- United States

- /

- Packaging

- /

- NYSE:IP

3 US Stocks Estimated To Be Up To 48.5% Undervalued Offering A 15.9% Discount Opportunity

Reviewed by Simply Wall St

As the U.S. stock market navigates a mixed landscape with the Dow rising and Nasdaq slipping amid tariff discussions and Federal Reserve Chair Jerome Powell's testimony, investors are keenly observing potential opportunities in undervalued stocks. In this environment, identifying stocks that offer significant discounts relative to their intrinsic value can be a strategic move for those looking to capitalize on current market conditions.

Top 10 Undervalued Stocks Based On Cash Flows In The United States

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Gilead Sciences (NasdaqGS:GILD) | $96.14 | $191.74 | 49.9% |

| Smurfit Westrock (NYSE:SW) | $53.64 | $107.04 | 49.9% |

| Bridgewater Bancshares (NasdaqCM:BWB) | $15.21 | $30.04 | 49.4% |

| DiDi Global (OTCPK:DIDI.Y) | $4.92 | $9.56 | 48.5% |

| Array Technologies (NasdaqGM:ARRY) | $6.87 | $13.66 | 49.7% |

| Datadog (NasdaqGS:DDOG) | $145.42 | $286.09 | 49.2% |

| Constellium (NYSE:CSTM) | $9.46 | $18.42 | 48.7% |

| Marcus & Millichap (NYSE:MMI) | $37.51 | $74.07 | 49.4% |

| PowerFleet (NasdaqGM:AIOT) | $8.51 | $16.52 | 48.5% |

| SolarEdge Technologies (NasdaqGS:SEDG) | $13.37 | $26.39 | 49.3% |

Here we highlight a subset of our preferred stocks from the screener.

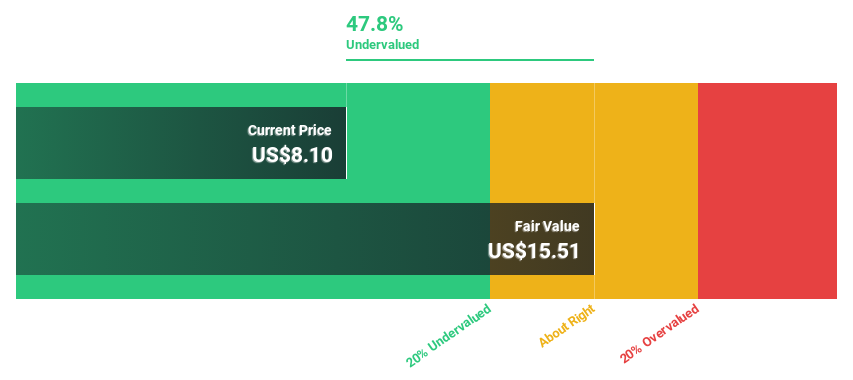

PowerFleet (NasdaqGM:AIOT)

Overview: PowerFleet, Inc. offers Internet-of-Things solutions across the United States, Israel, and internationally, with a market cap of $1.03 billion.

Operations: The company generates revenue from its Wireless IoT Asset Management segment, which amounts to $221.07 million.

Estimated Discount To Fair Value: 48.5%

PowerFleet, Inc. is trading at US$8.51, significantly below its estimated fair value of US$16.52, indicating potential undervaluation based on discounted cash flow analysis. Despite recent insider selling and shareholder dilution, the company raised its 2025 revenue guidance to exceed US$362.5 million due to strong financial performance and synergies from Fleet Complete's accounting transition to U.S. GAAP standards, highlighting robust growth prospects amid ongoing net losses.

- Our earnings growth report unveils the potential for significant increases in PowerFleet's future results.

- Take a closer look at PowerFleet's balance sheet health here in our report.

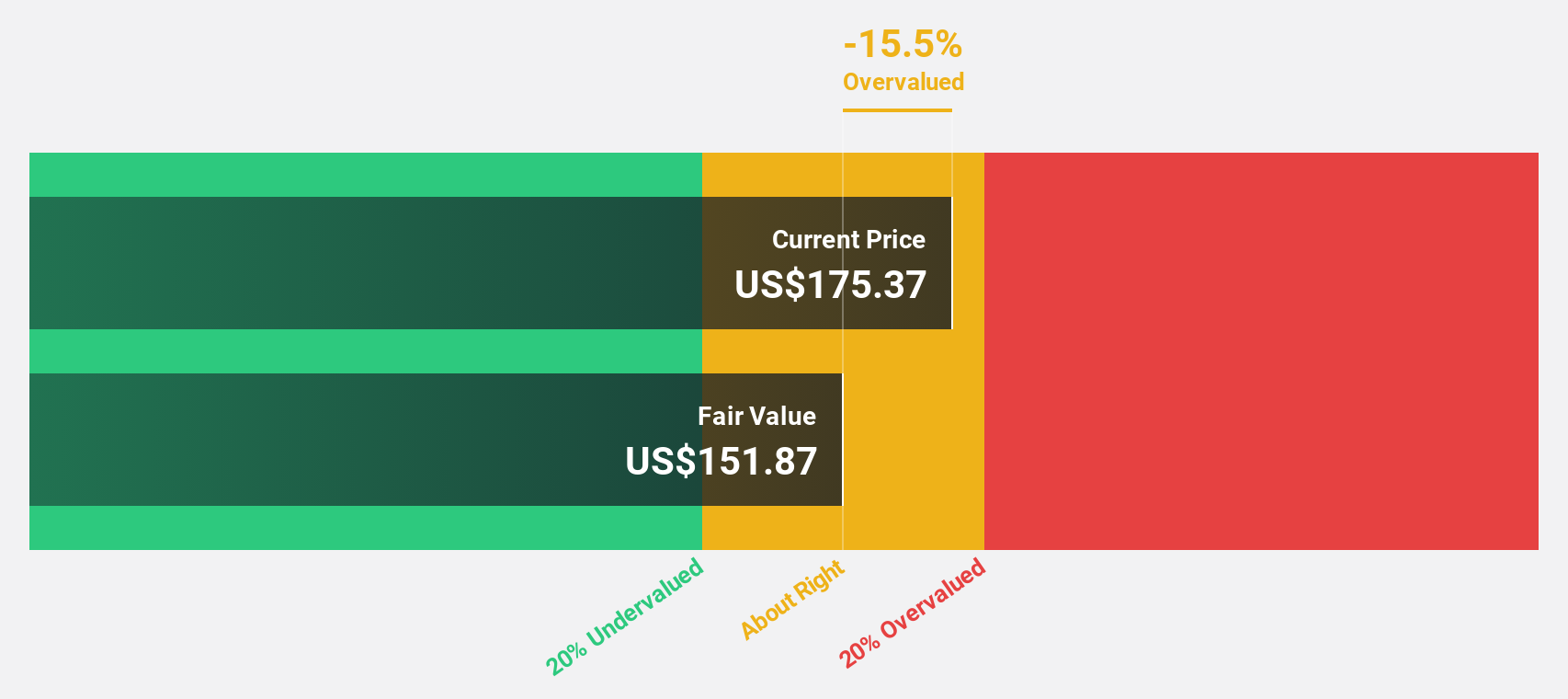

Howmet Aerospace (NYSE:HWM)

Overview: Howmet Aerospace Inc. offers advanced engineered solutions for the aerospace and transportation sectors across various countries, with a market cap of approximately $52.08 billion.

Operations: The company's revenue segments consist of Engine Products at $3.62 billion, Fastening Systems at $1.54 billion, Forged Wheels at $1.09 billion, and Engineered Structures at $1.04 billion.

Estimated Discount To Fair Value: 15.9%

Howmet Aerospace, with a trading price of US$129.32, is undervalued compared to its estimated fair value of US$153.69 based on discounted cash flow analysis. The company’s earnings grew by 68.5% last year and are forecasted to grow at 16.36% annually, surpassing the US market's growth rate. Despite high debt levels, Howmet maintains robust financial health and recently declared dividends on both preferred and common stock, reflecting confidence in its cash flow stability.

- Our growth report here indicates Howmet Aerospace may be poised for an improving outlook.

- Dive into the specifics of Howmet Aerospace here with our thorough financial health report.

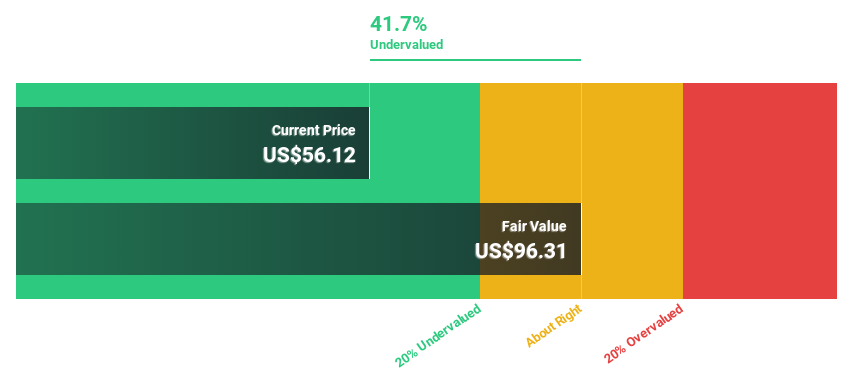

International Paper (NYSE:IP)

Overview: International Paper Company produces and sells renewable fiber-based packaging and pulp products across North America, Latin America, Europe, and North Africa with a market cap of approximately $28.90 billion.

Operations: The company's revenue segments include Industrial Packaging at $15.53 billion and Global Cellulose Fibers at $2.79 billion.

Estimated Discount To Fair Value: 42.3%

International Paper, trading at US$55.64, is significantly undervalued with an estimated fair value of US$96.43 based on discounted cash flow analysis. Despite high debt levels and a dividend not fully covered by earnings or free cash flows, the company's earnings grew substantially last year and are expected to grow at 22.73% annually over the next three years, outpacing the broader market's growth rate. Recent strategic acquisitions enhance its position in sustainable packaging solutions.

- Insights from our recent growth report point to a promising forecast for International Paper's business outlook.

- Unlock comprehensive insights into our analysis of International Paper stock in this financial health report.

Make It Happen

- Unlock our comprehensive list of 169 Undervalued US Stocks Based On Cash Flows by clicking here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade International Paper, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:IP

International Paper

Produces and sells renewable fiber-based packaging and pulp products in North America, Latin America, Europe, and North Africa.

Reasonable growth potential with proven track record.

Similar Companies

Market Insights

Community Narratives