- United States

- /

- Electrical

- /

- NYSE:VRT

Natera And 2 Other Stocks That May Be Trading Below Their Estimated Value

Reviewed by Simply Wall St

As the U.S. stock market experiences volatility with the S&P 500 and Nasdaq on track for their fourth consecutive week of losses, investors are keenly observing opportunities that may arise from these fluctuations. In this environment, identifying undervalued stocks becomes crucial as they offer potential value by trading below their estimated worth, providing a strategic entry point for those looking to capitalize on market corrections.

Top 10 Undervalued Stocks Based On Cash Flows In The United States

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Eagle Financial Services (NasdaqCM:EFSI) | $32.55 | $64.24 | 49.3% |

| WesBanco (NasdaqGS:WSBC) | $30.92 | $60.83 | 49.2% |

| German American Bancorp (NasdaqGS:GABC) | $37.75 | $75.38 | 49.9% |

| International Paper (NYSE:IP) | $50.38 | $98.82 | 49% |

| Midland States Bancorp (NasdaqGS:MSBI) | $18.13 | $35.74 | 49.3% |

| Vericel (NasdaqGM:VCEL) | $45.39 | $88.65 | 48.8% |

| Coastal Financial (NasdaqGS:CCB) | $81.94 | $162.87 | 49.7% |

| Workiva (NYSE:WK) | $85.06 | $169.05 | 49.7% |

| Mobileye Global (NasdaqGS:MBLY) | $14.47 | $28.78 | 49.7% |

| First Advantage (NasdaqGS:FA) | $12.66 | $25.15 | 49.7% |

Let's dive into some prime choices out of the screener.

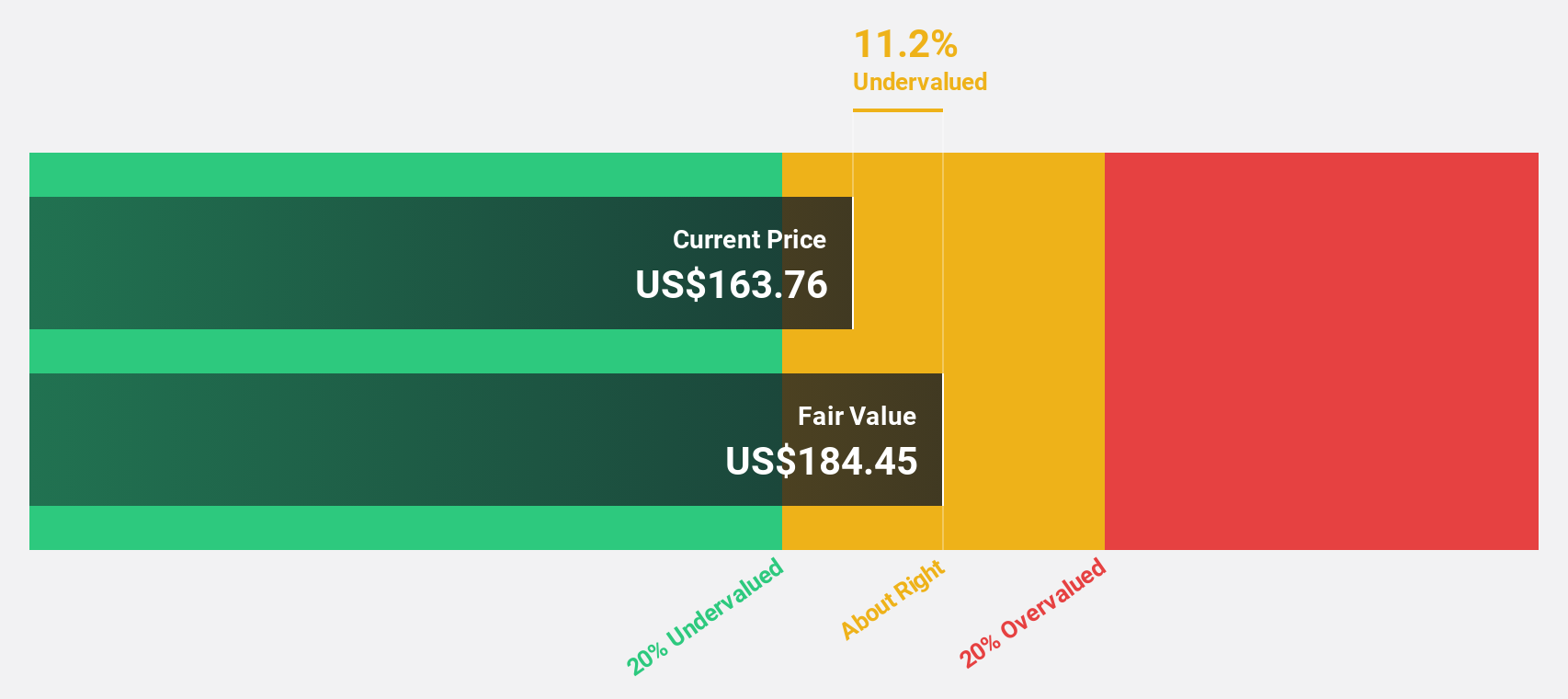

Natera (NasdaqGS:NTRA)

Overview: Natera, Inc. is a diagnostics company that offers molecular testing services globally and has a market cap of approximately $19.53 billion.

Operations: The company generates revenue of $1.70 billion from the development and commercialization of its molecular testing services globally.

Estimated Discount To Fair Value: 22.1%

Natera, trading at US$142.51, is considered undervalued with a fair value estimate of US$182.99, reflecting a 22.1% discount based on discounted cash flow analysis. Despite reporting a net loss of US$190.43 million for 2024, Natera's revenue grew to approximately US$1.7 billion from the previous year and is expected to continue growing faster than the broader market at 13% annually. Recent Medicare coverage expansion for its Signatera test underscores potential future revenue growth opportunities in oncology diagnostics.

- Our growth report here indicates Natera may be poised for an improving outlook.

- Delve into the full analysis health report here for a deeper understanding of Natera.

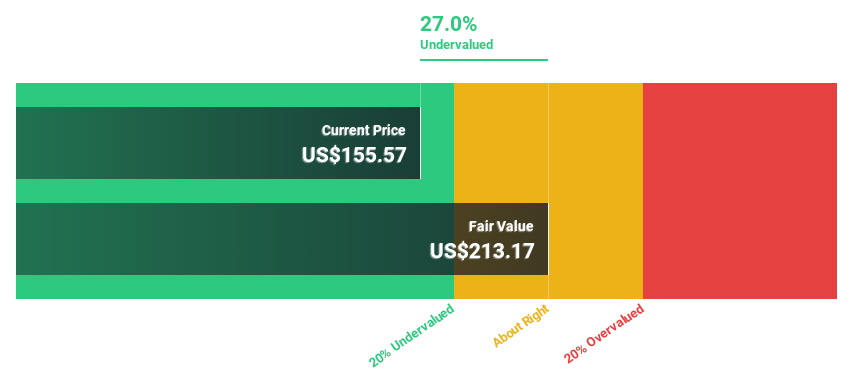

Dycom Industries (NYSE:DY)

Overview: Dycom Industries, Inc. offers specialty contracting services to the telecommunications infrastructure and utility sectors in the United States, with a market cap of approximately $4.31 billion.

Operations: The company's revenue primarily comes from its general contracting services, totaling $4.70 billion.

Estimated Discount To Fair Value: 30.8%

Dycom Industries, trading at US$147.47, is undervalued with a fair value estimate of US$213.1, offering a 30.8% discount based on discounted cash flow analysis. Despite high debt levels and recent significant insider selling, Dycom's earnings are projected to grow faster than the market at 15.8% annually. Recent earnings showed increased sales and net income year-over-year, while a new share repurchase program up to US$150 million indicates confidence in future performance.

- Our earnings growth report unveils the potential for significant increases in Dycom Industries' future results.

- Click here and access our complete balance sheet health report to understand the dynamics of Dycom Industries.

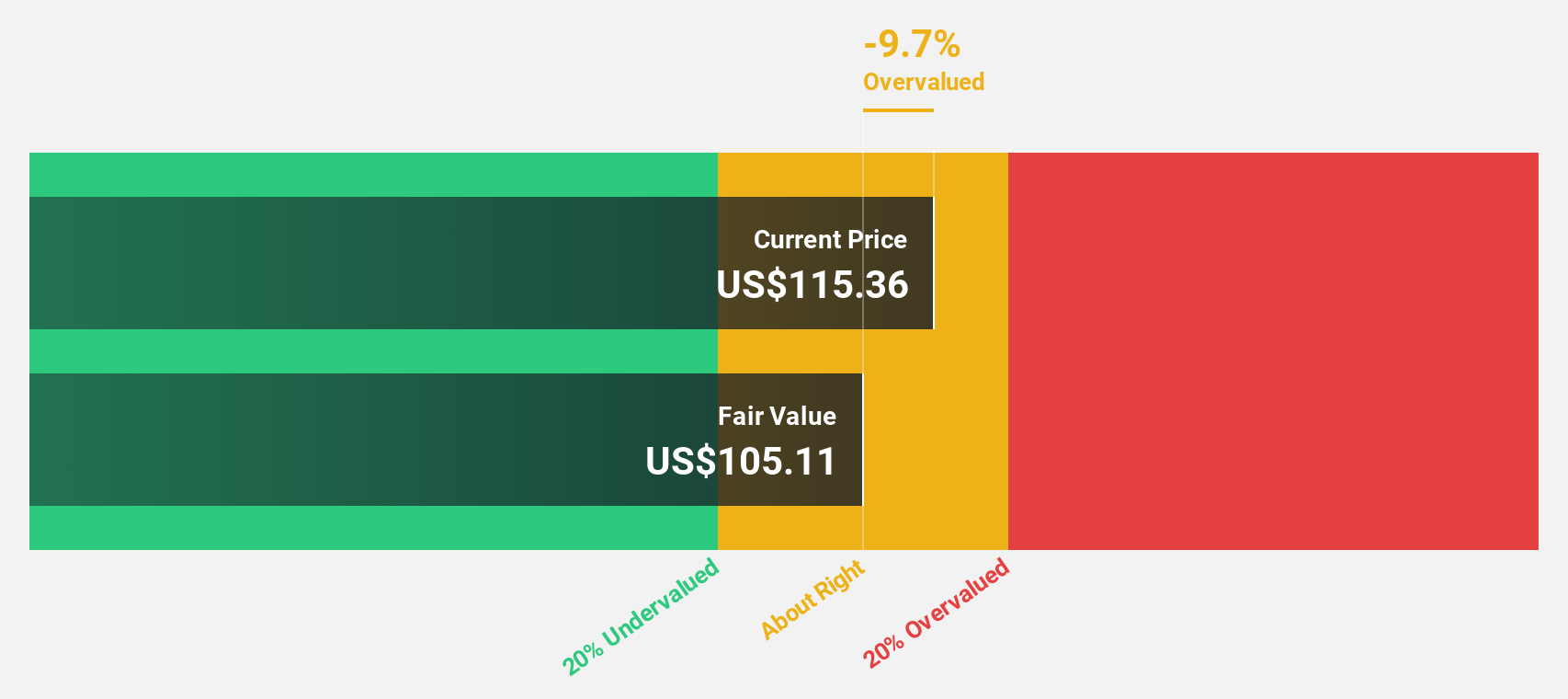

Vertiv Holdings Co (NYSE:VRT)

Overview: Vertiv Holdings Co designs, manufactures, and services critical digital infrastructure technologies for data centers and various environments worldwide, with a market cap of approximately $32.51 billion.

Operations: The company's revenue segments are comprised of $4.56 billion from the Americas, $1.88 billion from the Asia Pacific, and $2.32 billion from Europe, the Middle East, and Africa.

Estimated Discount To Fair Value: 24%

Vertiv Holdings Co is trading at US$83.09, significantly below its estimated fair value of US$109.28, indicating it is undervalued based on discounted cash flow analysis. Despite a high debt level and recent share price volatility, Vertiv's earnings are forecast to grow at 24.67% annually, outpacing the broader market growth rate of 13.9%. Recent product innovations in cooling solutions for AI applications enhance operational efficiency and align with evolving industry needs, potentially supporting future revenue growth.

- The growth report we've compiled suggests that Vertiv Holdings Co's future prospects could be on the up.

- Unlock comprehensive insights into our analysis of Vertiv Holdings Co stock in this financial health report.

Make It Happen

- Click through to start exploring the rest of the 190 Undervalued US Stocks Based On Cash Flows now.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:VRT

Vertiv Holdings Co

Designs, manufactures, and services critical digital infrastructure technologies and life cycle services for data centers, communication networks, and commercial and industrial environments in the Americas, the Asia Pacific, Europe, the Middle East, and Africa.

High growth potential with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives