- United States

- /

- Insurance

- /

- NYSE:AII

Undiscovered Gems in the US Market for May 2025

Reviewed by Simply Wall St

As the U.S. market experiences a surge, driven by new trade agreements and optimism around further deals, investors are keenly watching for opportunities amid this dynamic landscape. In such an environment, identifying undiscovered gems in the small-cap sector can be particularly rewarding as these stocks often thrive on innovation and adaptability to changing economic conditions.

Top 10 Undiscovered Gems With Strong Fundamentals In The United States

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Oakworth Capital | 42.08% | 15.43% | 7.31% | ★★★★★★ |

| Teekay | NA | -0.89% | 62.53% | ★★★★★★ |

| Solesence | 33.45% | 23.87% | -3.75% | ★★★★★★ |

| FRMO | 0.09% | 44.64% | 49.91% | ★★★★★☆ |

| Innovex International | 2.58% | 42.69% | 44.34% | ★★★★★☆ |

| Pure Cycle | 5.11% | 1.07% | -4.05% | ★★★★★☆ |

| First IC | 38.58% | 9.04% | 14.76% | ★★★★☆☆ |

| Greenfire Resources | 39.33% | 22.94% | -38.12% | ★★★★☆☆ |

| Reitar Logtech Holdings | 31.39% | 231.46% | 41.38% | ★★★★☆☆ |

Here's a peek at a few of the choices from the screener.

Enterprise Bancorp (NasdaqGS:EBTC)

Simply Wall St Value Rating: ★★★★★★

Overview: Enterprise Bancorp, Inc. is the holding company for Enterprise Bank and Trust Company, offering community-focused commercial banking products and services, with a market cap of $475.51 million.

Operations: Enterprise Bancorp generates revenue primarily through its banking segment, which reported $172.24 million in revenue. The company has a market capitalization of approximately $475.51 million.

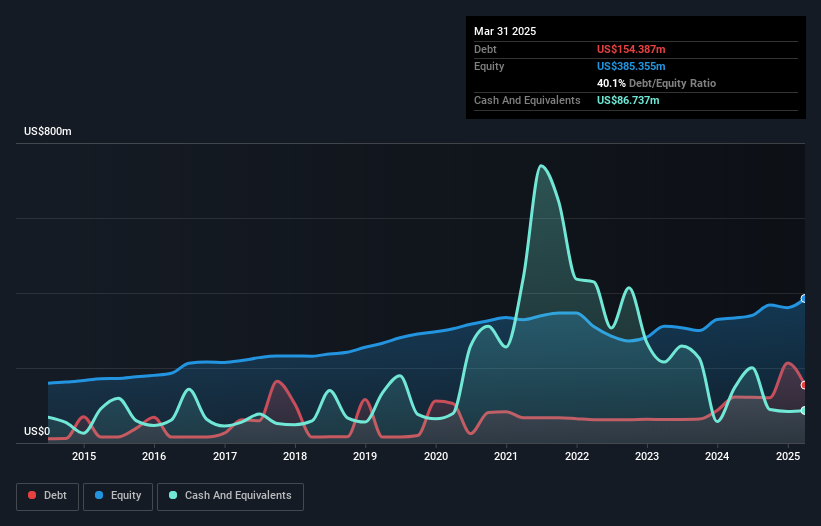

Enterprise Bancorp, with total assets of US$4.9 billion and equity of US$385.4 million, stands out for its low-risk funding structure, as 95% of liabilities are customer deposits. The bank's financial health is underscored by a sufficient allowance for bad loans at 225%, covering the 0.7% non-performing loan ratio effectively. Total deposits reach US$4.3 billion against loans of US$4 billion, reflecting a stable balance sheet with a net interest margin of 3.2%. Recent earnings growth at 13.6% surpasses industry averages, signaling robust performance and potential value trading at over half its estimated fair value below market price.

American Integrity Insurance Group (NYSE:AII)

Simply Wall St Value Rating: ★★★★☆☆

Overview: American Integrity Insurance Group, Inc. operates as an insurance company with a market cap of $313.31 million.

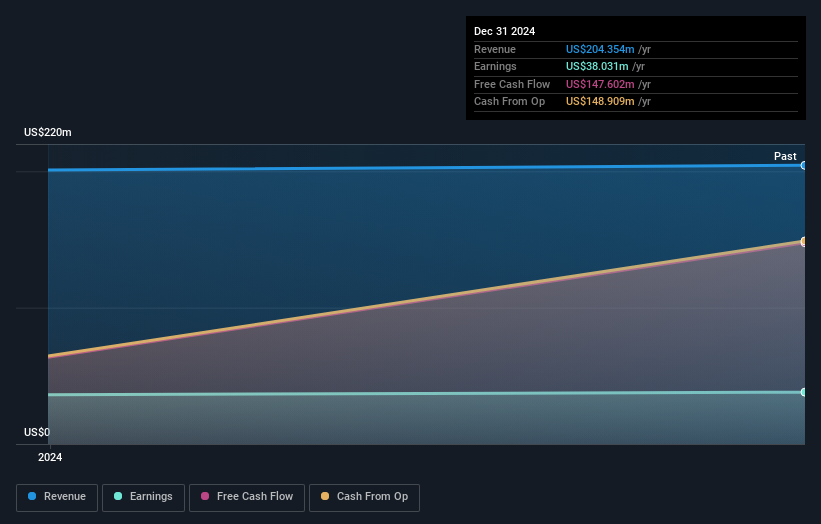

Operations: The company generates revenue primarily through its Property & Casualty insurance segment, which reported $204.35 million in revenue.

American Integrity Insurance Group recently made waves with its $110 million IPO, offering 6.88 million shares at $16 each. The company boasts high-quality earnings and is free cash flow positive, which speaks to strong operational efficiency. Although their earnings growth of 5.3% fell slightly behind the industry average of 6.1%, they remain a solid player in the insurance sector, trading significantly below estimated fair value by nearly 100%. Despite having more cash than total debt, limited financial data over three years suggests cautious optimism for potential investors exploring this under-the-radar opportunity in the market.

Miller Industries (NYSE:MLR)

Simply Wall St Value Rating: ★★★★★☆

Overview: Miller Industries, Inc. manufactures and sells towing and recovery equipment, with a market capitalization of $482.32 million.

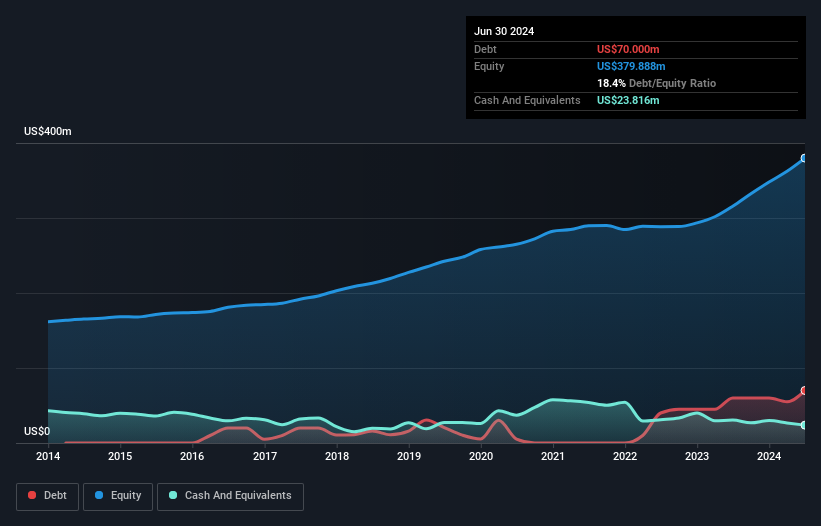

Operations: The company generates revenue primarily from the auto manufacturers segment, totaling $1.26 billion.

Miller Industries, a small cap player in the machinery sector, has seen its earnings grow by 8.9% over the past year, outperforming the industry average of 7.2%. The company is trading at a significant discount of 55.5% below its estimated fair value, suggesting potential for appreciation. With interest payments well covered by EBIT at 21.5 times and a net debt to equity ratio of 10.1%, financial stability appears satisfactory despite an increase in debt over five years from 2.1% to 16.2%. Recent military contracts and CARB-compliant chassis designs are likely to expand market reach and diversify revenue streams further into regulated markets by late 2025.

Next Steps

- Discover the full array of 284 US Undiscovered Gems With Strong Fundamentals right here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade American Integrity Insurance Group, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:AII

Good value with adequate balance sheet.

Market Insights

Community Narratives