- United States

- /

- Trade Distributors

- /

- NYSE:NPKI

Undervalued Small Caps With Insider Activity In Global Markets For June 2025

Reviewed by Simply Wall St

Over the last 7 days, the United States market has remained flat, yet it has shown a robust increase of 11% over the past year with anticipated earnings growth of 14% per annum in the coming years. In this context, identifying small-cap stocks with significant insider activity can be promising as they may offer unique opportunities for investors looking to capitalize on potential value within global markets.

Top 10 Undervalued Small Caps With Insider Buying In The United States

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Lindblad Expeditions Holdings | NA | 0.9x | 32.59% | ★★★★★★ |

| Columbus McKinnon | NA | 0.4x | 39.32% | ★★★★★☆ |

| Industrial Logistics Properties Trust | NA | 0.7x | 34.78% | ★★★★★☆ |

| S&T Bancorp | 10.3x | 3.6x | 45.38% | ★★★★☆☆ |

| Myomo | NA | 2.6x | 35.37% | ★★★★☆☆ |

| Vital Energy | NA | 0.4x | 6.36% | ★★★★☆☆ |

| MVB Financial | 13.9x | 1.8x | 34.93% | ★★★☆☆☆ |

| Cracker Barrel Old Country Store | 21.9x | 0.4x | -671.58% | ★★★☆☆☆ |

| BlueLinx Holdings | 14.3x | 0.2x | -78.75% | ★★★☆☆☆ |

| Titan Machinery | NA | 0.2x | -364.79% | ★★★☆☆☆ |

Underneath we present a selection of stocks filtered out by our screen.

CPI Card Group (PMTS)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: CPI Card Group is a payment technology company specializing in the production and personalization of financial payment cards, with operations focused on prepaid debit and debit and credit card segments, and it has a market capitalization of approximately $0.29 billion.

Operations: CPI Card Group's revenue streams primarily consist of Prepaid Debit and Debit and Credit segments, generating $109.06 million and $383.81 million respectively. The company's gross profit margin has shown fluctuations, reaching 41.33% at its peak in June 2021 before declining to 37.09% by March 2025. Operating expenses are a significant cost factor, with general and administrative expenses consistently being the largest component within operating costs across the periods analyzed.

PE: 13.8x

CPI Card Group, a small company in the payment solutions industry, has recently reported Q1 2025 revenue of US$122.76 million, up from US$111.94 million the previous year. However, net income dipped slightly to US$4.77 million from US$5.46 million. The company affirmed its guidance for mid-to-high single-digit organic growth in net sales for 2025, indicating potential future value despite current challenges like negative shareholders' equity and reliance on external borrowing for funding. Notably, insider confidence is evident with recent share purchases by insiders earlier this year.

- Click here and access our complete valuation analysis report to understand the dynamics of CPI Card Group.

Evaluate CPI Card Group's historical performance by accessing our past performance report.

James River Group Holdings (JRVR)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: James River Group Holdings is an insurance holding company primarily engaged in providing specialty insurance services through its Excess and Surplus Lines and Specialty Admitted Insurance segments, with a market capitalization of approximately $0.95 billion.

Operations: The company's primary revenue streams are derived from Excess and Surplus Lines, contributing significantly to its total income. Over recent periods, the gross profit margin has shown variability, with a notable increase to 41.15% in early 2024 before declining again by mid-2025. Operating expenses have consistently been a significant portion of costs, impacting overall profitability.

PE: -2.4x

James River Group Holdings, a smaller player in the insurance sector, has shown insider confidence with a significant purchase of 100,000 shares by their CEO Frank D’Orazio for US$474,560. Despite facing revenue and net income declines in Q1 2025 compared to the previous year—US$172.29 million and US$9.57 million respectively—the company is poised for potential growth with earnings projected to rise by over 85% annually. Leadership changes aim to strengthen its Excess and Surplus Lines segment under Todd Sutherland's guidance.

NPK International (NPKI)

Simply Wall St Value Rating: ★★★☆☆☆

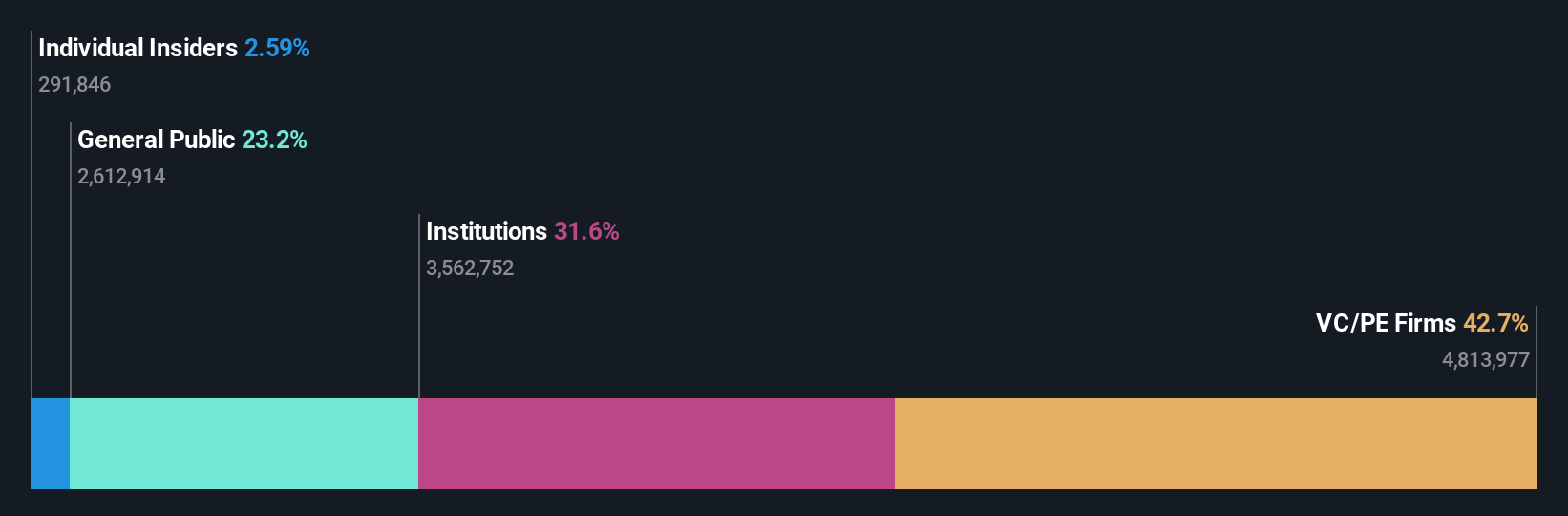

Overview: NPK International specializes in industrial solutions, excluding industrial blending, with a market capitalization of $2.45 billion.

Operations: NPKI generates revenue primarily from its Industrial Solutions segment, with the latest quarter showing a revenue of $233.30 million. The company's cost structure is heavily influenced by its cost of goods sold (COGS), which was $148.56 million in the same period, contributing to a gross profit margin of 36.32%. Operating expenses are another significant component, totaling $46.26 million for the quarter ending March 31, 2025, while non-operating expenses were -$3.44 million during this time frame.

PE: 17.6x

NPK International, a company with a focus on external borrowing for funding, recently showcased insider confidence through the purchase of 12,500 shares by an independent director for US$99,998. This activity aligns with their strategic financial moves, including significant share repurchases totaling over 2 million shares since February 2024. The company raised its full-year revenue guidance to US$240-252 million and reported Q1 sales growth from US$48.97 million to US$64.78 million year-over-year, reflecting potential growth opportunities in the market.

- Navigate through the intricacies of NPK International with our comprehensive valuation report here.

Assess NPK International's past performance with our detailed historical performance reports.

Make It Happen

- Click through to start exploring the rest of the 84 Undervalued US Small Caps With Insider Buying now.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if NPK International might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:NPKI

NPK International

A temporary worksite access solutions company, manufactures, sells, and rents recyclable composite matting products.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives