- United States

- /

- Professional Services

- /

- NasdaqGS:ADP

A Look at ADP's Valuation After New AI Upgrades for Workforce and Payroll Platforms

Reviewed by Simply Wall St

Automatic Data Processing (ADP) just wrapped up its Innovation Day with a spotlight on new artificial intelligence features for its Workforce Now, Global Payroll, and Lyric HCM platforms. These upgrades could catch the eye of investors who are weighing what comes next for ADP, given the ways AI is reshaping day-to-day HR operations. The focus here was not just on flashy technology but on concrete improvements, such as catching payroll errors early and making compliance less of a headache for clients with complex needs.

This product reveal arrives following a year shaped by ongoing innovation and steady financial execution from ADP. The stock is up about 11% over the past twelve months, continuing a trend of solid long-term gains. While there has been a dip of about 5% in the past three months, the broader performance signals consistent momentum as ADP continues expanding its digital capabilities. Notably, these tech investments come at a time when efficiency and labor management are pressing topics across industries.

With the stock showing durable growth but experiencing a recent pullback, the question remains whether these AI-driven moves are a catalyst for further upside, or if the market has already factored in these developments.

Most Popular Narrative: 14.9% Overvalued

According to WallStreetWontons, the most widely followed perspective is that ADP's current market price sits above its estimated fair value. The narrative signals room for future correction unless assumptions prove too conservative.

Fair value estimation is based on a forward revenue growth of 7.10%, current net profit margin of 19.56%, and forward P/E of 25.14. The total fair value is $131 billion for 5 years and $184.66 billion for 10 years.

Curious how this valuation lands at a premium? The narrative uses growth assumptions typically reserved for best-in-class providers and anchors profitability at levels not often seen in mature sectors. Ever wondered what blend of expansion, margins, and future multiples could propel this stock higher, or risk a slide if expectations miss? Dig into the full narrative to see which numbers shape this provocative call.

Result: Fair Value of $259.70 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, factors such as rising competition in HR tech and ADP's concentration in the US market could challenge assumptions behind today's overvaluation call.

Find out about the key risks to this Automatic Data Processing narrative.Another View: SWS DCF Model Sheds Different Light

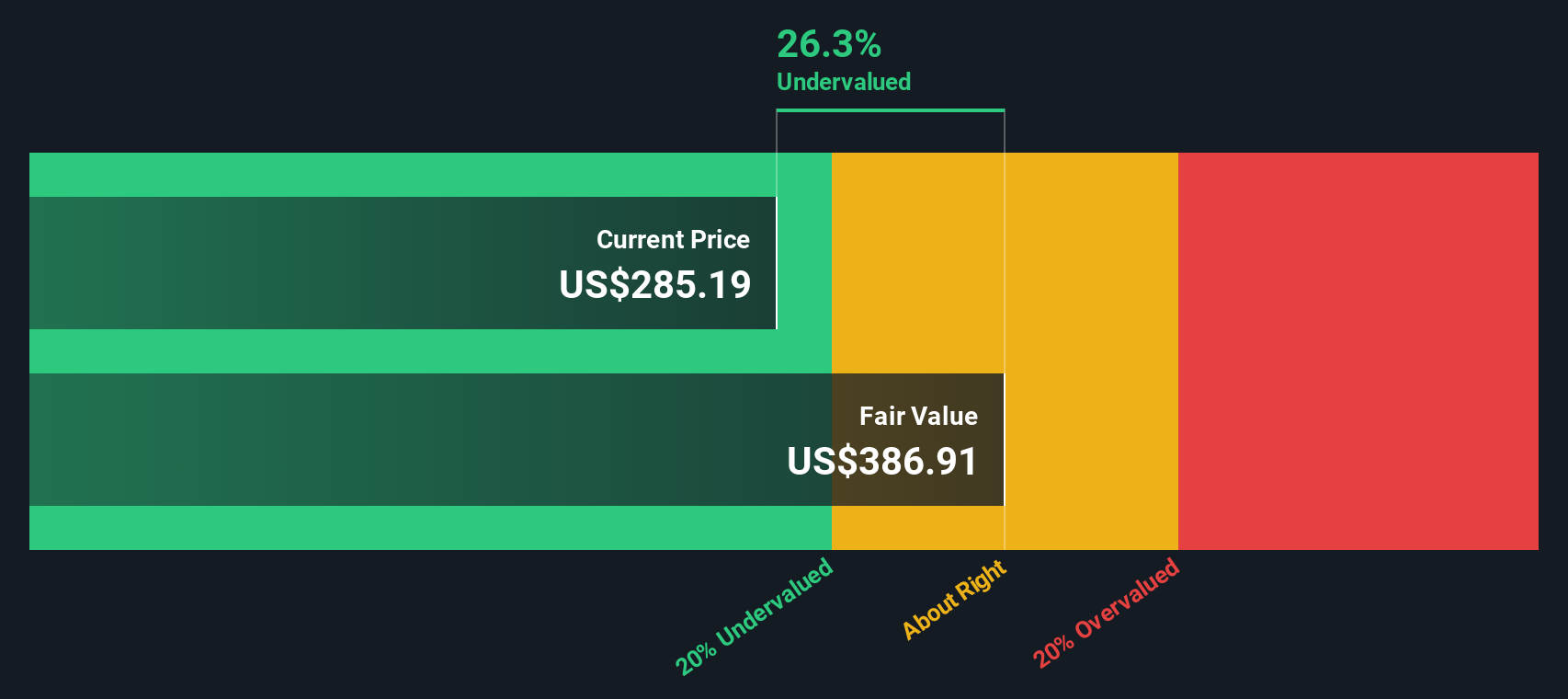

While some see ADP as trading above fair value, our DCF model paints a different picture. This model suggests the shares may actually be undervalued. Could this discrepancy signal opportunity, or does it reveal a risk others are missing?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Automatic Data Processing Narrative

If you see things differently or want to reach your own conclusions, you can create a custom analysis in just a few minutes. Do it your way

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding Automatic Data Processing.

Looking for More Investment Ideas?

Confidently expand your horizons with fresh stock opportunities beyond ADP. You could be missing out on powerful trends unless you check what else is out there. Here are three proven ways to spot tomorrow’s standouts before the crowd:

- Unearth bargain stocks that may be trading under their true worth when you check out undervalued stocks based on cash flows and see which companies have compelling cash flow potential.

- Kickstart your search for reliable income by scanning dividend stocks with yields > 3% for companies paying attractive dividends above 3% that can boost your returns even in uncertain markets.

- Ride the wave of innovation in medicine by seeing what is ahead with healthcare AI stocks, where healthcare and AI combine for potentially explosive growth prospects.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Kshitija Bhandaru

Kshitija (or Keisha) Bhandaru is an Equity Analyst at Simply Wall St and has over 6 years of experience in the finance industry and describes herself as a lifelong learner driven by her intellectual curiosity. She previously worked with Market Realist for 5 years as an Equity Analyst.

About NasdaqGS:ADP

Automatic Data Processing

Provides cloud-based human capital management (HCM) solutions worldwide.

Excellent balance sheet established dividend payer.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Unicycive Therapeutics (Nasdaq: UNCY) – Preparing for a Second Shot at Bringing a New Kidney Treatment to Market (TEST)

Rocket Lab USA Will Ignite a 30% Revenue Growth Journey

Dollar general to grow

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026