- United States

- /

- Consumer Durables

- /

- NasdaqGS:LGIH

3 Growth Companies Insiders Are Betting On

Reviewed by Simply Wall St

As the U.S. stock market shows signs of recovery with major indexes like the S&P 500 and Nasdaq advancing, investor attention is keenly focused on tech giants and their earnings reports, such as Nvidia's, which could have significant implications for AI-related trades. In this environment of fluctuating valuations and economic uncertainties, companies with strong growth potential and high insider ownership often attract interest due to the confidence insiders demonstrate by holding substantial stakes in their own firms.

Top 10 Growth Companies With High Insider Ownership In The United States

| Name | Insider Ownership | Earnings Growth |

| Super Micro Computer (SMCI) | 13.9% | 50.7% |

| StubHub Holdings (STUB) | 21.9% | 73.4% |

| SES AI (SES) | 12% | 68.9% |

| Prairie Operating (PROP) | 26.3% | 204.4% |

| Niu Technologies (NIU) | 37.2% | 93.7% |

| FTC Solar (FTCI) | 23% | 78.8% |

| Credo Technology Group Holding (CRDO) | 10.9% | 30.4% |

| Atour Lifestyle Holdings (ATAT) | 18.1% | 24.2% |

| Astera Labs (ALAB) | 12.5% | 27.1% |

| AppLovin (APP) | 27.5% | 26.6% |

Let's review some notable picks from our screened stocks.

LGI Homes (LGIH)

Simply Wall St Growth Rating: ★★★★☆☆

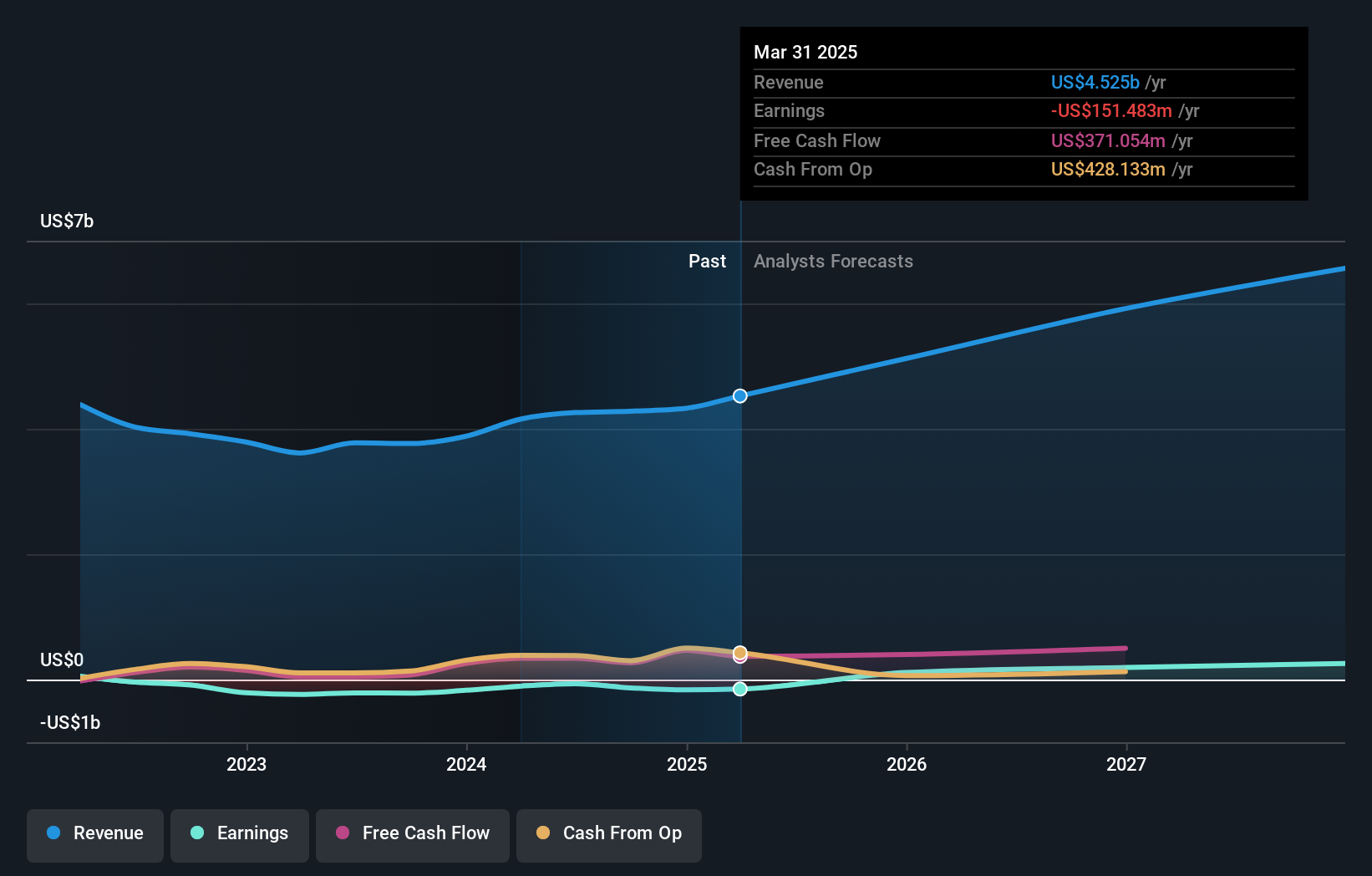

Overview: LGI Homes, Inc. is a company involved in the design, construction, and sale of homes across the United States with a market capitalization of approximately $1.05 billion.

Operations: The company generates revenue primarily through its homebuilding business, which reported $1.79 billion in sales.

Insider Ownership: 12.3%

Earnings Growth Forecast: 28.5% p.a.

LGI Homes, a growth-oriented company with substantial insider ownership, is expanding its footprint through strategic community launches like Orchard Park in California. Despite recent earnings declines, with net income at US$19.7 million for Q3 2025 compared to US$69.58 million a year ago, LGI's revenue is forecasted to grow faster than the broader U.S. market at 17.5% annually. The company's P/E ratio of 9.9x suggests potential value relative to the market average of 17.9x.

- Take a closer look at LGI Homes' potential here in our earnings growth report.

- According our valuation report, there's an indication that LGI Homes' share price might be on the expensive side.

Upstart Holdings (UPST)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Upstart Holdings, Inc. operates a cloud-based AI lending platform in the United States and has a market cap of approximately $3.51 billion.

Operations: The company's revenue primarily comes from its personal lending segment, which generated $868.82 million.

Insider Ownership: 12.6%

Earnings Growth Forecast: 68.4% p.a.

Upstart Holdings, with substantial insider ownership, is demonstrating robust growth potential. Recent partnerships with financial institutions like Pathward Financial and Peak Credit Union highlight its expanding lending marketplace. Upstart's Q3 2025 revenue surged to US$277.11 million from US$162.14 million a year ago, turning a net income of US$31.81 million from a loss previously reported. Forecasts predict earnings growth significantly above the market average, supported by strong insider buying and trading below estimated fair value by 13.1%.

- Delve into the full analysis future growth report here for a deeper understanding of Upstart Holdings.

- Our expertly prepared valuation report Upstart Holdings implies its share price may be too high.

Tutor Perini (TPC)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Tutor Perini Corporation is a construction company offering general contracting, construction management, and design-build services to private and public clients globally, with a market cap of approximately $3.10 billion.

Operations: The company's revenue is derived from three main segments: Civil (Including Management Services) at $2.86 billion, Building (Including Management Services) at $1.77 billion, and Specialty Contractors at $742.35 million.

Insider Ownership: 14.4%

Earnings Growth Forecast: 95.9% p.a.

Tutor Perini, with significant insider ownership, is poised for growth as it forecasts profitability within three years and revenue expansion at 13.2% annually. Despite recent substantial insider selling, the stock trades at a 24% discount to its estimated fair value. Recent earnings reports show a positive turnaround with Q3 sales reaching US$1.42 billion and net income of US$3.63 million from a previous loss, supported by new project wins like the Guam Defense System contract valued at approximately $181.8 million.

- Navigate through the intricacies of Tutor Perini with our comprehensive analyst estimates report here.

- The valuation report we've compiled suggests that Tutor Perini's current price could be quite moderate.

Key Takeaways

- Explore the 194 names from our Fast Growing US Companies With High Insider Ownership screener here.

- Interested In Other Possibilities? Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:LGIH

LGI Homes

Engages in the design, construction, and sale of homes in the United States.

Reasonable growth potential and slightly overvalued.

Similar Companies

Market Insights

Community Narratives