- United States

- /

- Construction

- /

- NYSE:ORN

3 Undervalued Small Caps In US With Insider Action

Reviewed by Simply Wall St

The United States market has experienced a notable upswing, rising 3.9% in the past week and achieving a 33% increase over the last year, with earnings projected to grow by 16% annually. In this dynamic environment, identifying stocks that may be undervalued can present opportunities for investors seeking potential growth aligned with insider activity.

Top 10 Undervalued Small Caps With Insider Buying In The United States

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Civista Bancshares | 11.9x | 2.5x | 32.99% | ★★★★★☆ |

| Thryv Holdings | NA | 0.7x | 49.31% | ★★★★★☆ |

| Hanover Bancorp | 11.4x | 2.3x | 42.57% | ★★★★☆☆ |

| Franklin Financial Services | 10.2x | 2.0x | 32.54% | ★★★★☆☆ |

| HighPeak Energy | 10.9x | 1.6x | 35.35% | ★★★★☆☆ |

| USCB Financial Holdings | 19.6x | 5.6x | 44.80% | ★★★☆☆☆ |

| First United | 14.0x | 3.2x | 45.60% | ★★★☆☆☆ |

| Orion Group Holdings | NA | 0.4x | -223.95% | ★★★☆☆☆ |

| Community West Bancshares | 18.7x | 2.9x | 42.25% | ★★★☆☆☆ |

| Delek US Holdings | NA | 0.1x | -66.88% | ★★★☆☆☆ |

Let's take a closer look at a couple of our picks from the screened companies.

Domo (NasdaqGM:DOMO)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Domo is a software company specializing in business intelligence and data visualization solutions, with a market cap of approximately $0.35 billion.

Operations: The company generates revenue primarily from its Software & Programming segment, with the latest reported figure at $318.37 million. Key expenses include cost of goods sold (COGS) at $78.65 million and operating expenses totaling $302.98 million, which encompass sales & marketing, research & development, and general & administrative costs. The gross profit margin has shown an upward trend reaching 76.56% in recent periods, indicating effective management of production costs relative to revenue growth.

PE: -4.3x

Domo, a small company in the United States, has been making strategic moves despite financial challenges. With recent leadership changes and partnerships like Bond Vet and Secil, Domo is enhancing its data technology platform's reach. The company's revenue for Q2 2024 was US$78 million with a net loss of US$19 million. Although unprofitable, insider confidence is evident with purchases over the past year. These initiatives could position Domo for future growth amidst its current funding risks.

- Navigate through the intricacies of Domo with our comprehensive valuation report here.

Gain insights into Domo's past trends and performance with our Past report.

Old Second Bancorp (NasdaqGS:OSBC)

Simply Wall St Value Rating: ★★★★★☆

Overview: Old Second Bancorp operates as a community banking institution with a market cap of $0.93 billion, primarily focusing on providing financial services within its local communities.

Operations: The company generates revenue primarily from community banking, with recent figures showing $264.07 million in revenue. Operating expenses have consistently been a significant cost factor, reaching $147.21 million in the latest period. The net income margin has shown variability, recently recorded at 31.95%.

PE: 9.9x

Old Second Bancorp, a smaller financial entity, is currently exploring avenues for inorganic growth to sustain returns on tangible common equity. Despite a slight dip in earnings, with net income at US$22.95 million for Q3 2024 compared to US$24.34 million the previous year, insider confidence remains evident as they continue strategic maneuvers like dividend increases. Though earnings are projected to decline slightly over the next few years, their proactive approach suggests potential resilience and adaptability in the evolving market landscape.

Orion Group Holdings (NYSE:ORN)

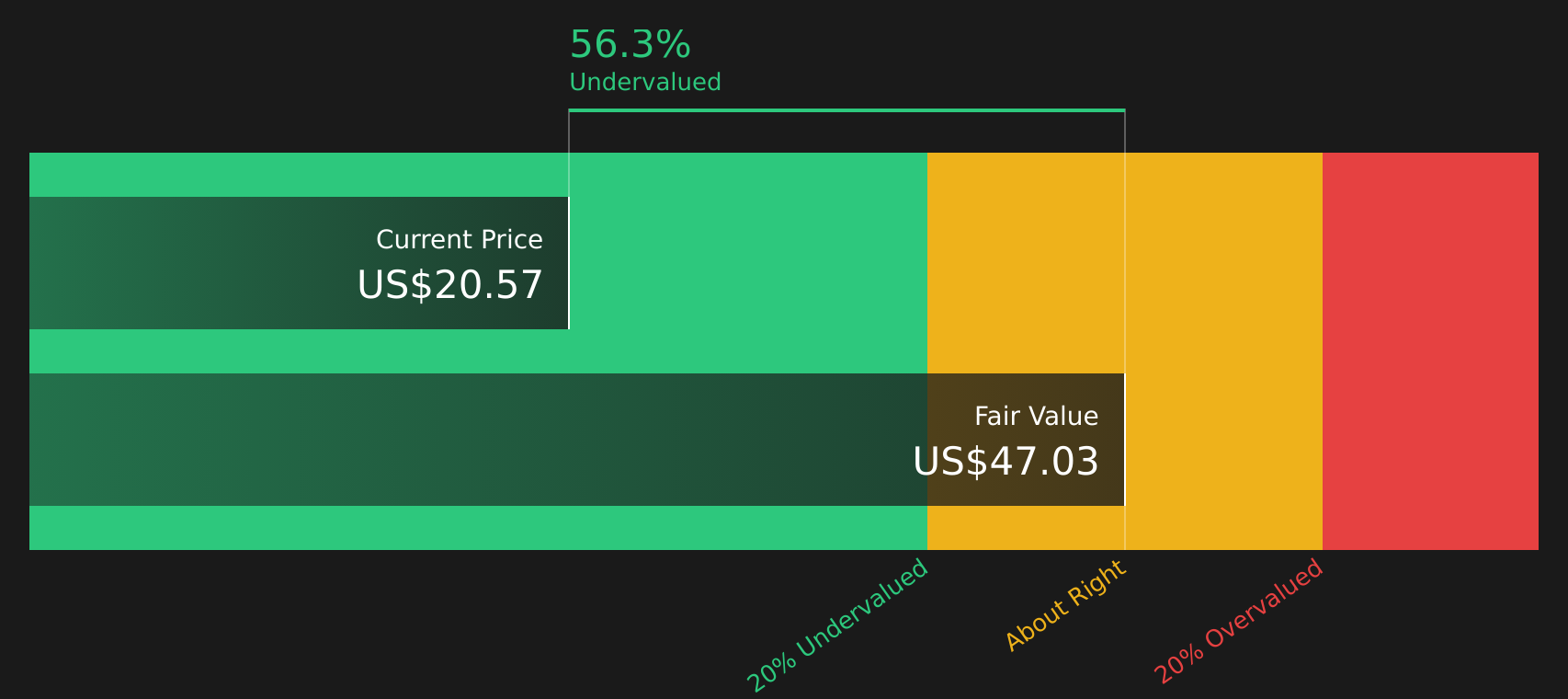

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Orion Group Holdings is a construction company specializing in marine and concrete services, with a market cap of approximately $0.11 billion.

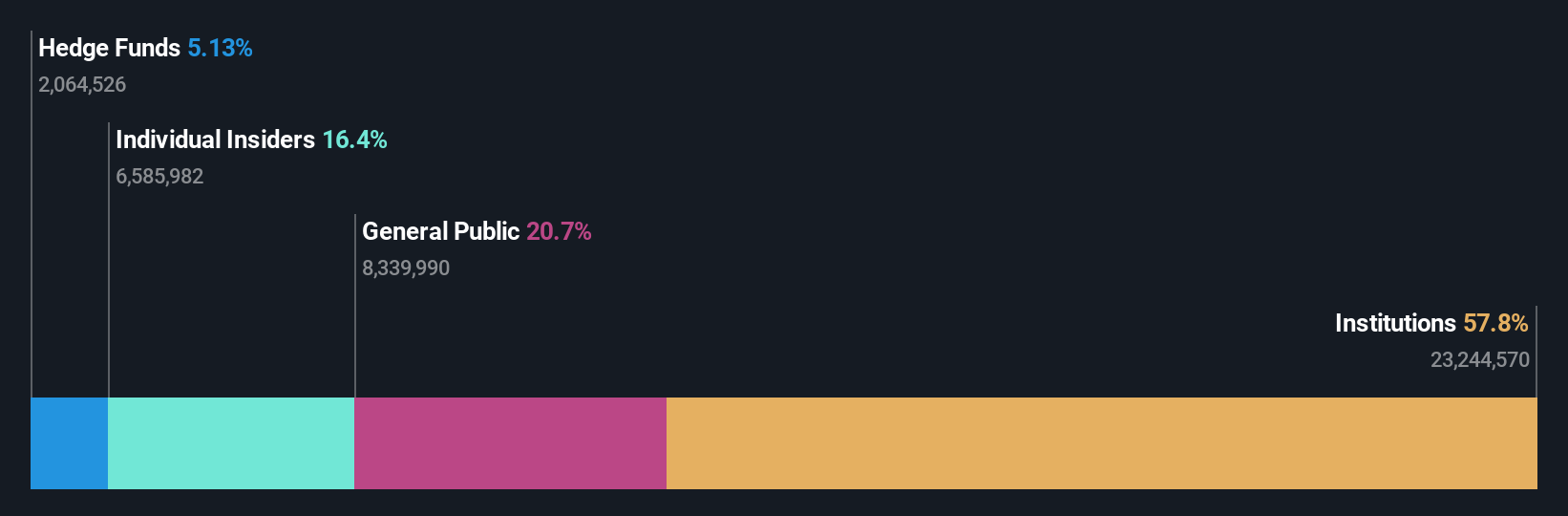

Operations: Orion Group Holdings generates revenue primarily from its Marine and Concrete segments, with recent figures showing a gross profit margin of 10.73%. The company has experienced fluctuations in net income, with the latest data indicating a net loss of $12.76 million for the period ending September 30, 2024. Operating expenses have consistently been significant, impacting overall profitability.

PE: -25.2x

Orion Group Holdings, a smaller company with potential for growth, has seen insider confidence through recent share purchases. Over the past year, they reported a notable improvement in financial performance, with Q3 sales jumping to US$226.68 million from US$168.48 million the previous year and net income reaching US$4.26 million compared to a loss before. Despite relying on higher-risk funding sources, earnings are projected to grow significantly by 124% annually, suggesting future opportunities amidst current challenges.

Where To Now?

- Unlock more gems! Our Undervalued US Small Caps With Insider Buying screener has unearthed 36 more companies for you to explore.Click here to unveil our expertly curated list of 39 Undervalued US Small Caps With Insider Buying.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ORN

Orion Group Holdings

Operates as a specialty construction company in the building, industrial, and infrastructure sectors in the United States, Alaska, Hawaii, Canada, and the Caribbean Basin.

Flawless balance sheet and fair value.