- United States

- /

- Machinery

- /

- NYSE:PLOW

OceanFirst Financial And 2 Dividend Stocks To Enhance Your Portfolio

Reviewed by Simply Wall St

As the U.S. stock market reaches new heights, with the S&P 500 closing at a record high amid anticipation of potential interest rate cuts, investors are increasingly focused on strategies to enhance their portfolios in a dynamic economic environment. In such conditions, dividend stocks can offer stability and income potential, making them an attractive option for those looking to bolster their investment strategies amidst market fluctuations.

Top 10 Dividend Stocks In The United States

| Name | Dividend Yield | Dividend Rating |

| Peoples Bancorp (PEBO) | 5.26% | ★★★★★☆ |

| Huntington Bancshares (HBAN) | 3.47% | ★★★★★☆ |

| First Interstate BancSystem (FIBK) | 5.73% | ★★★★★★ |

| Ennis (EBF) | 5.37% | ★★★★★★ |

| Douglas Dynamics (PLOW) | 3.52% | ★★★★★☆ |

| Dillard's (DDS) | 4.55% | ★★★★★★ |

| DHT Holdings (DHT) | 7.74% | ★★★★★☆ |

| Columbia Banking System (COLB) | 5.38% | ★★★★★★ |

| Citizens & Northern (CZNC) | 5.48% | ★★★★★☆ |

| Archer-Daniels-Midland (ADM) | 3.29% | ★★★★★☆ |

Click here to see the full list of 120 stocks from our Top US Dividend Stocks screener.

Let's review some notable picks from our screened stocks.

OceanFirst Financial (OCFC)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: OceanFirst Financial Corp. operates as the bank holding company for OceanFirst Bank N.A., with a market cap of $1.04 billion.

Operations: OceanFirst Financial Corp. generates revenue primarily through its Community Banking Services segment, which accounts for $376.08 million.

Dividend Yield: 4.3%

OceanFirst Financial offers a stable dividend, yielding 4.28%, although it falls short of the top 25% in the US market. The company's dividends have shown consistent growth over the past decade, supported by a reasonable payout ratio of 56.8%. Recent earnings reveal a decline in net income despite an increase in net interest income, and OceanFirst has completed significant share buybacks totaling $45.22 million, potentially enhancing shareholder value amidst these financial challenges.

- Get an in-depth perspective on OceanFirst Financial's performance by reading our dividend report here.

- According our valuation report, there's an indication that OceanFirst Financial's share price might be on the expensive side.

Douglas Dynamics (PLOW)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Douglas Dynamics, Inc. is a North American manufacturer and upfitter of commercial work truck attachments and equipment, with a market cap of $754.36 million.

Operations: Douglas Dynamics generates revenue through its Work Truck Solutions segment, which accounts for $323.74 million, and its Work Truck Attachments segment, contributing $258.60 million.

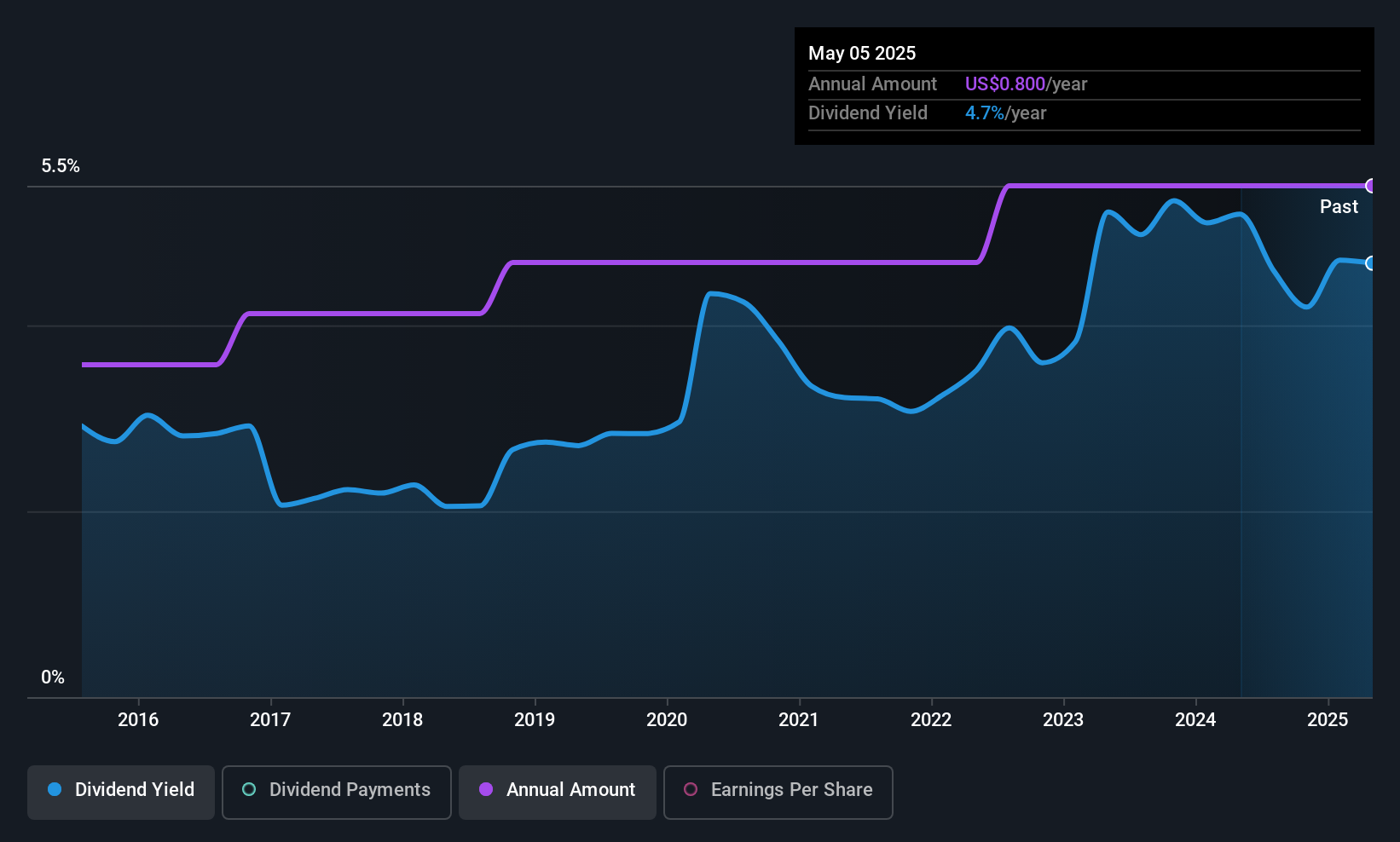

Dividend Yield: 3.5%

Douglas Dynamics maintains a reliable dividend yield of 3.52%, though it trails the top US payers. The dividend is well-supported by earnings, with a payout ratio of 42%, and cash flows at 72.8%. Recent earnings showed net income growth despite slightly lower sales, and the company has completed share buybacks worth $12 million. However, future earnings are expected to decline, posing potential challenges for sustaining its dividend growth trajectory.

- Delve into the full analysis dividend report here for a deeper understanding of Douglas Dynamics.

- The valuation report we've compiled suggests that Douglas Dynamics' current price could be quite moderate.

Southern Copper (SCCO)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Southern Copper Corporation is involved in the mining, exploration, smelting, and refining of copper and other minerals across Peru, Mexico, Argentina, Ecuador, and Chile with a market cap of $81.97 billion.

Operations: Southern Copper Corporation's revenue segments include Mexican Open-Pit operations generating $6.62 billion, Peruvian Operations contributing $4.77 billion, and the Mexican Industrial Minera Mexico and Subsidiaries (IMMSA) Unit adding $707.20 million.

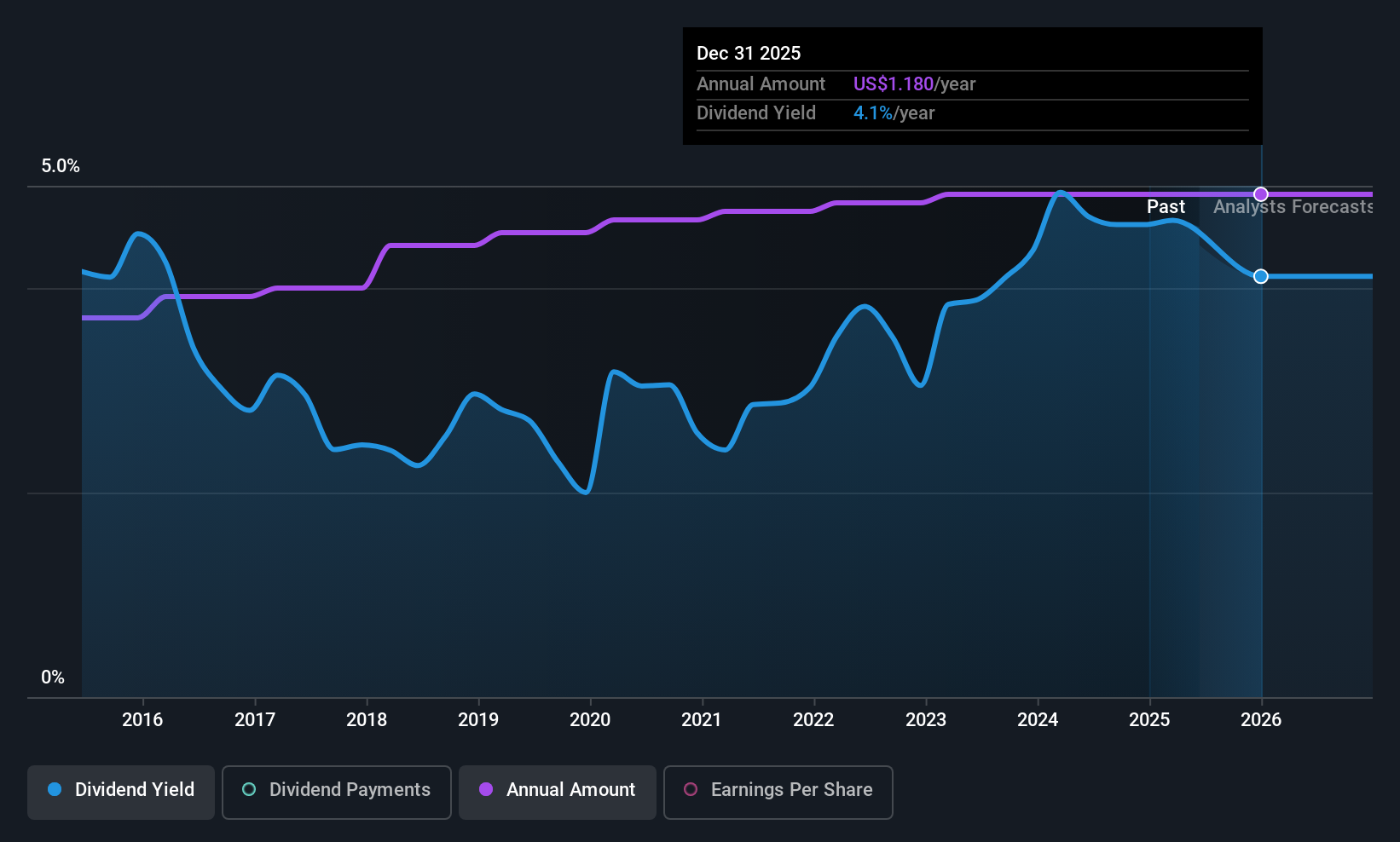

Dividend Yield: 3.1%

Southern Copper's dividend payments are covered by earnings (payout ratio: 58.5%) and cash flows (cash payout ratio: 74.3%), though they have been volatile over the past decade. The recent quarterly dividend of $0.80 per share reflects an increase, indicating a focus on returning value to shareholders despite a lower yield of 3.14% compared to top US payers. Earnings grew significantly last year, supporting its inclusion in value indices after being dropped from growth benchmarks.

- Unlock comprehensive insights into our analysis of Southern Copper stock in this dividend report.

- Insights from our recent valuation report point to the potential overvaluation of Southern Copper shares in the market.

Seize The Opportunity

- Get an in-depth perspective on all 120 Top US Dividend Stocks by using our screener here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:PLOW

Douglas Dynamics

Operates as a manufacturer and upfitter of commercial work truck attachments and equipment in North America.

Solid track record with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives