- United States

- /

- Trade Distributors

- /

- NYSE:CNM

Core & Main (CNM) Q3 2026: Margin Gain on Lower Revenue Tests Premium Valuation Narrative

Reviewed by Simply Wall St

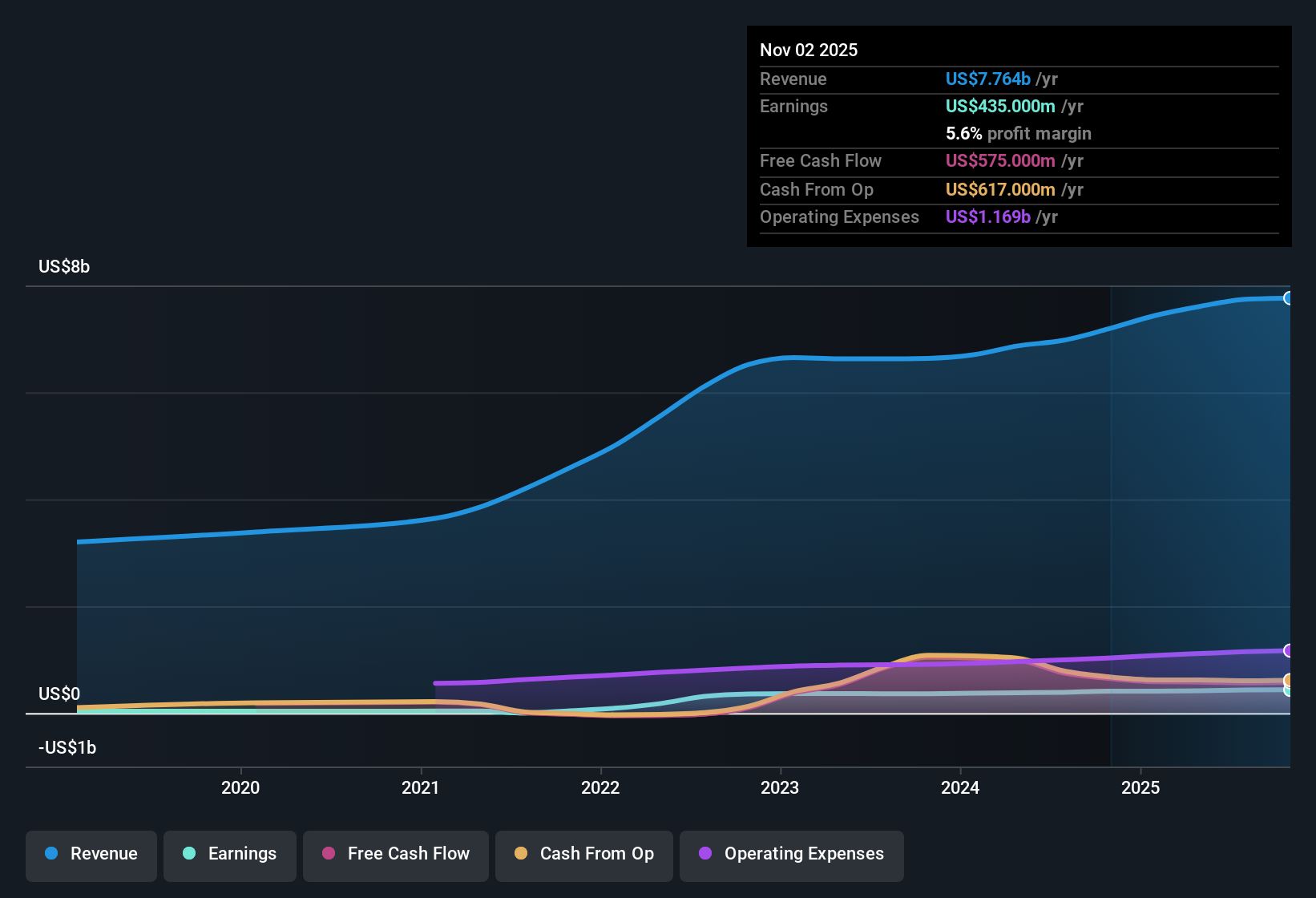

Core & Main (CNM) just posted its Q3 2026 numbers, with revenue at about $2.1 billion and EPS of roughly $0.72, against a trailing twelve month haul of $7.8 billion in revenue and $2.29 in EPS that reflects 6.1% earnings growth over the past year. The company has seen revenue move from $7.0 billion to $7.8 billion on a trailing basis while EPS has climbed from $2.11 to $2.29. This sets up an earnings profile where profit growth is outpacing a more modest top line and keeps margins firmly in focus for investors.

See our full analysis for Core & Main.With the headline numbers on the table, the next step is to line them up against the most persistent market narratives around Core & Main to see which stories hold up and which ones the latest margins quietly push into question.

See what the community is saying about Core & Main

Margins Edge Up While Revenue Softens

- Net income in Q3 2026 was $137 million on $2,062 million of revenue, slightly higher than $134 million on $2,093 million in Q2, which points to a small margin improvement despite a modest revenue dip.

- Consensus narrative points to margin benefits from private labels and municipal infrastructure spending, and this quarter’s higher net income on lower revenue:

- Municipal water infrastructure, over 40 percent of sales, is framed as a stabilizer, and this steadier demand lines up with the relatively tight revenue range from $1,698 million in Q4 2025 to $2,093 million in Q2 2026.

- Expected margin expansion from private labels contrasts with the trailing net margin of 5.6 percent being just below last year’s 5.7 percent, so investors will watch whether recent quarter to quarter margin gains can push that longer term figure higher.

Earnings Growth Outruns Modest Sales

- On a trailing basis, revenue is about $7.8 billion with net income of $435 million, and earnings per share are expected to grow about 10.5 percent annually while revenue is only forecast to grow around 3.8 percent per year.

- Supporters of the bullish view, which leans on strategic expansion and M&A, will note that trailing net income rose from $389 million to $435 million as trailing revenue moved from $7.0 billion to $7.8 billion:

- Analysts expect earnings to reach $645.7 million and earnings per share of $3.19 by around 2028, which would extend the pattern where profit growth outpaces the more moderate revenue gains seen in the last twelve months.

- Planned growth in private label sales from about 4 percent to over 10 percent of revenue is cited as a key driver for higher margins, which ties directly to the forecast that profit margins could move from 5.5 percent to 7.4 percent over the next three years.

Premium Valuation With Thin Margin Cushion

- Core & Main trades at a price to earnings multiple of 22.6 times, above both the peer average of 19.6 times and the US Trade Distributors industry at 19.5 times, while trailing net margin sits at 5.6 percent, slightly below last year’s 5.7 percent.

- Critics in the bearish camp argue that this combination of rich valuation and only slight margin compression leaves little room for disappointment:

- Revenue is forecast to grow about 3.8 percent annually, well below the broader US market expectation of 10.7 percent, so slower top line growth is one of the main pressure points behind that concern.

- A high level of debt is flagged as a financial risk, and when paired with a premium multiple, it reinforces the idea that the company needs to keep delivering the forecast 10.5 percent annual earnings growth to justify paying above peer valuation.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Core & Main on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Spot something in the numbers you would frame another way? Take a couple of minutes to shape that view into your own narrative, Do it your way.

A great starting point for your Core & Main research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

See What Else Is Out There

Core & Main’s premium valuation, slower revenue growth than the wider market, and elevated debt load leave investors exposed if earnings momentum cools.

If that mix of leverage and high expectations feels uncomfortable, use our solid balance sheet and fundamentals stocks screener (1937 results) today to quickly zero in on financially sturdier businesses built to protect your downside.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CNM

Core & Main

Distributes water, wastewater, storm drainage, and fire protection products and related services in the United States.

Adequate balance sheet with acceptable track record.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Unicycive Therapeutics (Nasdaq: UNCY) – Preparing for a Second Shot at Bringing a New Kidney Treatment to Market (TEST)

Rocket Lab USA Will Ignite a 30% Revenue Growth Journey

Dollar general to grow

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Trending Discussion