- United States

- /

- Electronic Equipment and Components

- /

- NasdaqGM:CLMB

Undiscovered Gems In The US Stock Market February 2025

Reviewed by Simply Wall St

Over the last 7 days, the United States market has risen by 1.5%, contributing to an impressive 22% increase over the past year, with earnings anticipated to grow by 15% annually in the coming years. In such a dynamic environment, identifying stocks that are not only poised for growth but also remain underappreciated can offer unique opportunities for investors seeking potential value in an evolving market landscape.

Top 10 Undiscovered Gems With Strong Fundamentals In The United States

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Omega Flex | NA | 0.39% | 2.57% | ★★★★★★ |

| Cashmere Valley Bank | 15.51% | 5.80% | 3.51% | ★★★★★★ |

| Oakworth Capital | 31.49% | 14.78% | 4.46% | ★★★★★★ |

| Parker Drilling | 46.05% | 0.86% | 52.25% | ★★★★★★ |

| ASA Gold and Precious Metals | NA | 7.47% | -26.86% | ★★★★★★ |

| Teekay | NA | -3.71% | 60.91% | ★★★★★★ |

| Metalpha Technology Holding | NA | 81.88% | -4.97% | ★★★★★★ |

| Pure Cycle | 5.15% | -2.61% | -6.23% | ★★★★★☆ |

| Reitar Logtech Holdings | 31.39% | 231.46% | 41.38% | ★★★★☆☆ |

Here's a peek at a few of the choices from the screener.

Climb Global Solutions (NasdaqGM:CLMB)

Simply Wall St Value Rating: ★★★★★☆

Overview: Climb Global Solutions Inc. is a value-added IT distribution and solutions company with operations in the United States, Canada, Europe, the United Kingdom, and internationally, and it has a market cap of approximately $579.32 million.

Operations: The company generates revenue primarily through its distribution segment, which accounts for $384.88 million, while the solutions segment contributes $25.75 million.

Climb Global Solutions, a company with a focus on growth through M&A and international expansion, has shown impressive earnings growth of 42% over the past year, outpacing the electronic industry’s -4.5%. Its debt to equity ratio is low at 1%, indicating prudent financial management. The company is profitable with positive free cash flow, reducing concerns about its cash runway. Recent executive changes include Matthew Sullivan as CFO and John McCarthy as Chairman of the Board. While analysts forecast a 14% annual revenue increase over three years, potential challenges in operational efficiencies and net margin contraction from 4% to 3.8% warrant cautious optimism for future prospects.

Himax Technologies (NasdaqGS:HIMX)

Simply Wall St Value Rating: ★★★★★☆

Overview: Himax Technologies, Inc. is a fabless semiconductor company specializing in display imaging processing technologies across various regions including China, Taiwan, the Philippines, Korea, Japan, Europe, and the United States with a market cap of approximately $1.90 billion.

Operations: Himax generates revenue primarily through the sale of display imaging processing technologies, with significant contributions from regions such as China, Taiwan, and the United States. The company focuses on optimizing its cost structure to enhance profitability. Notably, Himax's net profit margin has shown variability over recent periods.

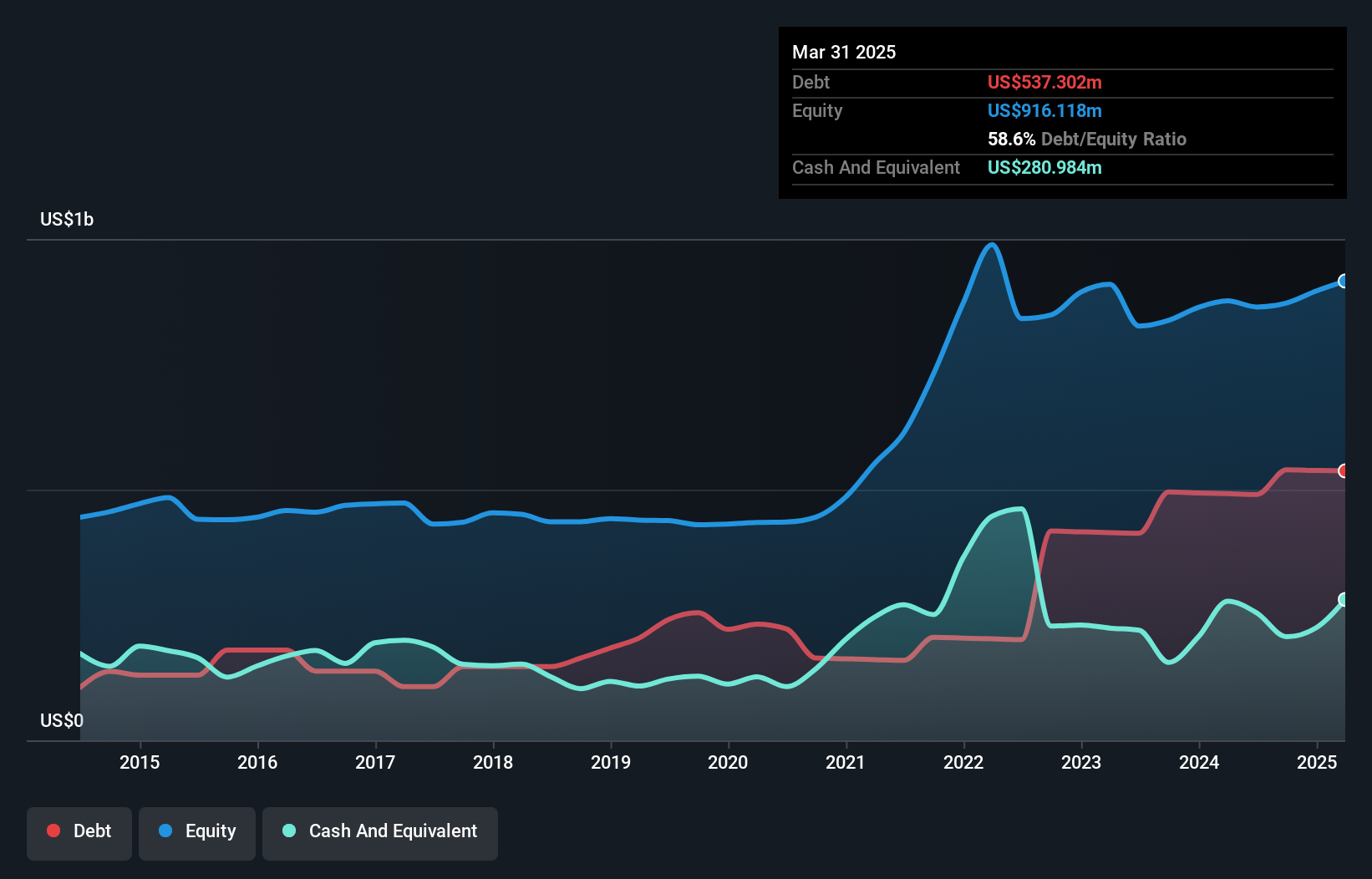

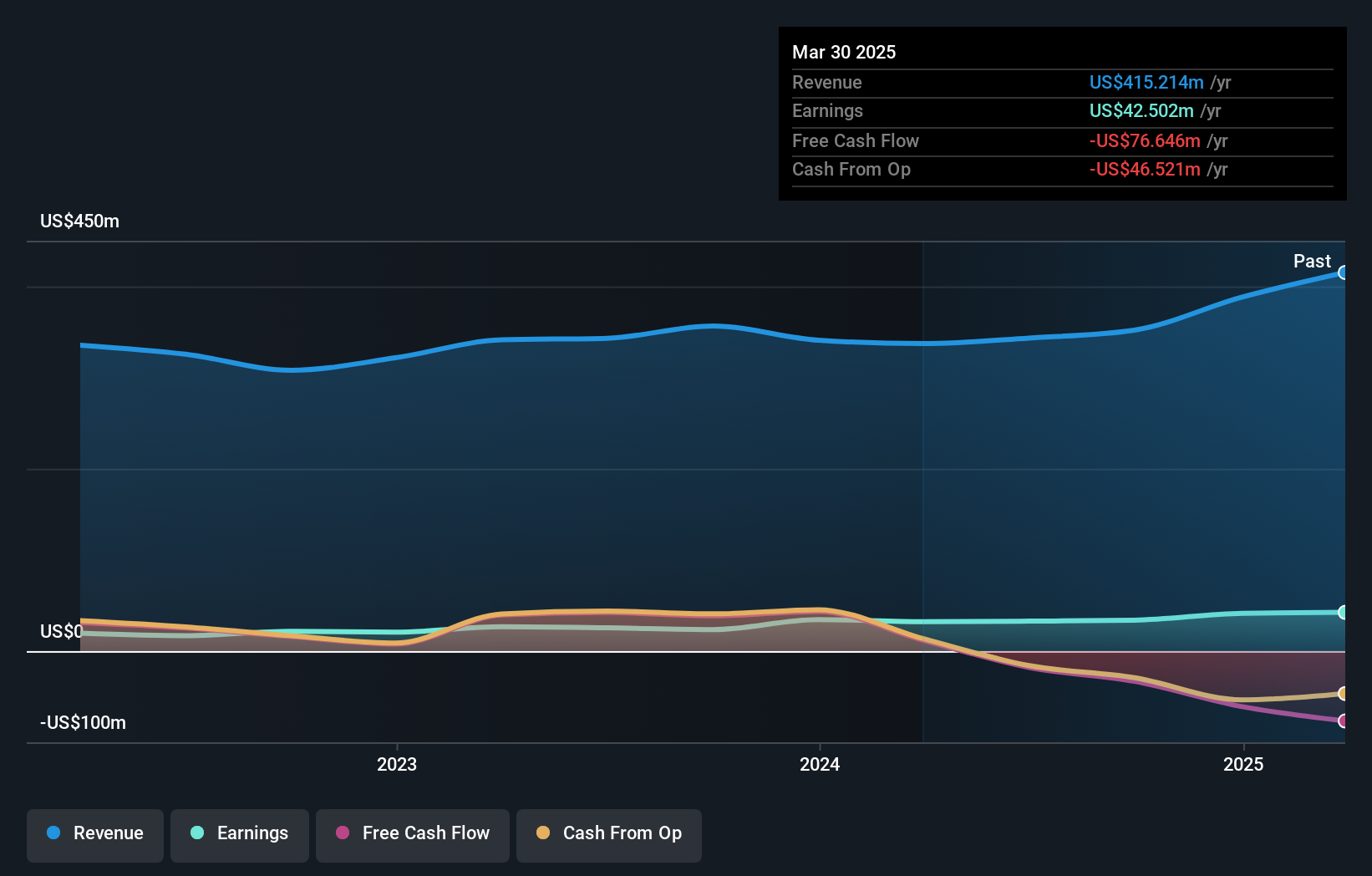

Himax Technologies, a fabless semiconductor player, is making waves with its innovative display imaging processing technologies. Its debt to equity ratio has risen from 51.3% to 60% over the past five years, yet it maintains a satisfactory net debt to equity ratio of 35%. The company's P/E ratio stands at 23.8x, undercutting the industry average of 32.2x, suggesting good relative value. Recent earnings growth of 57.6% outpaces the industry's -1.6%, positioning Himax for continued success as it leverages advancements in automotive displays and OLED technology to drive future revenue growth and expand market reach amidst competitive pressures.

National Presto Industries (NYSE:NPK)

Simply Wall St Value Rating: ★★★★★★

Overview: National Presto Industries, Inc. operates in North America, offering a range of housewares and small appliances, defense products, and safety solutions with a market capitalization of $705.63 million.

Operations: The company generates revenue primarily from its defense segment at $249.79 million, followed by housewares and small appliances at $100.84 million, and safety products contributing $1.33 million. The net profit margin shows a notable trend over recent periods, reflecting the company's ability to manage costs relative to its revenue streams effectively.

National Presto Industries, a small player in the Aerospace & Defense sector, showcases a robust financial profile with no debt over the last five years. Its earnings growth of 43.5% in the past year outpaced the industry average of 24.2%, indicating strong performance relative to peers. Despite this impressive growth, earnings have seen an 11.4% decrease annually over five years, suggesting some inconsistencies in longer-term performance. Trading at 13.3% below estimated fair value highlights potential undervaluation for investors seeking opportunities within this niche market segment while maintaining high-quality non-cash earnings further underscores its financial health.

Key Takeaways

- Click through to start exploring the rest of the 276 US Undiscovered Gems With Strong Fundamentals now.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:CLMB

Climb Global Solutions

Operates as a value-added information technology (IT) distribution and solutions company in the United States, Canada, Europe, and the United Kingdom.

Outstanding track record with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives