- United States

- /

- Media

- /

- NYSE:OMC

3 Dividend Stocks On US Exchanges Yielding At Least 3%

Reviewed by Simply Wall St

As the Federal Reserve's policy meeting on interest rates captures investor attention, stock futures indicate a cautious market with the Dow Jones poised for another potential decline. In this environment of fluctuating indices and economic uncertainty, dividend stocks yielding at least 3% can offer investors a measure of stability and income, making them an attractive option for those looking to balance risk with consistent returns.

Top 10 Dividend Stocks In The United States

| Name | Dividend Yield | Dividend Rating |

| Polaris (NYSE:PII) | 4.32% | ★★★★★★ |

| Peoples Bancorp (NasdaqGS:PEBO) | 4.58% | ★★★★★★ |

| Columbia Banking System (NasdaqGS:COLB) | 4.84% | ★★★★★★ |

| Interpublic Group of Companies (NYSE:IPG) | 4.41% | ★★★★★★ |

| Isabella Bank (OTCPK:ISBA) | 4.55% | ★★★★★★ |

| Dillard's (NYSE:DDS) | 4.93% | ★★★★★★ |

| Chevron (NYSE:CVX) | 4.37% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.67% | ★★★★★★ |

| First Interstate BancSystem (NasdaqGS:FIBK) | 5.47% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 4.42% | ★★★★★★ |

Click here to see the full list of 140 stocks from our Top US Dividend Stocks screener.

Here's a peek at a few of the choices from the screener.

ESSA Bancorp (NasdaqGS:ESSA)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: ESSA Bancorp, Inc. is a bank holding company for ESSA Bank & Trust, offering various financial services to individuals, families, and businesses in Pennsylvania with a market cap of approximately $192.50 million.

Operations: ESSA Bancorp, Inc. generates revenue primarily through its Thrift/Savings and Loan Institutions segment, which accounts for $67.84 million.

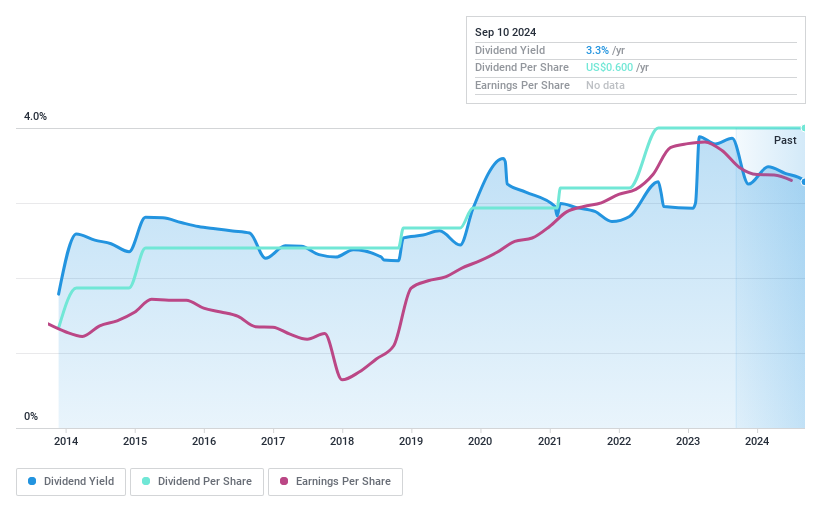

Dividend Yield: 3%

ESSA Bancorp offers a reliable dividend history, with stable and growing payments over the past decade. The current yield of 3% is lower than the top US dividend payers, yet it remains well-covered by earnings with a payout ratio of 33.7%. Trading at 25% below its estimated fair value enhances its appeal. Recent affirmations include a $0.15 per share dividend declared for December 2024, though recent earnings showed slight declines in income and EPS compared to last year.

- Click here and access our complete dividend analysis report to understand the dynamics of ESSA Bancorp.

- Insights from our recent valuation report point to the potential undervaluation of ESSA Bancorp shares in the market.

Kennametal (NYSE:KMT)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Kennametal Inc. develops and applies tungsten carbides, ceramics, and super-hard materials for metal cutting and extreme wear applications, with a market cap of approximately $2.07 billion.

Operations: Kennametal Inc.'s revenue is divided into two primary segments: Metal Cutting, which generated $1.27 billion, and Infrastructure, which contributed $766.92 million.

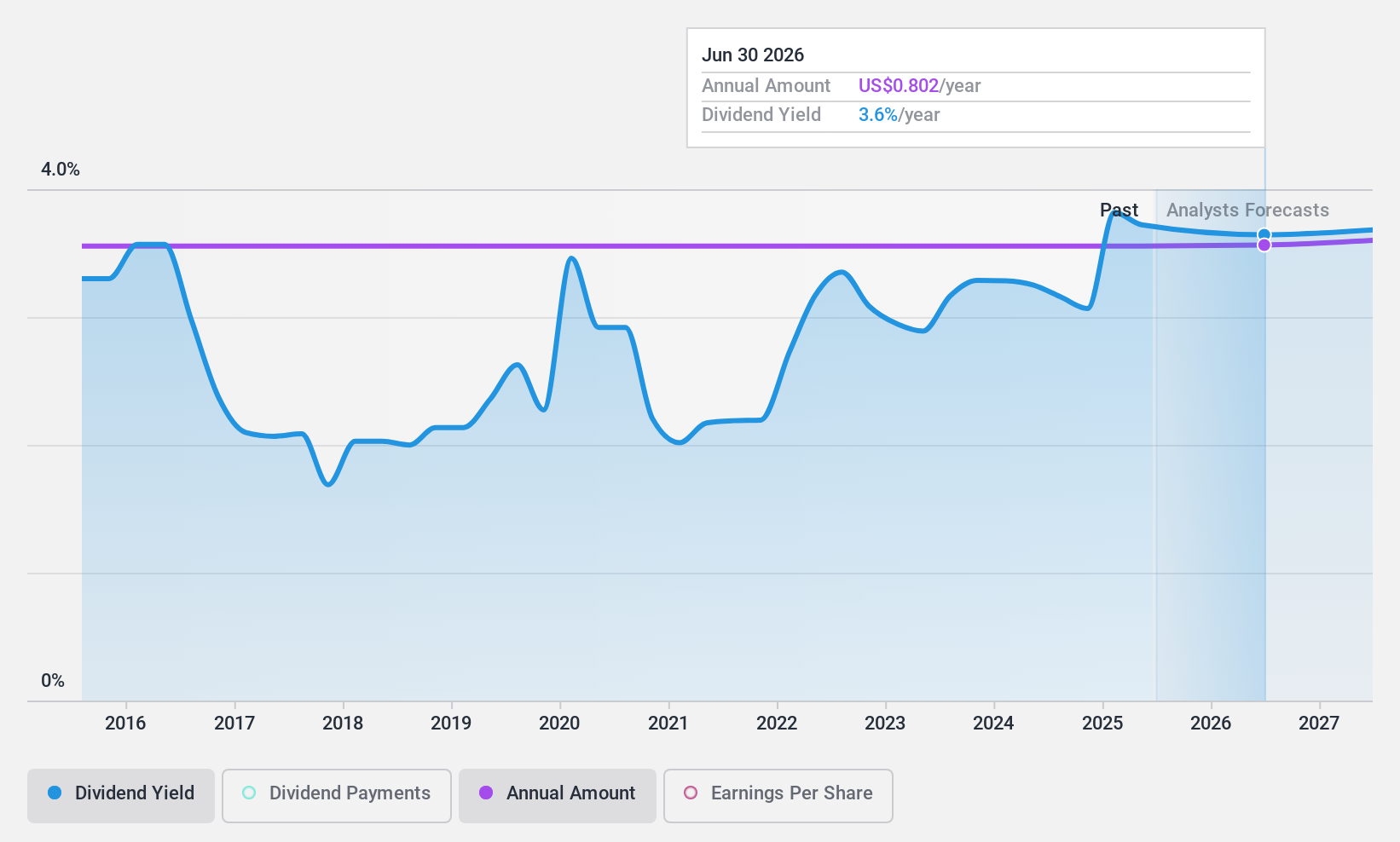

Dividend Yield: 3%

Kennametal provides a stable dividend history, with payments increasing over the past decade. The current yield of 3.02% is below top US dividend payers but remains well-covered by earnings and cash flows, with payout ratios of 62.3% and 31.6%, respectively. Trading at 27.5% below estimated fair value adds appeal despite recent declines in earnings and net income for Q1 2025 compared to last year. A $0.20 per share dividend was recently affirmed for November 2024.

- Navigate through the intricacies of Kennametal with our comprehensive dividend report here.

- Upon reviewing our latest valuation report, Kennametal's share price might be too pessimistic.

Omnicom Group (NYSE:OMC)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Omnicom Group Inc., along with its subsidiaries, provides advertising, marketing, and corporate communications services and has a market cap of approximately $17.62 billion.

Operations: Omnicom Group Inc. generates revenue of $15.43 billion from its advertising, marketing, and corporate communications services industry.

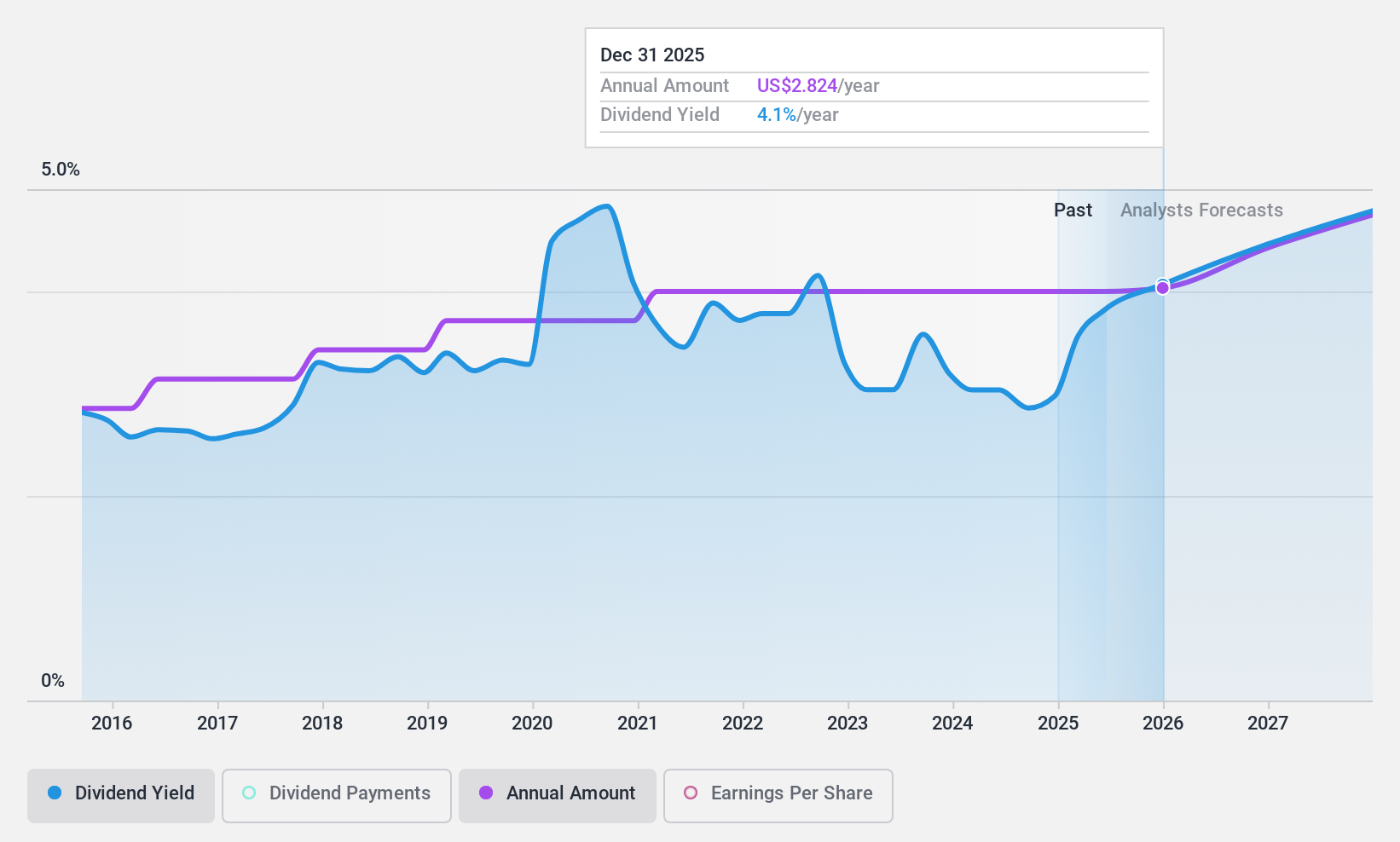

Dividend Yield: 3.1%

Omnicom Group offers a stable dividend history, with payments increasing over the past decade and currently yielding 3.08%. Dividends are well-covered by earnings and cash flows, with payout ratios of 37.8% and 36.4%, respectively. The company is trading at an attractive valuation, 56% below estimated fair value, despite high debt levels. Recent acquisitions aim to enhance growth potential while maintaining substantial dividends supported by US$3 billion in combined cash flow for strategic flexibility and share buybacks.

- Unlock comprehensive insights into our analysis of Omnicom Group stock in this dividend report.

- The valuation report we've compiled suggests that Omnicom Group's current price could be quite moderate.

Make It Happen

- Unlock more gems! Our Top US Dividend Stocks screener has unearthed 137 more companies for you to explore.Click here to unveil our expertly curated list of 140 Top US Dividend Stocks.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:OMC

Omnicom Group

Offers advertising, marketing, and corporate communications services.

Very undervalued established dividend payer.