- United States

- /

- Diversified Financial

- /

- NasdaqCM:MBIN

Discovering US Market's Undiscovered Gems In March 2025

Reviewed by Simply Wall St

The United States market has shown resilience, climbing by 2.8% over the past week and achieving a 7.6% increase over the last year, with earnings projected to grow by 14% annually. In such an environment, identifying stocks that combine strong fundamentals with growth potential can lead to uncovering true gems within the market.

Top 10 Undiscovered Gems With Strong Fundamentals In The United States

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Morris State Bancshares | 9.72% | 4.93% | 6.51% | ★★★★★★ |

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Oakworth Capital | 31.49% | 14.78% | 4.46% | ★★★★★★ |

| Cashmere Valley Bank | 15.51% | 5.80% | 3.51% | ★★★★★★ |

| ASA Gold and Precious Metals | NA | 7.47% | -26.86% | ★★★★★★ |

| Teekay | NA | -0.89% | 62.53% | ★★★★★★ |

| Anbio Biotechnology | NA | 8.43% | 184.88% | ★★★★★★ |

| FRMO | 0.08% | 38.78% | 45.85% | ★★★★★☆ |

| First IC | 38.58% | 9.04% | 14.76% | ★★★★☆☆ |

| Reitar Logtech Holdings | 31.39% | 231.46% | 41.38% | ★★★★☆☆ |

Underneath we present a selection of stocks filtered out by our screen.

Merchants Bancorp (NasdaqCM:MBIN)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Merchants Bancorp is a diversified bank holding company in the United States with a market cap of approximately $1.79 billion.

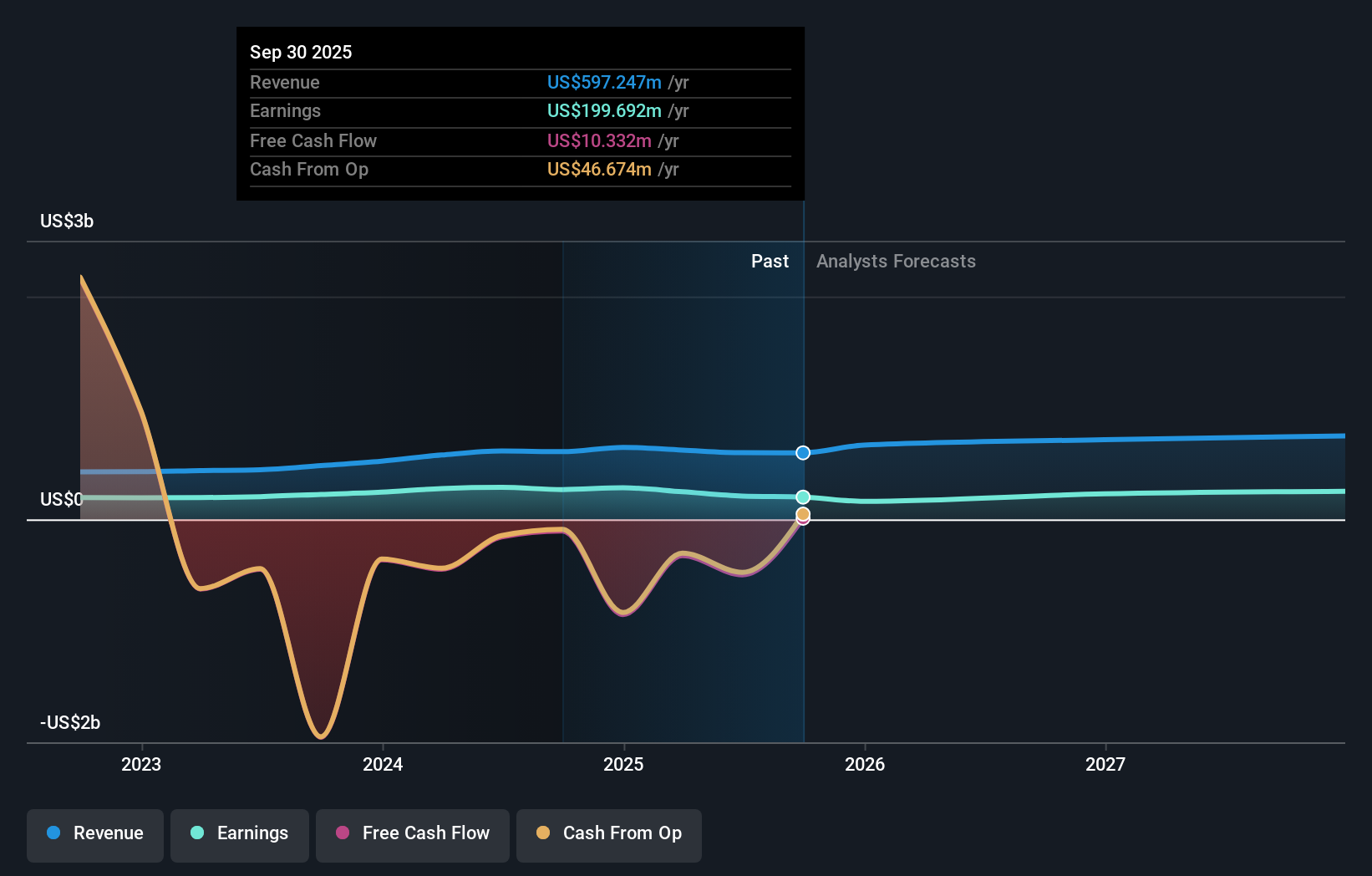

Operations: Merchants Bancorp generates revenue primarily from its Banking segment ($338.12 million), followed by Multi-Family Mortgage Banking ($174.19 million) and Mortgage Warehousing ($131.14 million).

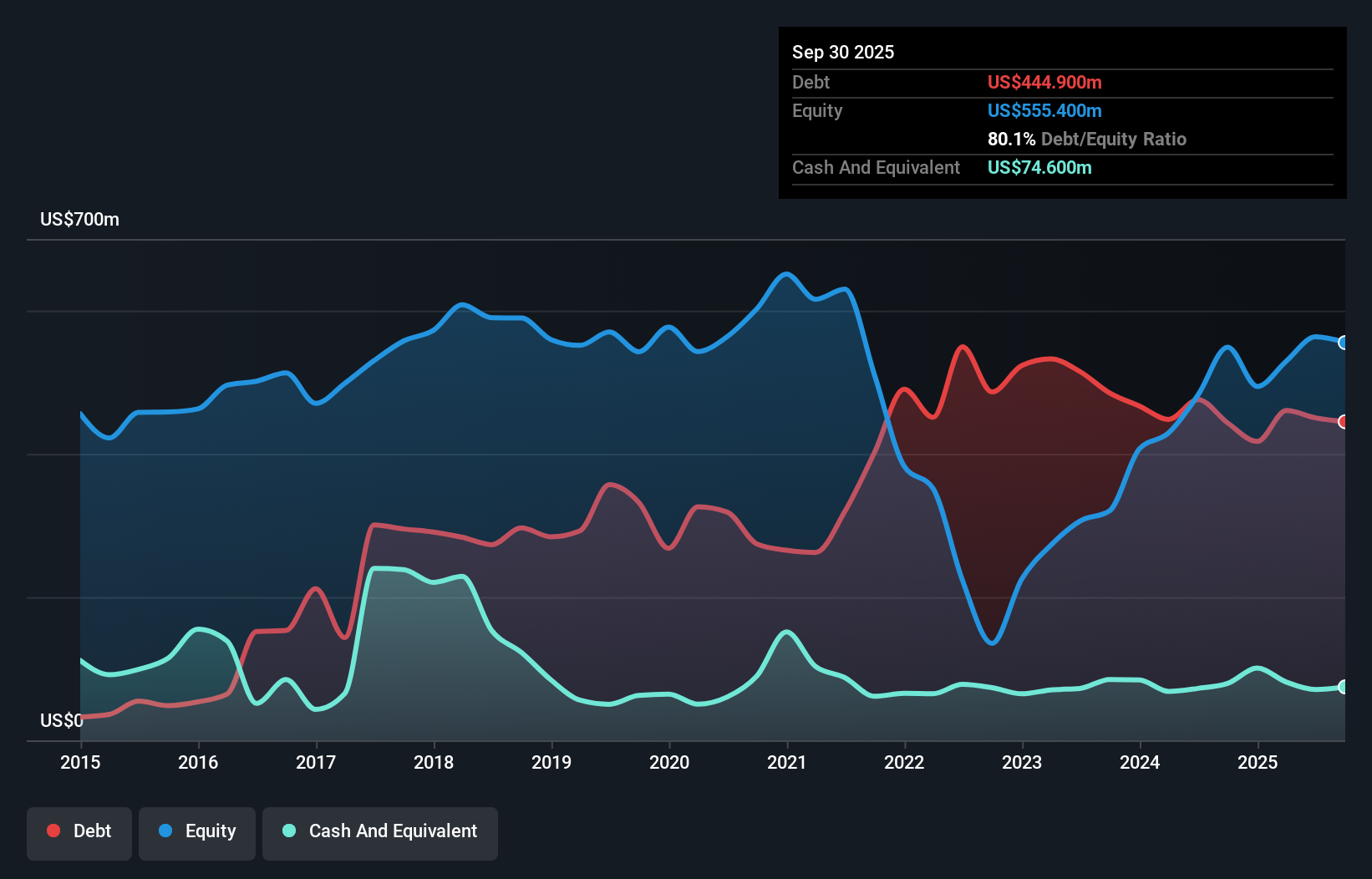

Merchants Bancorp, with total assets of US$18.8 billion and equity of US$2.2 billion, is trading at 70.8% below its estimated fair value, suggesting potential for investors seeking undervalued opportunities. The bank's liabilities are primarily low-risk due to a reliance on customer deposits, which compose 72% of funding sources. However, the level of bad loans stands at a high 2.7%, with an insufficient allowance set aside for these non-performing loans at just 30%. Despite these challenges, earnings grew by 16% last year, outperforming the industry average growth rate of 11.8%.

- Click here to discover the nuances of Merchants Bancorp with our detailed analytical health report.

Understand Merchants Bancorp's track record by examining our Past report.

Hyster-Yale (NYSE:HY)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Hyster-Yale, Inc. is a global company that designs, engineers, manufactures, sells, and services lift trucks and related products through its subsidiaries, with a market capitalization of approximately $819.92 million.

Operations: The primary revenue stream for Hyster-Yale comes from its Lift Truck Business, with significant contributions from the Americas at $3.22 billion and EMEA at $707.60 million. Bolzoni, a subsidiary segment, adds $379.10 million to the revenue mix.

Hyster-Yale, a company with a market presence in the machinery sector, has been navigating both opportunities and challenges. In 2024, sales reached US$4.31 billion with net income of US$142.3 million, reflecting growth from the prior year. However, earnings guidance for 2025 indicates expected revenue decreases due to lower production levels and increased expenses impacting operating profit. The company's debt to equity ratio rose to 84.5% over five years while its net debt to equity stands at a high 64%. Despite these hurdles, it trades at an attractive value relative to peers and completed a share buyback worth US$4.91 million recently.

X Financial (NYSE:XYF)

Simply Wall St Value Rating: ★★★★★☆

Overview: X Financial is a company that offers personal finance services in the People's Republic of China, with a market cap of approximately $623.94 million.

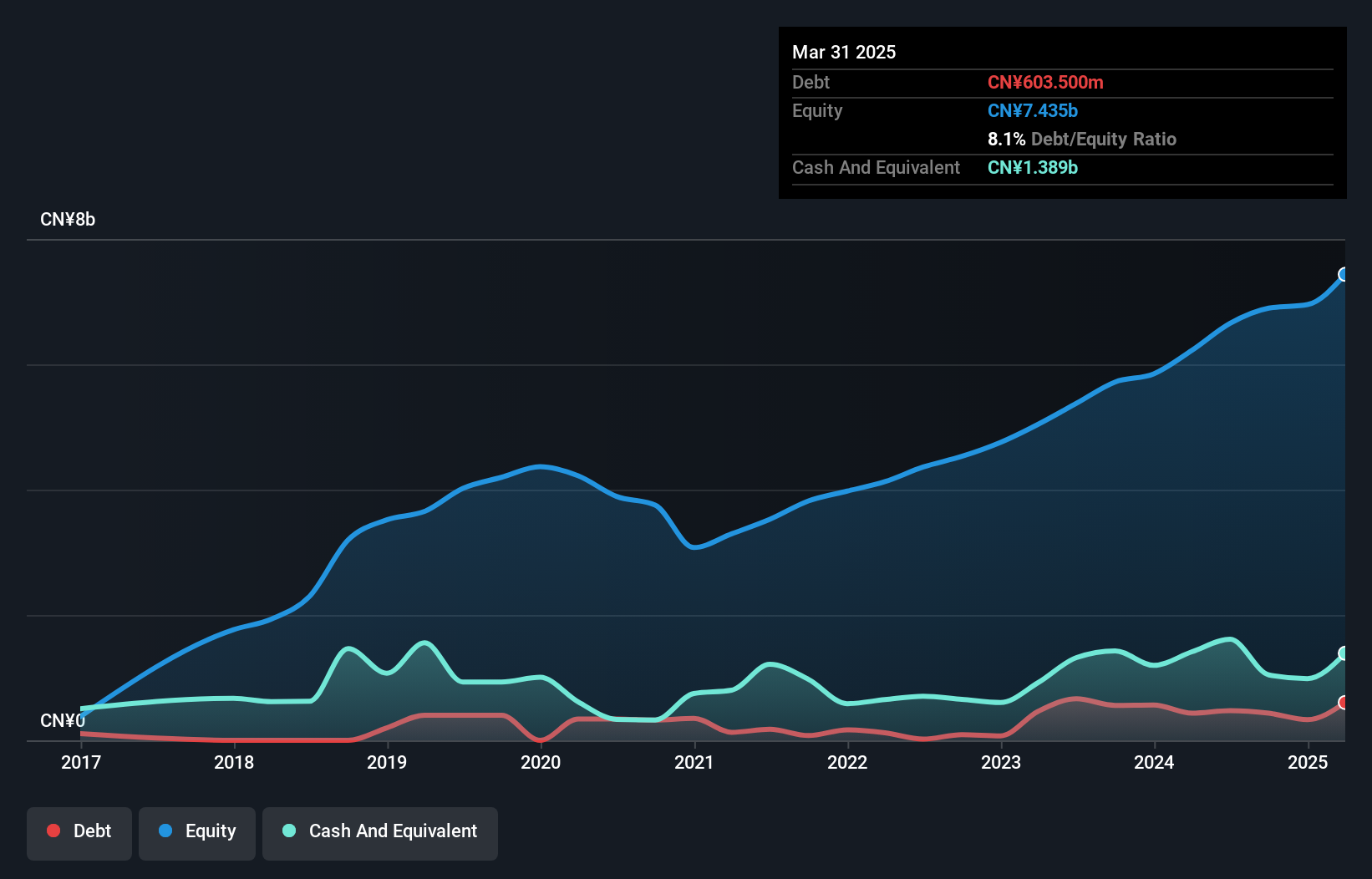

Operations: X Financial generates revenue primarily through personal finance services in China, with a market capitalization of approximately $623.94 million.

X Financial stands out with a notable earnings growth of 29.8% over the past year, surpassing the industry average of 12.5%. Despite a significant one-off loss of CN¥1.8 billion in its recent financials, it has managed to trade at 76.3% below estimated fair value, suggesting potential undervaluation. The company repurchased over 3 million shares for US$34.1 million recently, indicating robust confidence in its market position and future prospects. Additionally, X Financial's debt-to-equity ratio rose from 0% to 4.7% in five years but remains manageable given its cash holdings exceed total debt levels comfortably.

- Take a closer look at X Financial's potential here in our health report.

Review our historical performance report to gain insights into X Financial's's past performance.

Make It Happen

- Explore the 283 names from our US Undiscovered Gems With Strong Fundamentals screener here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Merchants Bancorp, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:MBIN

Merchants Bancorp

Operates as the diversified bank holding company in the United States.

Very undervalued with adequate balance sheet.

Market Insights

Community Narratives