- United States

- /

- Electrical

- /

- NYSE:STEM

Stem (NYSE:STEM) delivers shareholders stellar 223% return over 1 year, surging 17% in the last week alone

Unless you borrow money to invest, the potential losses are limited. But when you pick a company that is really flourishing, you can make more than 100%. For example, the Stem, Inc. (NYSE:STEM) share price has soared 223% in the last 1 year. Most would be very happy with that, especially in just one year! On top of that, the share price is up 48% in about a quarter. In contrast, the longer term returns are negative, since the share price is 90% lower than it was three years ago.

On the back of a solid 7-day performance, let's check what role the company's fundamentals have played in driving long term shareholder returns.

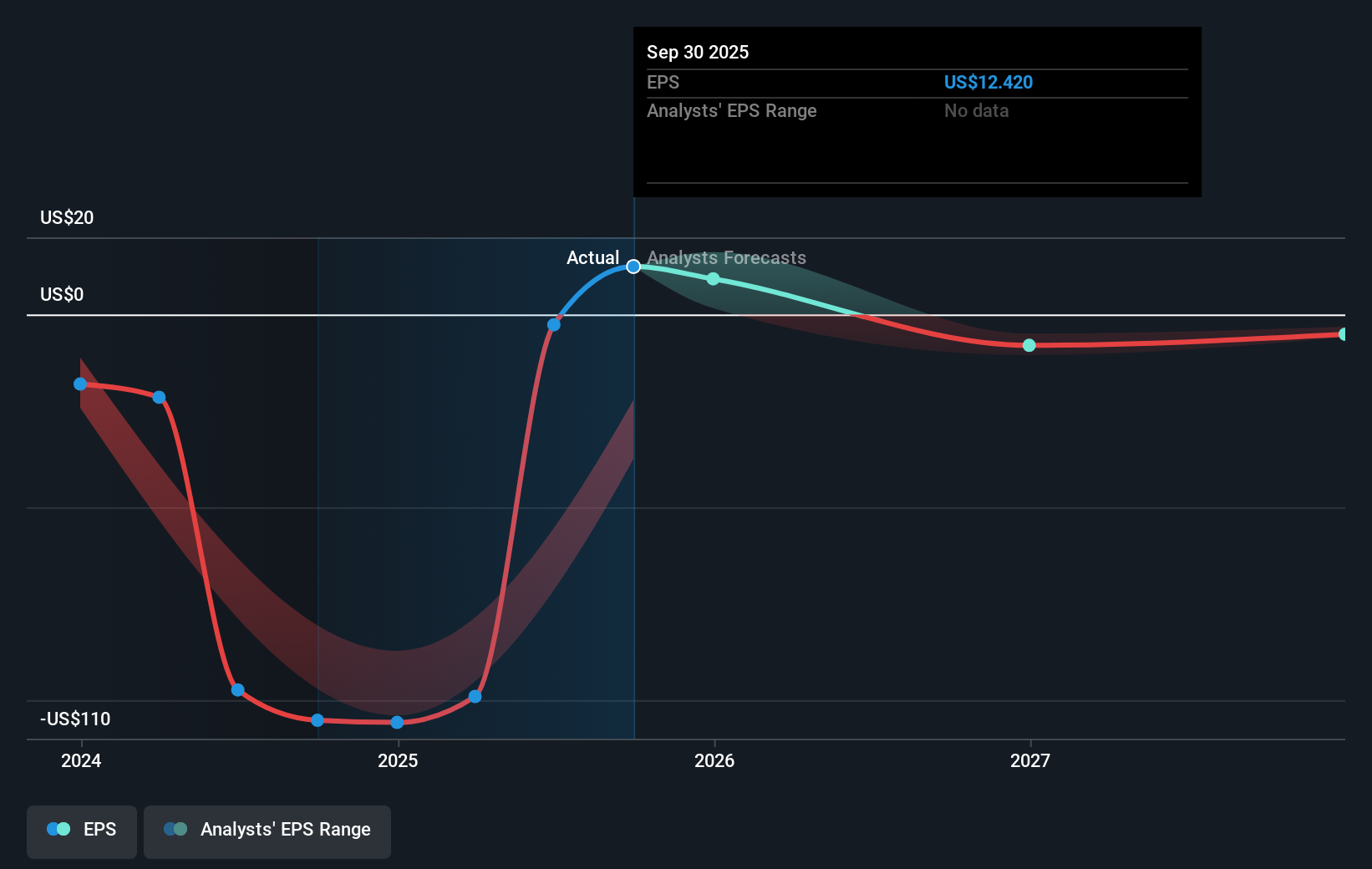

To quote Buffett, 'Ships will sail around the world but the Flat Earth Society will flourish. There will continue to be wide discrepancies between price and value in the marketplace...' One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

During the last year Stem grew its earnings per share, moving from a loss to a profit.

The result looks like a strong improvement to us, so we're not surprised the market likes the growth. Inflection points like this can be a great time to take a closer look at a company.

The image below shows how EPS has tracked over time (if you click on the image you can see greater detail).

We know that Stem has improved its bottom line lately, but is it going to grow revenue? This free report showing analyst revenue forecasts should help you figure out if the EPS growth can be sustained.

A Different Perspective

It's nice to see that Stem shareholders have received a total shareholder return of 223% over the last year. Notably the five-year annualised TSR loss of 14% per year compares very unfavourably with the recent share price performance. We generally put more weight on the long term performance over the short term, but the recent improvement could hint at a (positive) inflection point within the business. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. For instance, we've identified 6 warning signs for Stem (5 don't sit too well with us) that you should be aware of.

For those who like to find winning investments this free list of undervalued companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on American exchanges.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:STEM

Stem

Provides artificial intelligence driven software and services that enable its customers to plan, deploy, and operate clean energy assets in the United States and internationally.

Medium-low risk and fair value.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Unicycive Therapeutics (Nasdaq: UNCY) – Preparing for a Second Shot at Bringing a New Kidney Treatment to Market (TEST)

Rocket Lab USA Will Ignite a 30% Revenue Growth Journey

Dollar general to grow

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Trending Discussion