- United States

- /

- Energy Services

- /

- NasdaqGS:ACDC

March 2025's Top Undervalued Small Caps With Insider Activity

Reviewed by Simply Wall St

Over the last 7 days, the United States market has experienced a 1.7% decline, yet it remains up by 12% over the past year with earnings projected to grow by 14% annually. In this context of fluctuating market conditions and anticipated growth, identifying stocks that are potentially undervalued with notable insider activity can offer intriguing opportunities for investors seeking value in small-cap companies.

Top 10 Undervalued Small Caps With Insider Buying In The United States

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| First Mid Bancshares | 11.1x | 2.7x | 38.73% | ★★★★★★ |

| Eagle Financial Services | 7.3x | 1.6x | 40.05% | ★★★★★☆ |

| Shore Bancshares | 10.6x | 2.4x | 6.32% | ★★★★★☆ |

| Quanex Building Products | 28.9x | 0.7x | 40.79% | ★★★★☆☆ |

| Citizens & Northern | 12.3x | 3.0x | 43.70% | ★★★☆☆☆ |

| Columbus McKinnon | 54.9x | 0.5x | 42.48% | ★★★☆☆☆ |

| Franklin Financial Services | 14.8x | 2.4x | 26.65% | ★★★☆☆☆ |

| Alpha Metallurgical Resources | 9.2x | 0.6x | -328.38% | ★★★☆☆☆ |

| Thryv Holdings | NA | 0.9x | 4.96% | ★★★☆☆☆ |

| Delek US Holdings | NA | 0.1x | -39.23% | ★★★☆☆☆ |

Let's review some notable picks from our screened stocks.

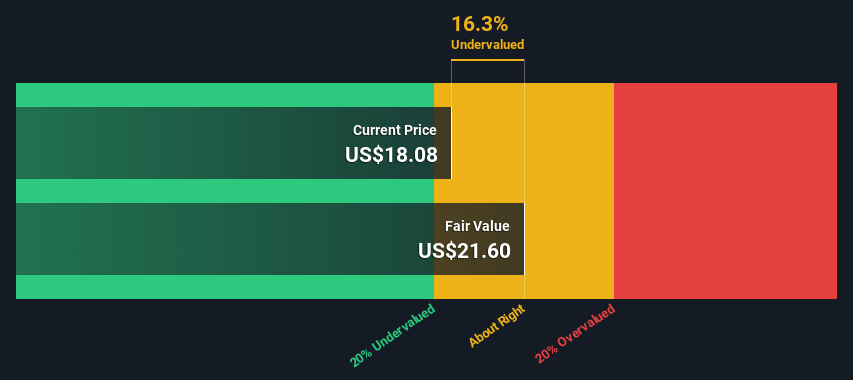

MasterCraft Boat Holdings (NasdaqGM:MCFT)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: MasterCraft Boat Holdings is a manufacturer of recreational powerboats, including pontoon boats and the MasterCraft line, with a market cap of $0.43 billion.

Operations: MasterCraft Boat Holdings generates revenue primarily from its Mastercraft segment, with additional income from the Pontoon segment. The company's gross profit margin has shown variability, most recently recorded at 24.92% in December 2023 and declining to 14.90% by December 2024. Operating expenses have consistently impacted profitability, with notable allocations towards general and administrative costs and sales and marketing efforts.

PE: -43.0x

MasterCraft Boat Holdings, a player in the marine industry, is experiencing insider confidence with recent share purchases. The company's earnings forecast suggests significant growth of 145% annually, yet it faces challenges with external borrowing as its sole funding source. Recent executive changes see Mike O’Connell taking charge of the Pontoon Segment, bringing decades of industry experience. Despite second-quarter sales dropping to US$63 million from US$90 million last year, future projections estimate annual sales between US$275 million and US$295 million.

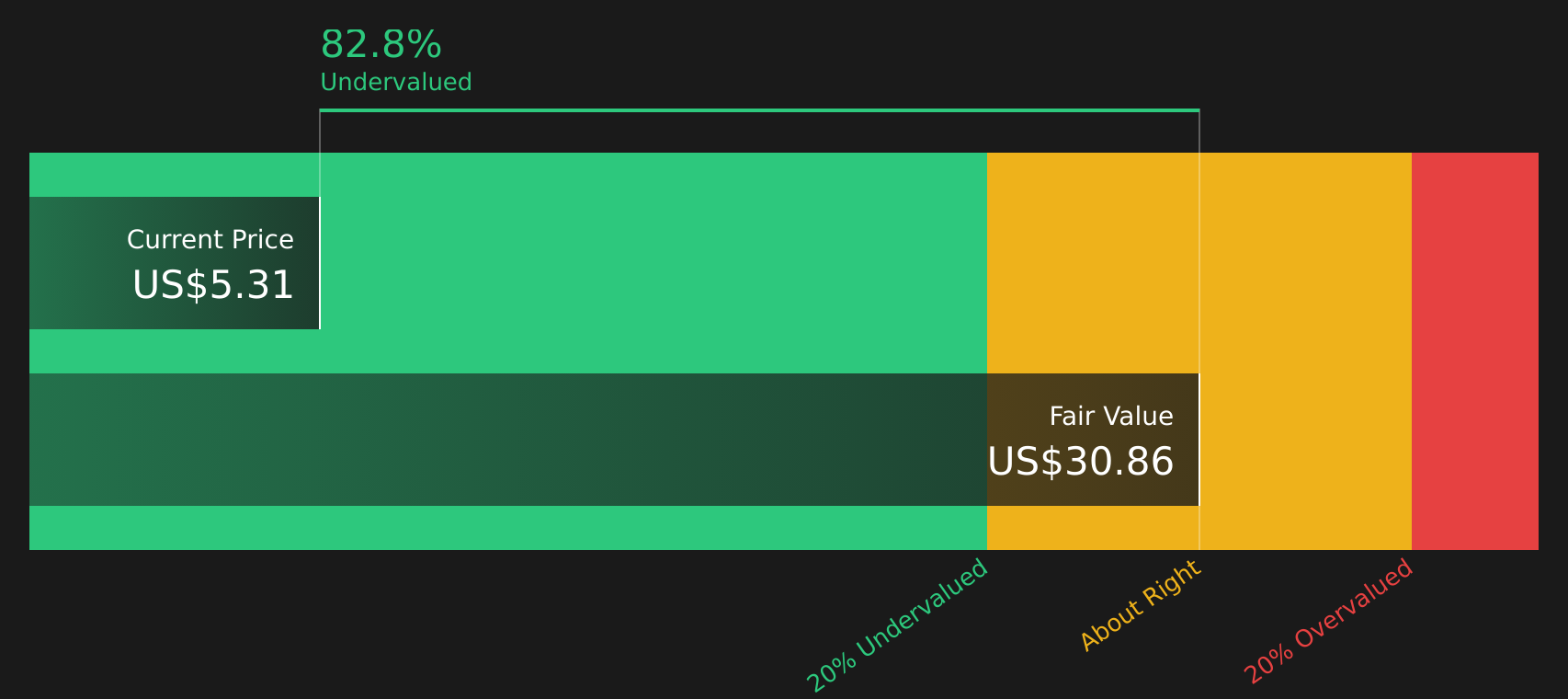

ProFrac Holding (NasdaqGS:ACDC)

Simply Wall St Value Rating: ★★★★★☆

Overview: ProFrac Holding operates in the oilfield services industry, providing stimulation services, proppant production, and manufacturing with a market capitalization of $2.38 billion.

Operations: ProFrac Holding generates revenue primarily from Stimulation Services, Proppant Production, and Manufacturing. Over recent periods, the company's gross profit margin has shown variability, reaching as high as 40.69% in late 2022 before declining to 31.76% by early 2025. The cost of goods sold (COGS) consistently represents a significant portion of expenses, impacting overall profitability trends.

PE: -5.2x

ProFrac Holding, a company in the energy sector, has caught attention with its potential for growth despite recent financial challenges. Their earnings guidance for Q1 2025 suggests improved revenues and profitability over Q4 2024, indicating a positive outlook. Notably, insider confidence is evident as Johnathan Wilks acquired 338,756 shares valued at US$2.35 million recently. While sales declined to US$2.19 billion in 2024 from US$2.63 billion in 2023, their forecasted earnings growth of 119% annually offers promising prospects amidst higher risk funding sources.

- Unlock comprehensive insights into our analysis of ProFrac Holding stock in this valuation report.

Explore historical data to track ProFrac Holding's performance over time in our Past section.

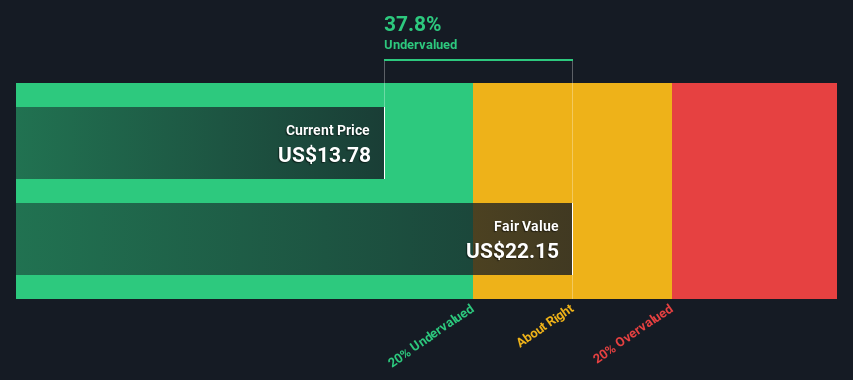

MasterBrand (NYSE:MBC)

Simply Wall St Value Rating: ★★★★☆☆

Overview: MasterBrand operates in the furniture and fixtures industry, focusing on designing and manufacturing a wide range of cabinetry products, with a market capitalization of $1.34 billion.

Operations: The primary revenue stream is from the Furniture & Fixtures segment, generating $2.70 billion. Cost of Goods Sold (COGS) significantly impacts profitability, with a Gross Profit Margin reaching 33.27% in recent periods. Operating expenses and non-operating expenses further influence net income outcomes for the company.

PE: 14.0x

MasterBrand's recent performance highlights challenges but also potential opportunities. For the fourth quarter of 2024, sales dipped slightly to US$667.7 million from US$677.1 million, and net income fell to US$14 million from US$36.1 million year-on-year, indicating some financial pressure. Insider confidence is evident as Independent Director Robert Crisci purchased 20,000 shares for approximately US$307,726 in January 2025, reflecting a belief in the company's prospects despite its high reliance on external borrowing for funding. The company forecasts mid-single-digit percentage growth in net sales for 2025, suggesting cautious optimism amid a competitive landscape.

- Dive into the specifics of MasterBrand here with our thorough valuation report.

Review our historical performance report to gain insights into MasterBrand's's past performance.

Make It Happen

- Investigate our full lineup of 65 Undervalued US Small Caps With Insider Buying right here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ACDC

ProFrac Holding

Operates as a technology-focused energy services holding company in the United States.

Undervalued with moderate growth potential.