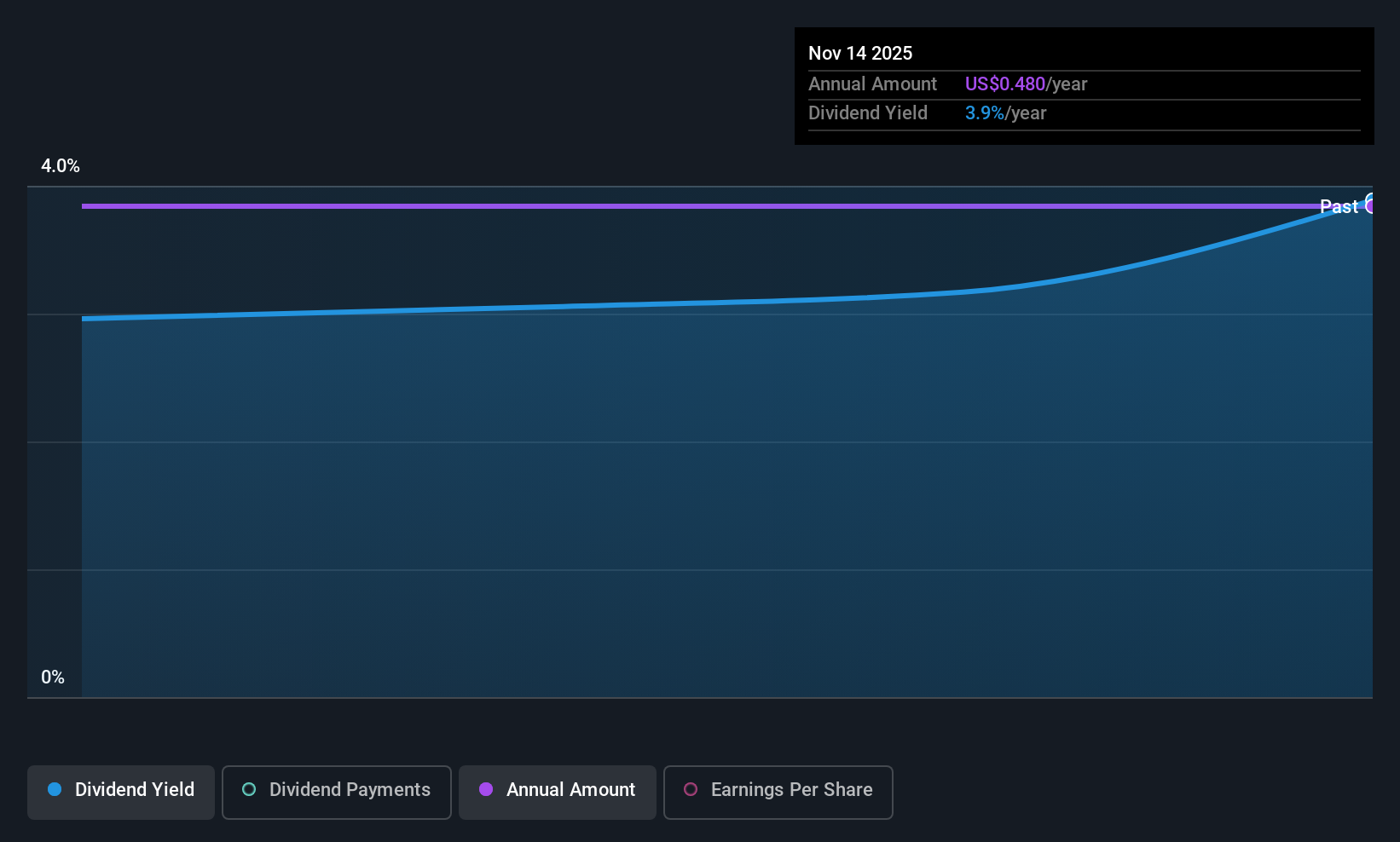

Dividend Yield: 4.2%

OneSpan's dividend yield of 4.23% places it in the top 25% of US dividend payers, with a sustainable payout ratio supported by earnings (31.6%) and cash flows (35.6%). Despite recent earnings growth of 102.4%, future earnings are forecasted to decline, raising concerns about long-term dividend reliability as payments have only just commenced. Recent strategic moves include appointing Shaun Bierweiler as CRO and expanding security solutions with Sumitomo Mitsui Trust Bank, potentially enhancing revenue streams amidst evolving regulatory landscapes.

- Take a closer look at OneSpan's potential here in our dividend report.

- The valuation report we've compiled suggests that OneSpan's current price could be quite moderate.

Automatic Data Processing (ADP)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Automatic Data Processing, Inc. offers cloud-based human capital management solutions globally and has a market capitalization of approximately $91.25 billion.

Operations: Automatic Data Processing, Inc. generates revenue through its Employer Services segment, which accounts for $14.33 billion, and its Professional Employer Organization (PEO) Services segment, contributing $6.90 billion.

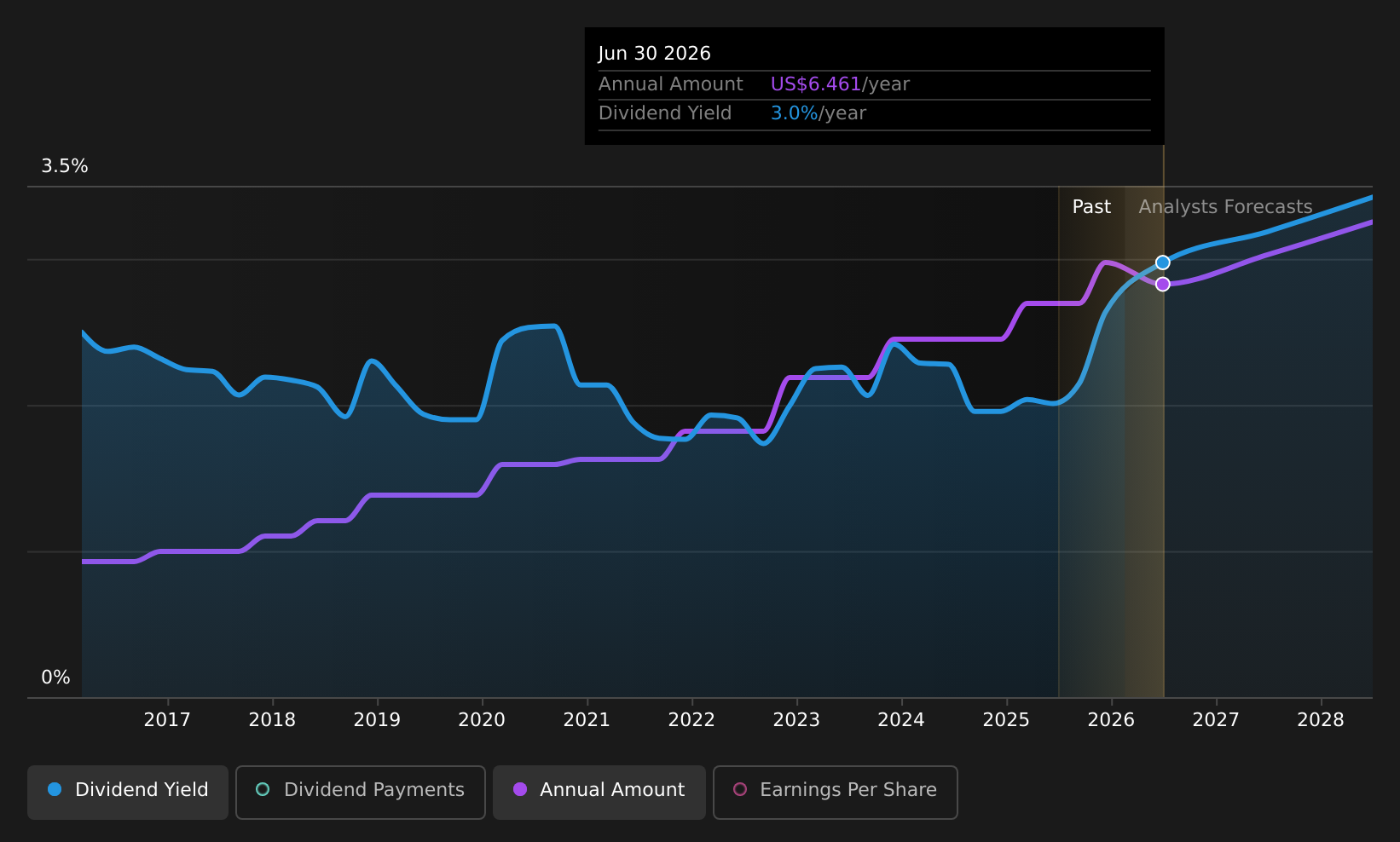

Dividend Yield: 3%

Automatic Data Processing offers a stable dividend yield of 3%, supported by a sustainable payout ratio covered by earnings (60.5%) and cash flows (65.4%). The company has consistently increased its dividend over the past decade, reflecting reliability. Recent earnings show growth, with net income rising to US$1.06 billion for Q2 2026, indicating financial strength. ADP's recent product innovations like ADP Assist agents enhance operational efficiency in HR and payroll management, potentially supporting future revenue streams.

- Dive into the specifics of Automatic Data Processing here with our thorough dividend report.

- Upon reviewing our latest valuation report, Automatic Data Processing's share price might be too pessimistic.

Paychex (PAYX)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Paychex, Inc. offers human capital management solutions including payroll, employee benefits, HR, and insurance services for small to medium-sized businesses across the United States, Europe, and India with a market cap of $35.37 billion.

Operations: Paychex, Inc.'s revenue from its Staffing & Outsourcing Services segment is $6.03 billion.

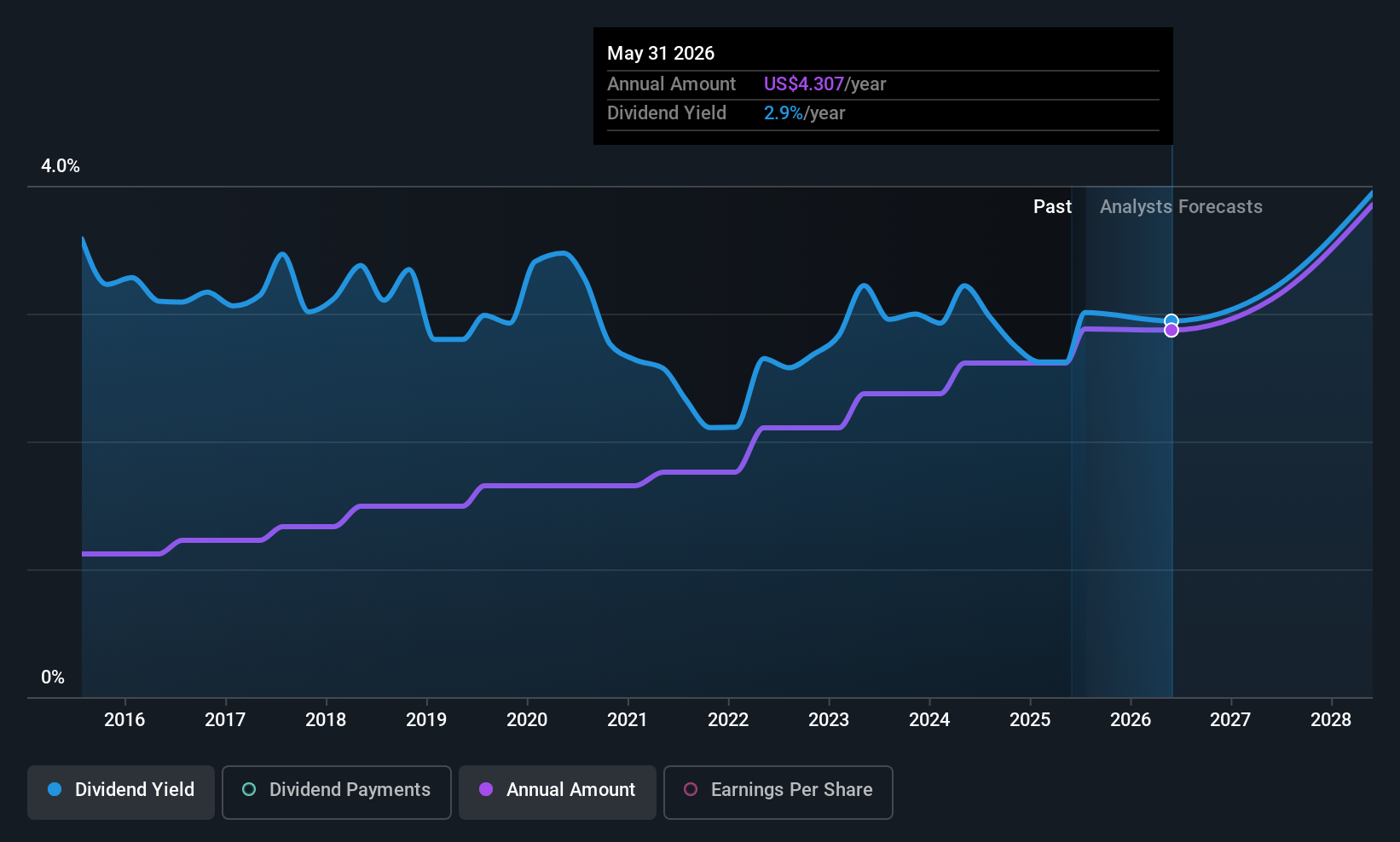

Dividend Yield: 4.4%

Paychex's dividend yield of 4.4% ranks among the top 25% in the US, though it's not well covered by earnings due to a high payout ratio of 95.2%. However, dividends are stable and growing, supported by a cash payout ratio of 77.7%. Recent strategic moves include appointing J. Michael Hansen to its board for financial expertise and launching a US$1 billion share buyback program, reflecting strong cash flow management despite high debt levels.

- Navigate through the intricacies of Paychex with our comprehensive dividend report here.

- In light of our recent valuation report, it seems possible that Paychex is trading behind its estimated value.

Where To Now?

- Discover the full array of 96 Top US Dividend Stocks right here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:OSPN

OneSpan

Provides digital solutions for security, authentication, identity, electronic signature, and digital workflow products in the Americas, Europe, the Middle East, Africa, and the Asia Pacific regions.

Outstanding track record with flawless balance sheet.

Similar Companies

Market Insights

Weekly Picks

The "Physical AI" Monopoly – A New Industrial Revolution

Czechoslovak Group - is it really so hot?

The Compound Effect: From Acquisition to Integration

Recently Updated Narratives

Delta loses shine after warning of falling travel demand, but still industry leader

Project Ixian Accelerated Rollout will Drive Valuation Expansion to £0.0150.

EU#5 - From Industrial Giant to the Digital Operating System of the Real World

Popular Narratives

Undervalued Key Player in Magnets/Rare Earth

Is Ubisoft the Market’s Biggest Pricing Error? Why Forensic Value Points to €33 Per Share

The Strategic Revaluation of Adobe: A Critical Analysis of Market Sentiment

Trending Discussion

When was the last time that Tesla delivered on its promises? Lets go through the list! The last successful would be the Tesla Model 3 which was 2019 with first deliveries 2017. Roadster not shipped. Tesla Cybertruck global roll out failed. They might have a bunch of prototypes (that are being controlled remotely) And you think they'll be able to ship something as complicated as a robot? It's a pure speculation buy.