- United States

- /

- Pharma

- /

- NasdaqCM:CORT

Top Growth Companies With Significant Insider Ownership

Reviewed by Simply Wall St

As the U.S. stock market grapples with heightened volatility due to tariff concerns and recession fears, investors are increasingly seeking stability amidst uncertainty. In such an environment, growth companies with significant insider ownership can offer a unique appeal, as high insider stakes often indicate confidence in the company's long-term potential despite broader market turbulence.

Top 10 Growth Companies With High Insider Ownership In The United States

| Name | Insider Ownership | Earnings Growth |

| Atour Lifestyle Holdings (NasdaqGS:ATAT) | 26% | 25.6% |

| Duolingo (NasdaqGS:DUOL) | 14.4% | 37% |

| Hims & Hers Health (NYSE:HIMS) | 13.2% | 21.9% |

| Corcept Therapeutics (NasdaqCM:CORT) | 11.7% | 36.7% |

| Astera Labs (NasdaqGS:ALAB) | 15.9% | 61.1% |

| Kingstone Companies (NasdaqCM:KINS) | 17.9% | 24.2% |

| BBB Foods (NYSE:TBBB) | 16.5% | 41.1% |

| Clene (NasdaqCM:CLNN) | 20.7% | 59.1% |

| Upstart Holdings (NasdaqGS:UPST) | 12.7% | 100.1% |

| Credit Acceptance (NasdaqGS:CACC) | 14.4% | 33.6% |

Let's dive into some prime choices out of the screener.

Corcept Therapeutics (NasdaqCM:CORT)

Simply Wall St Growth Rating: ★★★★★★

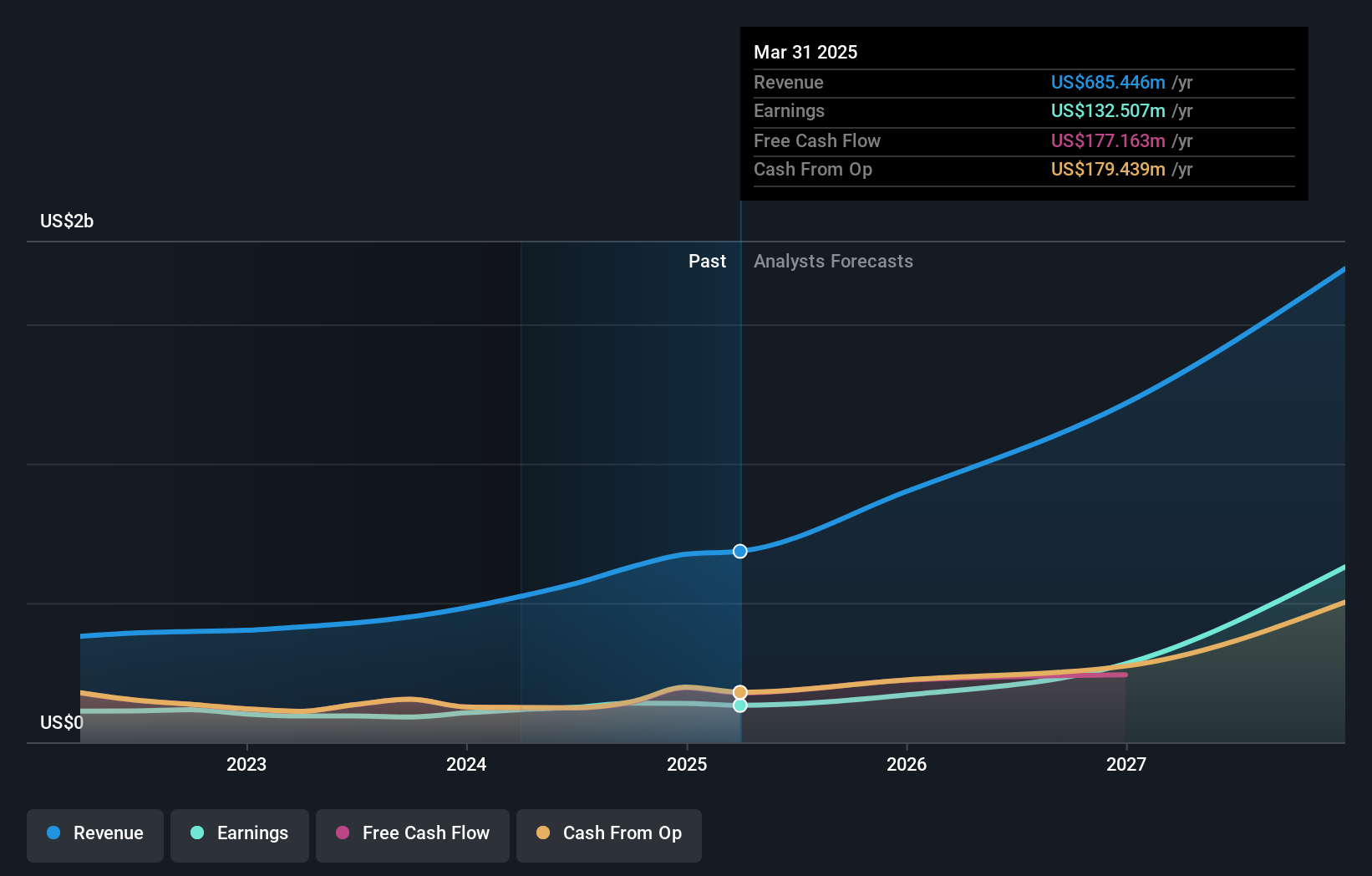

Overview: Corcept Therapeutics Incorporated focuses on discovering and developing medications for severe endocrinologic, oncologic, metabolic, and neurologic disorders in the United States, with a market cap of approximately $5.95 billion.

Operations: The company's revenue primarily comes from the discovery, development, and commercialization of pharmaceutical products, amounting to $675.04 million.

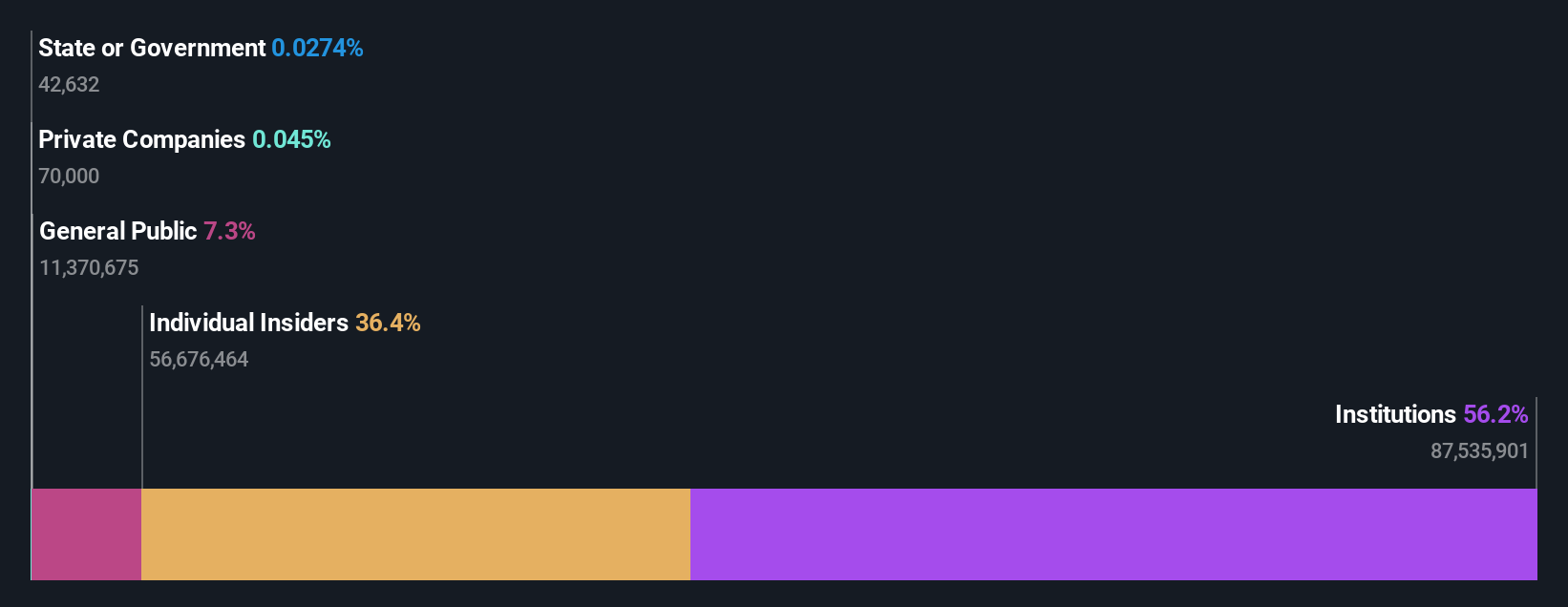

Insider Ownership: 11.7%

Corcept Therapeutics, a growth-focused company with significant insider ownership, is poised for substantial revenue and earnings expansion, outpacing the broader US market. The company's proprietary cortisol modulator, relacorilant, has shown promising results in treating hypercortisolism without major adverse effects. Recent FDA filings and clinical trials like MOMENTUM underscore its potential in addressing unmet medical needs. Despite no recent insider trading activity, Corcept's strategic initiatives and robust financial performance signal strong growth prospects.

- Unlock comprehensive insights into our analysis of Corcept Therapeutics stock in this growth report.

- Our expertly prepared valuation report Corcept Therapeutics implies its share price may be too high.

Zscaler (NasdaqGS:ZS)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Zscaler, Inc. is a global cloud security company with a market cap of approximately $32.03 billion.

Operations: Zscaler generates revenue primarily through sales of subscription services to its cloud platform and related support services, totaling $2.42 billion.

Insider Ownership: 37.2%

Zscaler, a growth-focused company with substantial insider ownership, is expected to achieve profitability within three years. Recent earnings show sales of US$647.9 million for the second quarter, a significant increase from the previous year. The company trades below its estimated fair value and analysts project a 21% stock price rise. With strategic executive appointments and ongoing innovation in AI and zero-trust security solutions, Zscaler is positioned for continued revenue growth above market averages.

- Get an in-depth perspective on Zscaler's performance by reading our analyst estimates report here.

- According our valuation report, there's an indication that Zscaler's share price might be on the cheaper side.

KULR Technology Group (NYSEAM:KULR)

Simply Wall St Growth Rating: ★★★★★☆

Overview: KULR Technology Group, Inc., operating through its subsidiary KULR Technology Corporation, focuses on developing and commercializing thermal management technologies for electronics and batteries in the United States, with a market cap of $263.34 million.

Operations: The company's revenue segment includes Superconductor Products & Systems, generating $9.70 million.

Insider Ownership: 17.3%

KULR Technology Group is advancing its position in the U.S. market through strategic partnerships, such as with Worksport Ltd., focusing on battery technology and domestic manufacturing. This collaboration aims to enhance battery safety and performance using KULR's thermal management technologies, aligning with increasing demand for American-made energy solutions. Despite recent shareholder dilution and a volatile share price, KULR's revenue is forecasted to grow significantly above market averages, driven by innovation in AI-integrated systems and nuclear applications.

- Dive into the specifics of KULR Technology Group here with our thorough growth forecast report.

- In light of our recent valuation report, it seems possible that KULR Technology Group is trading behind its estimated value.

Seize The Opportunity

- Access the full spectrum of 205 Fast Growing US Companies With High Insider Ownership by clicking on this link.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:CORT

Corcept Therapeutics

Engages in discovery and development of medication for the treatment of severe endocrinologic, oncologic, metabolic, and neurologic disorders in the United States.

Exceptional growth potential with flawless balance sheet.

Market Insights

Community Narratives